Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Suppose an investor invests in a portfolio with price S and constant dividend yield q. Assume the investor is charged a constant expense

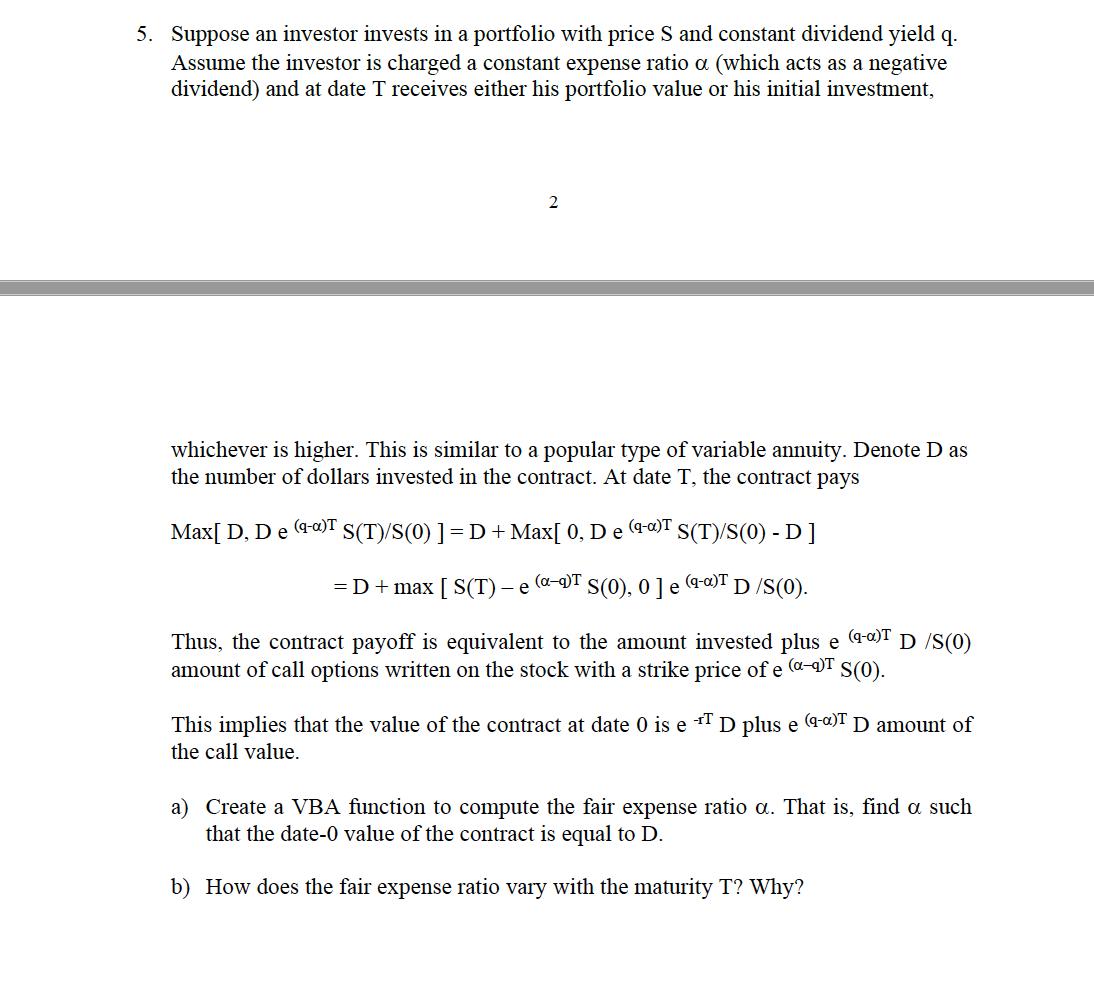

5. Suppose an investor invests in a portfolio with price S and constant dividend yield q. Assume the investor is charged a constant expense ratio a (which acts as a negative dividend) and at date T receives either his portfolio value or his initial investment, 2 whichever is higher. This is similar to a popular type of variable annuity. Denote D as the number of dollars invested in the contract. At date T, the contract pays S(T)/S(0) - D ] (q-a)T D/S(0). Max[ D, D e (9-)T S(T)/S(0) ] = D + Max[ 0, D e (q-a)T = D + max [S(T)-e (a-q)T S(0), 0 ] e Thus, the contract payoff is equivalent to the amount invested plus e (-a)T D /S(0) amount of call options written on the stock with a strike price of e (-T S(0). This implies that the value of the contract at date 0 is e TD plus e (9-0) D amount of the call value. a) Create a VBA function to compute the fair expense ratio a. That is, find a such that the date-0 value of the contract is equal to D. b) How does the fair expense ratio vary with the maturity T? Why?

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Heres a VBA function to compute the fair expense ratio a vba Function ComputeFairExpenseRatioD A...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started