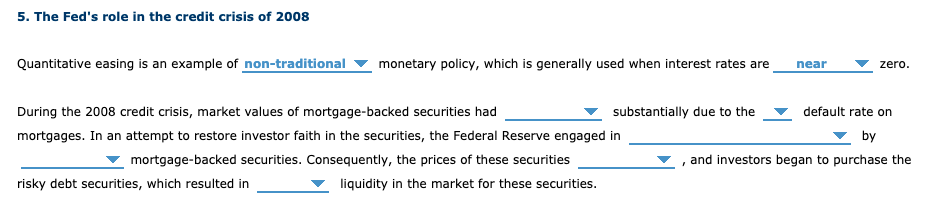

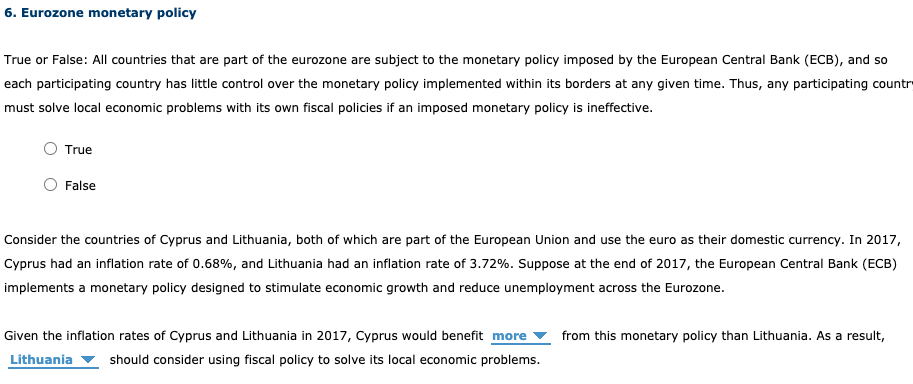

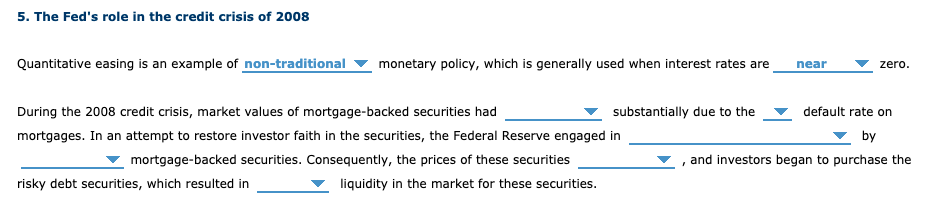

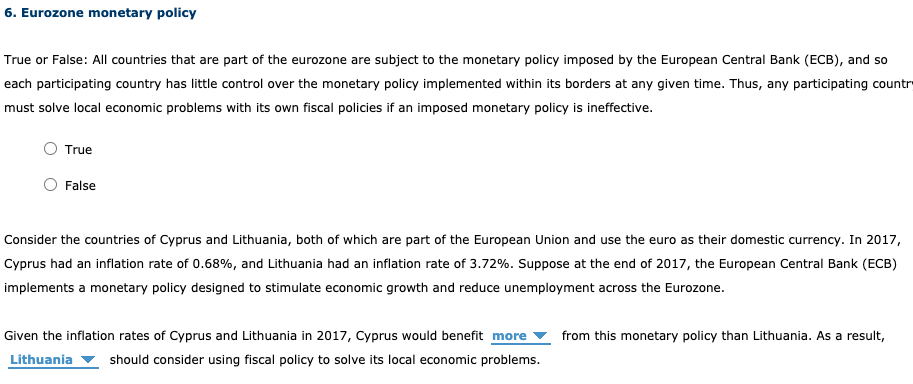

5. The Fed's role in the credit crisis of 2008 Quantitative easing is an example of non-traditional monetary policy, which is generally used when interest rates are near zero. During the 2008 credit crisis, market values of mortgage-backed securities had substantially due to the default rate on mortgages. In an attempt to restore investor faith in the securities, the Federal Reserve engaged in by mortgage-backed securities. Consequently, the prices of these securities and investors began to purchase the risky debt securities, which resulted in liquidity in the market for these securities. 6. Eurozone monetary policy True or False: All countries that are part of the eurozone are subject to the monetary policy imposed by the European Central Bank (ECB), and so each participating country has little control over the monetary policy implemented within its borders at any given time. Thus, any participating country must solve local economic problems with its own fiscal policies if an imposed monetary policy is ineffective. True False Consider the countries of Cyprus and Lithuania, both of which are part of the European Union and use the euro as their domestic currency. In 2017, Cyprus had an inflation rate of 0.68%, and Lithuania had an inflation rate of 3.72%. Suppose at the end of 2017, the European Central Bank (ECB) implements a monetary policy designed to stimulate economic growth and reduce unemployment across the Eurozone. from this monetary policy than Lithuania. As a result, Given the inflation rates of Cyprus and Lithuania in 2017, Cyprus would benefit more Lithuania should consider using fiscal policy to solve its local economic problems. 5. The Fed's role in the credit crisis of 2008 Quantitative easing is an example of non-traditional monetary policy, which is generally used when interest rates are near zero. During the 2008 credit crisis, market values of mortgage-backed securities had substantially due to the default rate on mortgages. In an attempt to restore investor faith in the securities, the Federal Reserve engaged in by mortgage-backed securities. Consequently, the prices of these securities and investors began to purchase the risky debt securities, which resulted in liquidity in the market for these securities. 6. Eurozone monetary policy True or False: All countries that are part of the eurozone are subject to the monetary policy imposed by the European Central Bank (ECB), and so each participating country has little control over the monetary policy implemented within its borders at any given time. Thus, any participating country must solve local economic problems with its own fiscal policies if an imposed monetary policy is ineffective. True False Consider the countries of Cyprus and Lithuania, both of which are part of the European Union and use the euro as their domestic currency. In 2017, Cyprus had an inflation rate of 0.68%, and Lithuania had an inflation rate of 3.72%. Suppose at the end of 2017, the European Central Bank (ECB) implements a monetary policy designed to stimulate economic growth and reduce unemployment across the Eurozone. from this monetary policy than Lithuania. As a result, Given the inflation rates of Cyprus and Lithuania in 2017, Cyprus would benefit more Lithuania should consider using fiscal policy to solve its local economic problems