Question

The Richter Company, a technology company, has been growing rapidly. After examining the companys operations very carefully, analysts at Meril Link have estimated that dividends

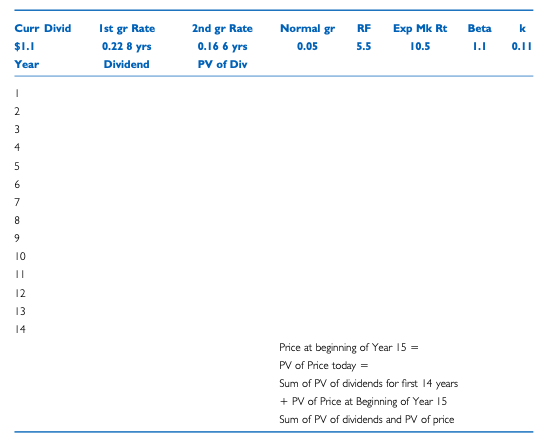

The Richter Company, a technology company, has been growing rapidly. After examining the companys operations very carefully, analysts at Meril Link have estimated that dividends and earnings will grow at a rate of 22 percent a year for the next eight years, followed by 16 percent growth for another six years. After 14 years, the expected growth rate is 5 percent The risk-free rate appropriate for this analysis is 5.5 percent, and the expected return on the market is 10.5 percent. The beta for Richter is 1.1. It currently pays a dividend of $1.10. As major stockholders, the Richter family has asked you to estimate the intrinsic value of this stock today. Note the following:

-

Calculate the required rate of return in cell H2 using the CAPM.

-

Calculate the dollar amount of each dividend for the first 14 years in cells B5 through B18, and the present value of these amounts in cells C5 through C18. Be sure to allow for the change in growth rates in year 9.

-

In cell G19, calculate the price of the stock at the beginning of year 15, using the then-constant growth rate of 5 percent.

-

In cell G20, discount the price found in 3) back to today using the proper number of periods for discounting.

-

Sum the present value of the dividends in cell C21. Add to this the present value of the price found in 4) by putting this value in C22.

-

In cell C23, add the values found in 5) in cell C24.

-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started