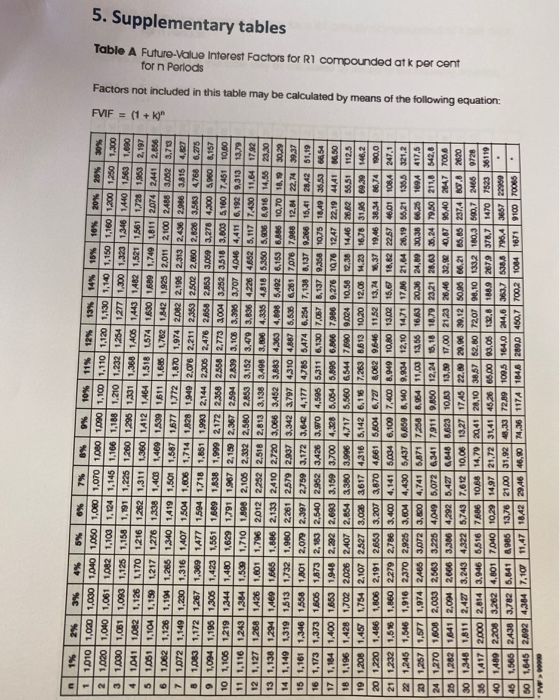

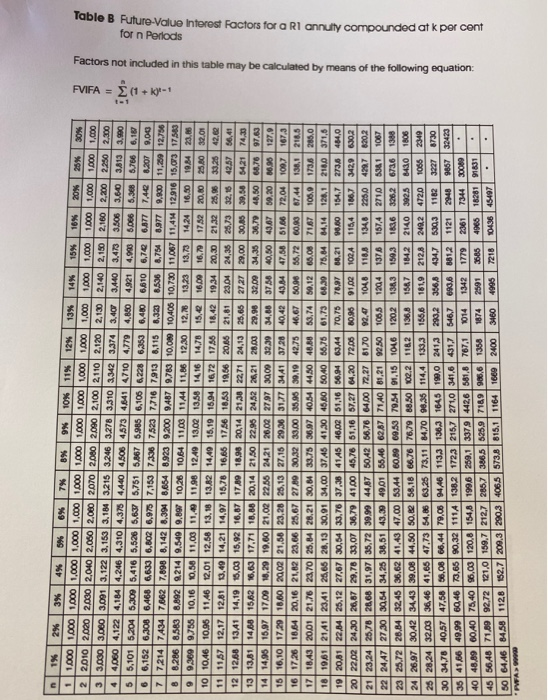

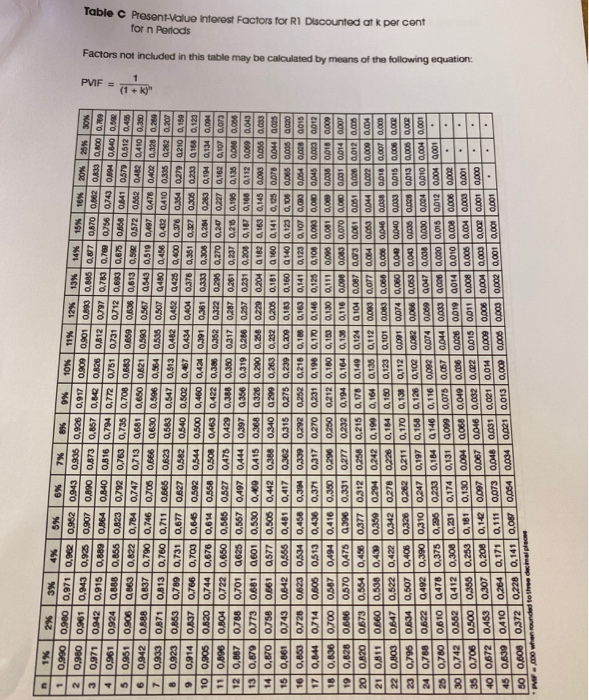

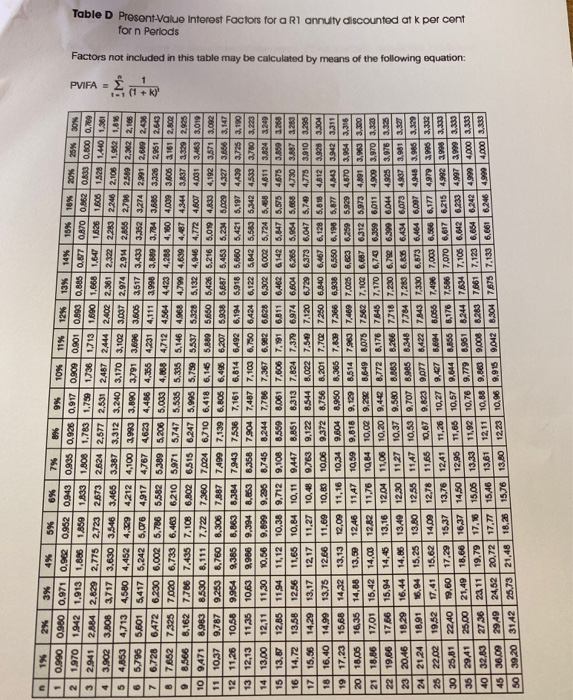

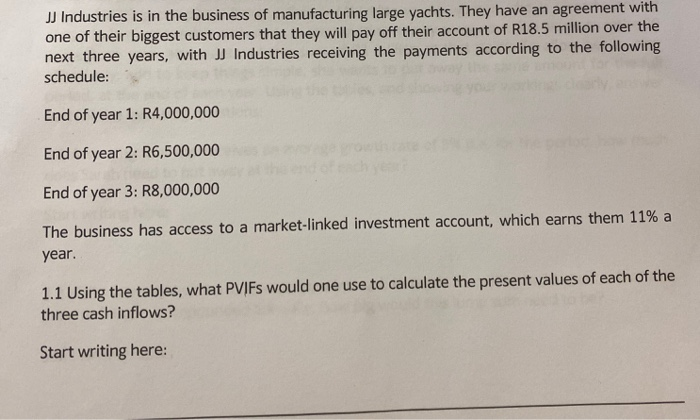

5. Supplementary tables 1% 2% % % % % % % % 10% 115 125 13% 14% 10% 10% 20% 20% 30% 2 1010 1.000 1.000 1.000 1.000 1.000 1.070 1.000 1.000 1.100 1.110 1.120 1,130 1,50 1,150 1.100 1.200 1.250 1,300 3 1.080 1.000 1.000 1.125 1,150 1,1 1.020 1,04 1,061 1.062 1,100 1,129 1,145 1.100 1.188 1.210 1.232 1.254 12771,300 1,320 13:45 14013601000 1,220 1280 1280 1991 1.360 1400 143 1422 121 12011720 1.950 2,487 3 1041 1.062 1.128 L170 1216 1282 1,311 1.360 1412 144 1.818 1.874 1630 1.500 1,740 1,811 2074 2,441 2,006 1.062 1,120 1,19 1.01 1.100 1.159 1217 1.276 1.338 1,400 1,400 1530 1811 1.695 1762 1.842 1.928 2,00 2,100 2.418 3,002 0,70 7 1,072 1,540 1,230 1,286 1340 1410 1,600 1,5871671 1772 1.870 1.974 2.082 2.100 2.313 2.436 2.000 3815 CIRI 1,316 1207 1.800 1.608 1,714 1828 1.940 2.018 2.211 2.383 2500 2,000 2,828 3.583 1788 6.875 1.000 1.17212671.00 TATT1.5041718 1,001 1999 2.144 2.300 2.476 2.858 2.850 1.000 2.278 4.200 DO 0.157 1,094 1,196 1,300 1,420 1,561 1800 1.838 1,990 2,172 2,386 2.368 2.773 2,004 3.252 3,918 3,600 160 7.481 10.00 10 1,106 1210 1344 1.400 1.629 1,701 1.967 2.100 2.367 2.594 2.890 3,100 3,986 3,707 4.096 4,419 6.192 2.313 13,70 111,116 1.240 1.384 1,500 1,710 1.100 2,108 2.832 2.580 2.250 3.150 3.00 3.038 1228 48825.171.40 . 6 07.12 12 1.12712081426 1.601 1,796 2012 2.252 2.818 2.813 3.138 3.498 3.60 4.896 4818 5.860 5,038 6.916 14,58 23,30 13 1,138 1.294 1.460 1.868 1.886 2,133 2,410 2,720 3,066 3,462 3,883 4,363 4,608 54926,163 6.886 10,70 18,19 30.29 141.1401,3101.613 1.732 1,080 2.201 2.570 2,037 ,342 3707 43101.007 0.03 0.200 700 7900 12.00 22,74 20.37 15 1,161 1,346 1.568 1.0012.07 2.307 | 2700 3.172 3.6e 4,177 1780 BAT 0.267,138 0,137 0.200 15,41 1842 81,19 161.173 1,373 1805 1,673 2,18 2,540 2.952 3428 3.40 4.506 5.311 6.1307.067 6.137.2368 1075 18,40 35.53 08.54 171.164 1,400 1800 1.940 2,292 2,000 3,180 3,700 4,228 5,0640.000 6.000 7.000 0.270 1970 1247 22,10 441 ms 18 1,196 1.428 1,702 2,000 2,407 2,664 .380 3.906 4,717 5.860 247.000 .000 10.50 18,30 19,46 28,42 58.51 112.5 19 1.208 1.45 1,754 2,107 2.527 3,008 2617 4316 5,142 6.115 7.283 3.813 10:20 12.05 .201638 31,80 00.30 146.2 20 1220 1,480 1.806 2,191 2860 3.20731870 4861 6,604 6,72 4.0820640 11.8813,106,37 10:46 30.400.4 100 21 1.232 1,68 1,860 2.210 2,700 3,400 4,141 5,034 6,100 7,400 6,000 10,00 13:00 15,67 18,62 2287 46.011084 247,1 4,430 6,437 6.660 0,10 0,854 12,10 1471 17,00 21,4 20,19 56:21 196.5 321,2 22 1,246 1,516 1916 2.370 2,925 3,00 231.267 1.071.9742.05 3.072 3.20 4,741 6.071 72258 0.86411,00 12.00 10.49 20.36 24.00 2038 2 417.8 24 1.270 1.600 2.0032.140 3.22540495.0726341 79119.000 12.04 15,181078 2321 28.65 38.478.50 2160 542,8 2,000 2,3064,290 B476648 6.823 10,49 13,00 17.00 21,28 20,40 92,0 20,17 15,40 1847 7000 281 282 101 2.00 30 1.946 1011 2,42 3.248 13226,740 7.612 10,00 13,27 1748 22,00 20,00 10,1260,00 00,2008,88 23740070 20:30 38 1417 2,000 2,814 3.9466,616 7506 1058 14,70 2041 28,10 38,67 52,60 7201 .101332 10,3 560,72468 0728 1400 2.200 3.262 .801 7040 10:20 1497 21,72 3140 45,2 08.00 09.00 12.0 10892079 378,7 1070782330110 1,688 2438 3,782 5,041 2.948 13,80 2100 31,920,30 72,00 1009 1840 14,0 3037 1303 1904 3457 2200 7,109 11,47 1042 20.46 46,60 74,36 117 118 2000 400,7700,21001 1871 100 000 1.045 2002 4.34 FVIF = (1 + )" forn Periods Factors not included in this table may be calculated by means of the following equation: Table A Future Value Interost Factors for Rl compounded atk por cent 1% 2% 3% 4% 5% 7 % 9% 1.000 1.000 10% 11% 12% 13% 14% 15% 10% 20% 20% 2 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1000 1.000 1.000 30% 1.000 1.000 1.000 1.000 1.000 1.000 2010 2000 2,000 2,040 2,060 2.080 2010 2.080 2080 2.100 2110 2120 2130 2,140 2.190 2.100 2.20 2.250 2.300 33.000 3.000 3.091 3.122 3,150 3,100 3.215 3.24 3.278 3.310 1.342 3.374 2.40 3.40 2.433.000 3.60 3.41 3.60 3 1.000 4,12 4,184 1.246 ,310 ,379 440 4.506 4573 4541 2710 47704.880 1921 1.980 .000 6.00 6,00 6,10 5.101 5.204 5.00 5.416 5.528 5.02 5.951 5.967 5.985 6.108 6228 6.353 6.480 4810 ve GATT TAB 8.00 8,00 6.152 6.306 6.468 46300.000 0.00 7,163 7330 7520 7718 7913 2,115 .32 2850 2,78489770.00 11,2012,7 7 7214 7434 78627,098 0,142 6.300 1.884 0.923 9200 9,487 9,783 10.000 10400 10.730 11.087 11, 4 12910 15.073 1758 0.3000758 10,16 10.50 11.00 11.00 12.40 13.00 1358 14 16 14.78 6.286 8.560 0.882 22149.540 0.0071038 1064 11.00 11.4 1186 12:30 12,10 13:20 13,79 1424 18,80 10.23.00 15.0 16.00 16.9 1782 20.10 25.00 32.00 10 1046 10.98 1146 1201 12,60 13,10 13:42 1440 18,10 15.94 1672 1786 18,42 10,4 20,30 21.32 25,00 33,28 2,60 111187 12,17 12,8113,40 14,21 14,9 18,78 16,46 17,86 18:58 1956 20.66 21,81 23,00 24,36 29,32,18 42,5760,41 1268 1341 14,19 15,00 15,92 16,69 1700 10.00 20,142138 22,71 24,13 28,45 2727 20,00 30,00 30,00 64,21 74.30 13 13,81 1480 15.62 16,69 17.71 16,00 20,14 21.50 22.95 24.522621 20.000,00 32,00 34,36 36.70 48,00 60.78 07.03 14 14.96 10,97 17.00 18,2019,00 21,00 22.38 24,2120,00 2797 39,00 32,00 24,00 37.56 40,00 4307 00,1000,00 127,9 16 16,10 17,2018,600 20:00 21,06 23,28 28,13 27,16 20,6 317 3411 0728 10,42 40. 4 47,00 1,00 72,04100,7 187,3 1617,26 18.84 20,16 21,82 23,66 25,67 2780 30,32 33.00 35.00 39,10 42,75 46,67 50.00 58,72 60,60 07.4 130,1 218.8 171843 2001 2170 23,70 25,0 20,2030,633,78 36.97 404 4.80 48.8869,7400,1260.00716710801738 286.0 10 1901 211 23:11 25,08 28,13 30,01 34,00 3746 41.30 45.00 5040 68,78 61,73 08.30 79. 04.14 123,121003710 10 20.01 22, 28,12 27,67 30,64 33.7637,38 41,48 10.02 3116 56.00 RM 70,787027 0.21 1.40 1847 2738 404,0 20 22.00 24,30 20,67 29,70 33,0739,70 4100 40,70 61,16 17,27 04,20 12.00 10.00 1.00 102A 1104 1067 3439 0302 21 23,24 25,78 28,68 31,97 38,72 39,90 44,87 5042 56,76 0400 72,27 8170 99, 1048 1189 1940 2250 227 1202 22 24A7 27303054 34,2838.01 13.30 1001 58.40 62,87714001,2192.50 106.5 1904 1378 1874 2710 38811067 23 23,72 28.84 3246 36.62 41,43 47,00 53. 60.00 09:58 70.5401,15 1046 1202 138.3 1993 1646 32826728 1988 24 26,97 3042 343 39.00 4.60 50.8266,10 6678 1670 10.50 102.2 1182 183 1847 102 2140 1025 1410 1906 28 28.24 32.03 36,46 41,08 47,79 14.00 0.38 73,11 14.7000.38 1144 1933 1866 1840 2120 2422472010052349 0.001140 1939 1943 1845 18.0 2012 20.2 309 430 8903 1902 30 3478 40.57 47,58 50.00064 32211730 36 418819.90 60,46 ,60 00,32 TNA 130217232187 2710 3418 131,546, 7 8 12 40 48,99 0040 75,40 56,00 120,8 1548 1906 280,13379 4426 581,0787, 1101134217002001734 2000 5648 71,00 92,72 121,0 159,7 212,7 286, 73065 5259714996,6 1358 174 2891380 1960 18281 GANG 84,58 1126 152,7 200,3 200,3 106.5 5738 015,1 1164 1680 2400 3460 4995 72181436 43 FVIFA = ( + ) Factors not included in this table may be calculated by means of the following equation: for n Periods Table B Puture-Value Inforest Factors for a Rl annully compounded atk per cent 2% 3% 4% 5% 6% 79 % % 10% 11% 12% 13% 1486 19% 10% 20% 25% 30 0,901 0800 0,886 0,87 0,870 0,002 0,300,000 0,00 | 2 309710942 0.918 0.8890.0040.540 0.16 0.794 077 0761 0731 071204099 097 5 PVIF = TKO 7 1% 0,90 0,980 0,971 0,942 09862 0943 0938 0,926 0,91 0,90 pszennem 0.960 0961 0.943 0.95 0.907 0000 0.873 0.867 0.02 0.826 0.812 071 0.700 0.78 075 0743 0894 000 0.96 0.961 0,924 0888 0.855 0.823 0792 0,763 0.735 0.708 0683 0.859 0836 0.613 0,52 08720862 0412 0410 0,380 0,951 0.906 0,863 0,822 0,784 0,747 0,713 0681 0,660 0621 0.998 0.567 2543 0.519 0,407 0478 0462 0.328 0,200 0.942 0.888 0.837 0790 0.746 0.705 0866 9630 0.586 0.64 0.338 0.807 2.400 0.456 042 0410 0318 0.22 0.000 0.923 0.933 0.871 0.813 0.760 0,711 0.868 0.823 0588 0.547 0.013 042 0482 028 0,400 0.300.34 0.270 92100,180 0,914 0.837 0.863 0789 0,731 0,677 0.827 0.582 0.540 0.502 0.467 0.434 0,04 0,376 0,381 0.27 0.306 0230 9188 0,123 0.766 0.700 0.66 0.592 0.544 0.500 0.400 0.438 0,301 0,381 0.333 0,30 0,28 0,283 0,184 0,134 0,004 10 0.905 0.820 0.744 0.676 0,64 0.568 0908 0463 0,422 0,380 0.382 0322 0.200 0,270 0,80 0,227 0,162 0,07 0,07 11 0.898 0.804 0722 0.650 0,665 0.827 0475 0429 0.388 0,380 03170,287 0281 0.237 0,28 0,1960,130 0.000 0.006 12 0.087 0788 070126280,867 0497044 0.397 2356 0.319 0200 0.250.231 0,308 0,1870,160 0,112 0.000 0,04 130,870 0773 0.001 0.6010,830 0.40 0415 0.368 2326 0,2000,268 0,220 0.2040182 0,16 0,148 0.000 0.000,00 140,670 0,758 0,061 06770,508 0.42 0.368 0.340 2290 0,268 0,252 0,20 0,161 160 0.1400, 120 0070 004 2005 150,861 0,743 064206660,461 0,417 0.362 0.313 0.275 0.250 0.200 0,183 0,160 140 0,123 0,100 0.00 0.00 0.00 170,84 0,714 0600 0.813 0,436 0,37 0917 0.270 0,231 0,1900,10 0,140 0.125 0.000 0.000 0.00 0.0489,0000012 030704040,410 0,360 0.200 0.250 0,212 0,1800,1600,130 0.11 0.000 0.00 0.00 0.008 0.0160.000 0,564 0.486 0,377 0.312 0,258 0.215 0.78 0.140 0,124 100 0,087 0,073 0.06 oszol 0475 0.3960.331 0271 0.232 0,194 0,16 0,16 0,116 0.00091983 Ware 0.059028 0,012.000 will also 0186 0.112 0.000 0.07 0.00 0.00 0.00 0.00 0.000 0.000 0.522 0.42 0.32 0.278 0.728 0,164 0,160 0,12 0,101 0,00 0,000 0.000 0.000 0.00 0.00 0,00 0,00 Factors not included in this table may be calculated by means of the following equation forn Porods Table C Prosent-Value Inforest Factors for R1 Discounted at k por cont X288 2 09 0,078 0,067 0.04 0.033 acaba. c om ore 2.00e 0,6070,408 0,328 0.282 0211 0,170 0,138 0,112 0.001 0.074 0,00 0,00 0000000000169008 acce 082224920,3800310 0.247 0,1970,1600,128 0,100 0.002 0.008 0.06 0.000000 manuale 6100478 0,378 0236 0.233 0,1640148 0.116 0.092 0.074 0.00000470.000 .000 0.004 0.010 0,004 0.001 0.706 0.500 0.356 0.253 0.181 0,130 0.004 2068 0.000 0.008 0.025 0.019 2014 0.0100,000 0.00 0.00 - 0.672 0453 0.307 0.208 0,12 0,097 0.067 0046 0,032 0,022 0.015 0011 0.008 0.005 0.004 0.003 0.0012 45 0.630 0410 0.264 0,171 0,111 0.073 0,048 0,031 0,021 0.01 0.000 0.008 0.0040,000 aoce 0.001 0.000 500.008 0.372 0.228 0,141 0,08 0,064 0.04 0.021 0,013 0,00 0,00 0,00 0,002 0.001 0,00110001 maller 2% 3% 4% 5% 2 6% A 12% 13% 7% % % 10% 11% 1808 1,789 1790 1738 1719 14% 15% 10% 20 20 30 3 3 7 1% 1970 1942 1.913 1,886 1880 2941 2. 0.9600.000 0.971 0.02 0.052 0.043 0988 0.928 0.91 0.809 0901 0.000 0.008 0.7 0.870 02 08800,000 0.00 3.902 2,629 2,778 2729 2673 2624 2.677 2.531 2487 244 2.40 1800 1.560 1.601838 1809 1820 10 1.30 4853 4,713 2.381 2.2 2283 224 2.100.000 3.806 2717 3.630 3.546 3.465 3.387 3.312 3.200 3.170 3,109 3.087 2.914 2.04 2.866 2.70 2.500 2.82 2.16 4.580 4,452 4.20 4212 4,100 1,980 3.000 3791 3.800 3.605 2.517 3.480 3,382 3.274 2m 2,000 2,436 6.795 5.801 5417 5.242 5,078 1917 1787 4620 4,438 4.85 4.231 4.111 2.990 3,800 3.704 3.600 3.328 20012.00 6720 GATZ 6230 6,002 5.706 5.582 5.380 5206 5.050 4,068 4712 45644428 4,280 4.60 4.000 5.000 2161 2,800 7882 7.328 7.000 6,738 6.40 6210 5.715,747 5.588 5.238 5.146 4.968 4700 4,630 4.6674.343.817 1,529 2,035 6,162 1.700 7.435 7,108 6.8026815 6:247 5.95 5.750 5.837 5320 5,1524,900 4.72 .000 2.001 3.49 2.010 0,787 0.250 0.760 6,306 7.887 7,490 0.830 6.111 7.7227200 7024 0,710 6.418 6,16 5.880 5800 6426 6.210 0,00 4,833 4,1823,870 3,000 7,139 6,808 6,496 6.20 5.938 5.887 5,468 5,234.000 4,327 3,00 3,147 | 2.385 | 8.663 6.3847,943 7.5.367,1616.814 6.4926.1946.9185.000 6.421 6.1974439 3. 10.632,900 .3940,000 8.356 7.9047,487 7,100 6.750 024 0,122 0,02 0,8906.9424880 3.700 3.20 12,11 11:30 10,66 0,099 9.296 8,745 0,244 7,786 7.387 6,9826,828 6.302 30028,7246,400 400 3,404 2200 12.86 11.94 11,12 10,38 9.712 9,108 0.360 8,061 7.6067,19168116,462 01426.047 5.88 4676 3,000 2.200 13.58 12.56 11.65 10,84 10,119.4478.851 8.313 7.8247 .370 6.9746 .604 6.265 ,054 5,0684730 3.087 3283 14,20 13,17 12,17 11,27 10,48 0,76 0,122 6.644 8,022 7.50 7,120 6,720 6373 6,047 5.70 4.778 3,010 3,286 13,78 12.00 11.60 10,00 10,06 9,372 0,786 8,201 7,70 7280 6.840 6.467 6,120 5,813 4812 3,000 3.301 14.32 13,13 12,00 11,16 10,34 3,604 8,960 6,386 7,820 7,366 6,358 6.550 6,1965,877 44 3.942 3,911 14,00 13,00 1248 1197 19,50 0,818 0,129 0.314 7900 7,400 7,028 6,6206,250 5,20 4170 3,004 2,310 18,42 14,00 12,82 11,76 1984 10,02 0,28 0,649 6.078 7562 7.1026.687 6312 5.873 4.391 ,960 5.20 1766 15,94 14.45 13,16 12.04 11.00 10.20 0,442 8.7728.176 7648 7,170 0,70 6.300 60114900 3,870 3,30 19.00 18:29 | 16,44 14.86 | 1340 12.30 | 127 | 10,37 9.500 | A3 234 231 230 6 6 99 824 1923 | as a 10,58 0,707 0.985 .348 7784 7.250 6.00 6434 6.073 4.937 3.001 3.33 18.91 16,04 15.25 13.00 12.56 1147 64 6.087 494 3,000 3,300 10,67 0,823 2.077 3.422 7.843 2,3306,873 19.52 17,41 15,62 14,00 12,78 11.88 500 1.0567,400 7.000 6.000 0.1774,379 1.000 2.382 2240 10,60 17.20 15,37 13,70 1201 11.2010,277 2140 18.06 16,37 14.50 1296 11,65 10,57 2,644 3.865 0,176 7.586 7,970 6.07 6.215 1902 1901.380 29,11 25,00 2211 19,79 17,16 15.06 13.30 11,92 10,769.779 6961 024 703 7,106 8.042 6.230 1987 2000 0.00 32,00 27.36 1121110.68 0.060 2.008 0.280 70617.1296.0002224900 4.000.000 48 36.00 2949 2452 2072 17,77 1540 1961 121110.00. 00 .280 PMIFA - Factors not included in this table may be calculated by means of the following equation: forn Periods Table D Prosont-Value Intorost Factors for a R1 annuity discounted at k por cont 16.20 18.78 13.80 1223 10,96 0,95 9042330478787.183 6.6000.000 1.000 1.000.00 50 59.20 3142 23,73 21,4 JJ Industries is in the business of manufacturing large yachts. They have an agreement with one of their biggest customers that they will pay off their account of R18.5 million over the next three years, with JJ Industries receiving the payments according to the following schedule: End of year 1: R4,000,000 End of year 2: R6,500,000 End of year 3: R8,000,000 The business has access to a market-linked investment account, which earns them 11% a year. 1.1 Using the tables, what PVIFs would one use to calculate the present values of each of the three cash inflows? Start writing here: 1.2 What is the present value of this income stream? Start writing here: 1.3 What is the total opportunity cost of allowing their customer to pay over three years, instead of right now? Start writing here: 1.4 If their customer offered them R15 million to settle their account today, would you recommend that J Industries accept it? Why, or why not? (Max. 3 lines) Start writing here: 1.5 In a brief point, mention one other factor that the business should take into account when allowing a customer to pay off an account over an extended period. (Max. 2 lines) Start writing here