Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Testing EMH. On February 18th, Ohio State announced that it had entered into exclu- sive contracts with two companies (company ABC and XYZ)

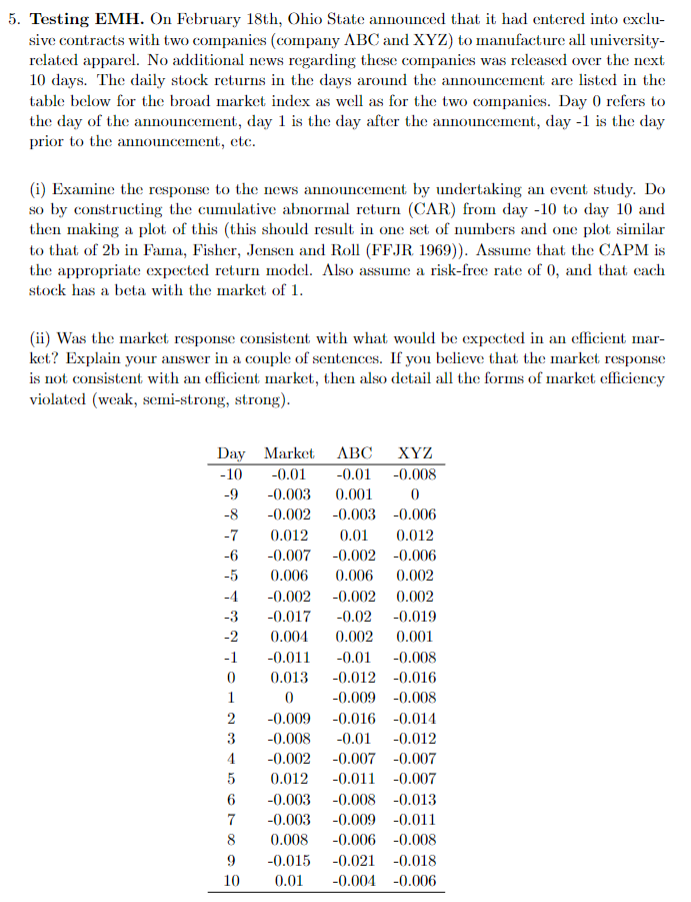

5. Testing EMH. On February 18th, Ohio State announced that it had entered into exclu- sive contracts with two companies (company ABC and XYZ) to manufacture all university- related apparel. No additional news regarding these companies was released over the next 10 days. The daily stock returns in the days around the announcement are listed in the table below for the broad market index as well as for the two companies. Day 0 refers to the day of the announcement, day 1 is the day after the announcement, day -1 is the day prior to the announcement, etc. (i) Examine the response to the news announcement by undertaking an event study. Do so by constructing the cumulative abnormal return (CAR) from day -10 to day 10 and then making a plot of this (this should result in one set of numbers and one plot similar to that of 2b in Fama, Fisher, Jensen and Roll (FFJR 1969)). Assume that the CAPM is the appropriate expected return model. Also assume a risk-free rate of 0, and that each stock has a beta with the market of 1. (ii) Was the market response consistent with what would be expected in an efficient mar ket? Explain your answer in a couple of sentences. If you believe that the market response is not consistent with an efficient market, then also detail all the forms of market efficiency violated (weak, semi-strong, strong). Day -10 -9 -8 -7 -6 -5 -3 -2 -1 0 1 2 3 4 5 6 7 8 9 10 Market ABC -0.01 -0.01 -0.003 0.001 -0.002 -0.003 0.012 0.01 -0.007 -0.002 0.006 0.006 XYZ -0.008 0 -0.006 -0.01 -0.012 0.012 -0.006 0.002 -0.002 -0.002 -0.017 -0.02 0.004 0.002 -0.011 0.013 0 -0.009 -0.008 -0.009 -0.016 -0.014 -0.008 -0.01 -0.012 -0.002 -0.007 -0.007 0.012 -0.011 -0.007 0.002 -0.019 0.001 -0.008 -0.016 -0.003 -0.008 -0.013 -0.003 -0.009 -0.011 0.008 -0.006 -0.008 -0.015 -0.021 -0.018 0.01 -0.004 -0.006

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Event Study Analysis of Market Response to Apparel Contract Announcement I Event Study and Cumulative Abnormal Returns CAR a Calculation of Abnormal R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started