Answered step by step

Verified Expert Solution

Question

1 Approved Answer

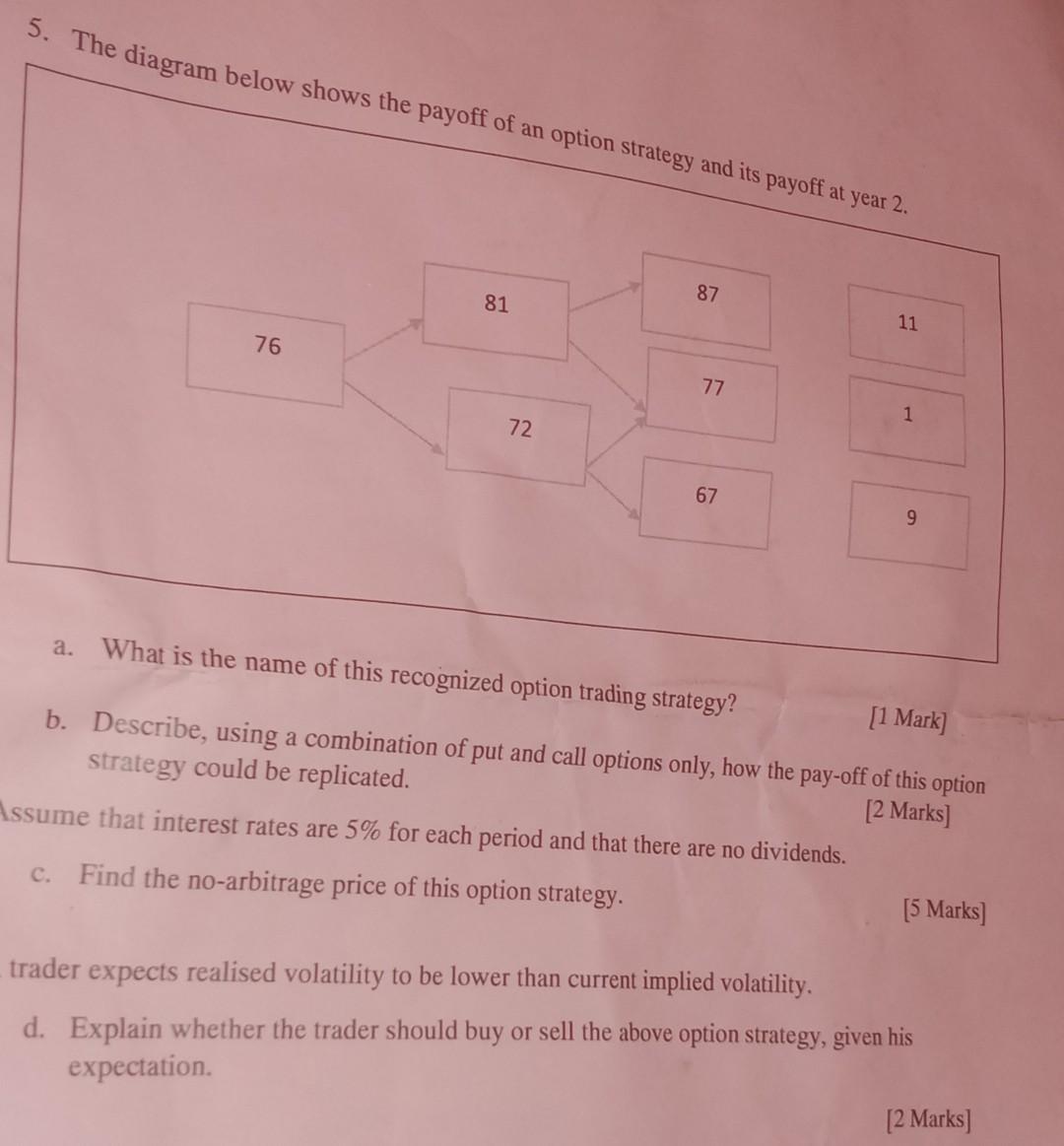

5. The diagram below shows the payoff of an option strategy and its payoff at year 2. 87 81 11 76 77 1 72 67

5. The diagram below shows the payoff of an option strategy and its payoff at year 2. 87 81 11 76 77 1 72 67 9 a. What is the name of this recognized option trading strategy? [1 Mark] b. Describe, using a combination of put and call options only, how the pay-off of this option strategy could be replicated. [2 Marks] Assume that interest rates are 5% for each period and that there are no dividends. [5 Marks] C. Find the no-arbitrage price of this option strategy. trader expects realised volatility to be lower than current implied volatility. d. Explain whether the trader should buy or sell the above option strategy, given his expectation [2 Marks] 5. The diagram below shows the payoff of an option strategy and its payoff at year 2. 87 81 11 76 77 1 72 67 9 a. What is the name of this recognized option trading strategy? [1 Mark] b. Describe, using a combination of put and call options only, how the pay-off of this option strategy could be replicated. [2 Marks] Assume that interest rates are 5% for each period and that there are no dividends. [5 Marks] C. Find the no-arbitrage price of this option strategy. trader expects realised volatility to be lower than current implied volatility. d. Explain whether the trader should buy or sell the above option strategy, given his expectation [2 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started