Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5 Sunny Day Manufacturing Company is considering Investing in a one-year project that requires an initial investment of $450,000. To do so, it will have

5

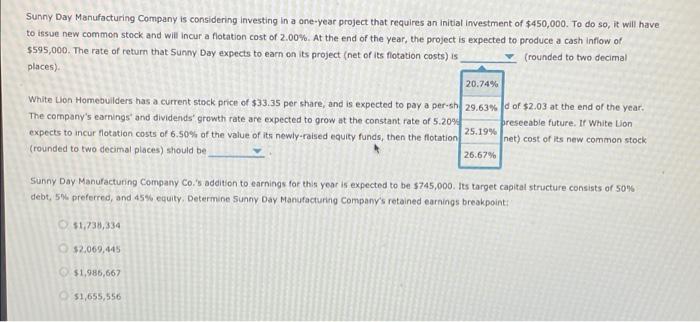

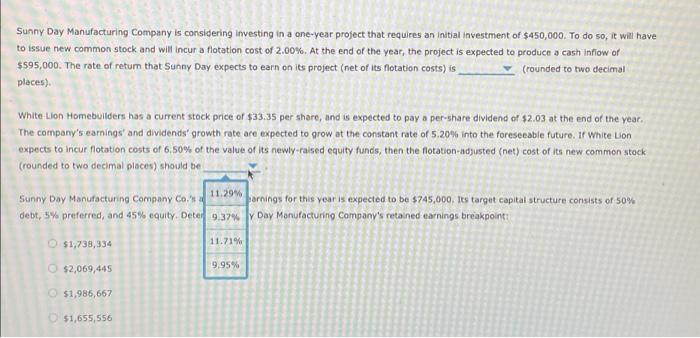

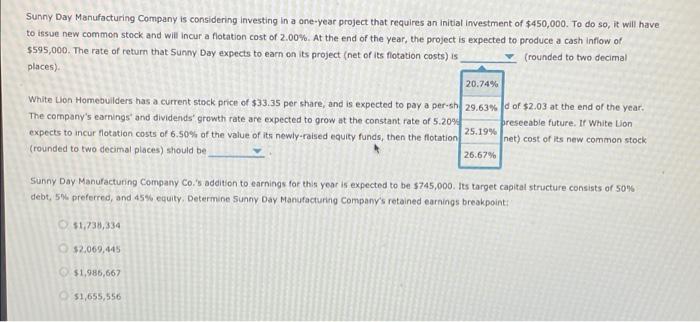

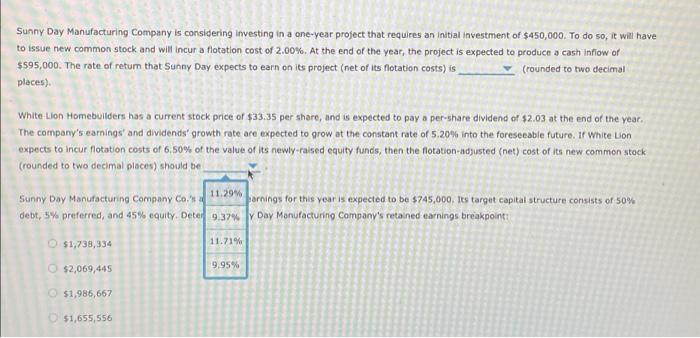

Sunny Day Manufacturing Company is considering Investing in a one-year project that requires an initial investment of $450,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Sunny Day expects to earn on its project (net of its flotation costs) is (rounded to two decimal places) 20.74% White Lion Homebuilders has a current stock price of $33.35 per share, and is expected to pay a per.sh 29,63%d of $2.03 at the end of the year. The company's earnings and dividends' growth rate are expected to grow at the constant rate of 5.20% preseeable future. If White Lion expects to incur flotation costs of 6.50% of the value of its newly-raised equity funds, then the flotation net) cost of its new common stock (rounded to two decimal places) should be 25.19% 26.67% Sunny Day Manufacturing Company Co.'s addition to earnings for this year is expected to be 5745,000. Its target capital structure consists of 50% debt, 5W preferred, and 45% equity. Determine Sunny Day Manufacturing Company's retained earnings breakpoint: 51,738,334 $2.069,445 $1,986,667 51,655,556 Sunny Day Manufacturing Company is considering investing in a one-year project that requires an initial investment of $450,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2,00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of retum that Sunny Day expects to earn on its project (net of its flotation costs) is (rounded to two decimal places) White Lion Homebuilders has a current stock price of $33.35 per share, and is expected to pay a pershare dividend of $2.03 at the end of the year. The company's earnings and dividends' growth rate are expected to grow at the constant rate of 5.20% into the foreseeable future. If White Lion expects to incur flotation costs of 6.50% of the value of its newly-raised equity funds, then the flotation-adjusted (net) cost of its new common stock (rounded to two decimal places) should be Sunny Day Manufacturing Company Cosa 11.29 pornings for this year is expected to be $745,000, les target capital structure consists of 50% de txt, 5% preferred, and 45% equity. Deter 9.37% Day Manufacturing Company's retained earnings breakpoint $1,738,334 11.71% 9.95% $2,069,445 $1,986,667 $1,655,556

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started