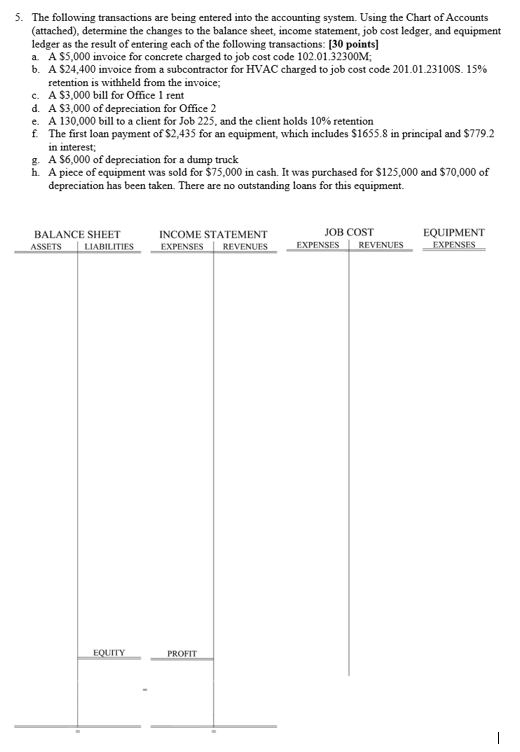

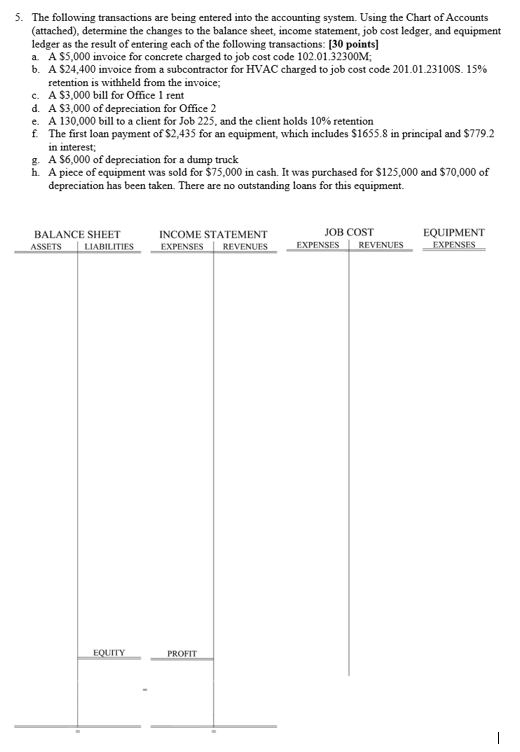

5. The following transactions are being entered into the accounting system. Using the Chart of Accounts (attached), determine the changes to the balance sheet, income statement, job cost ledger, and equipment ledger as the result of entering each of the following transactions: (30 points] a. A $5,000 invoice for concrete charged to job cost code 102.01.32300M; b. A $24.400 invoice from a subcontractor for HVAC charged to job cost code 201.01.231008. 15% retention is withheld from the invoice c. A $3.000 bill for Office I rent d. A $3,000 of depreciation for Office 2 e. A 130,000 bill to a client for Job 225, and the client holds 10% retention f. The first loan payment of $2,435 for an equipment, which includes $1655.8 in principal and $779.2 in interest g. A $6,000 of depreciation for a dump truck h. A piece of equipment was sold for $75,000 in cash. It was purchased for $125,000 and $70,000 of depreciation has been taken. There are no outstanding loans for this equipment. BALANCE SHEET ASSETS LIABILITIES INCOME STATEMENT EXPENSES REVENUES JOB COST EXPENSES REVENUES EQUIPMENT EXPENSES 5. The following transactions are being entered into the accounting system. Using the Chart of Accounts (attached), determine the changes to the balance sheet, income statement, job cost ledger, and equipment ledger as the result of entering each of the following transactions: (30 points] a. A $5,000 invoice for concrete charged to job cost code 102.01.32300M; b. A $24.400 invoice from a subcontractor for HVAC charged to job cost code 201.01.231008. 15% retention is withheld from the invoice c. A $3.000 bill for Office I rent d. A $3,000 of depreciation for Office 2 e. A 130,000 bill to a client for Job 225, and the client holds 10% retention f. The first loan payment of $2,435 for an equipment, which includes $1655.8 in principal and $779.2 in interest g. A $6,000 of depreciation for a dump truck h. A piece of equipment was sold for $75,000 in cash. It was purchased for $125,000 and $70,000 of depreciation has been taken. There are no outstanding loans for this equipment. BALANCE SHEET ASSETS LIABILITIES INCOME STATEMENT EXPENSES REVENUES JOB COST EXPENSES REVENUES EQUIPMENT EXPENSES