Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5) The International Monetary Fund a) was created as part of the Bretton Woods system of fixed exchange rates b) ceased to exist when the

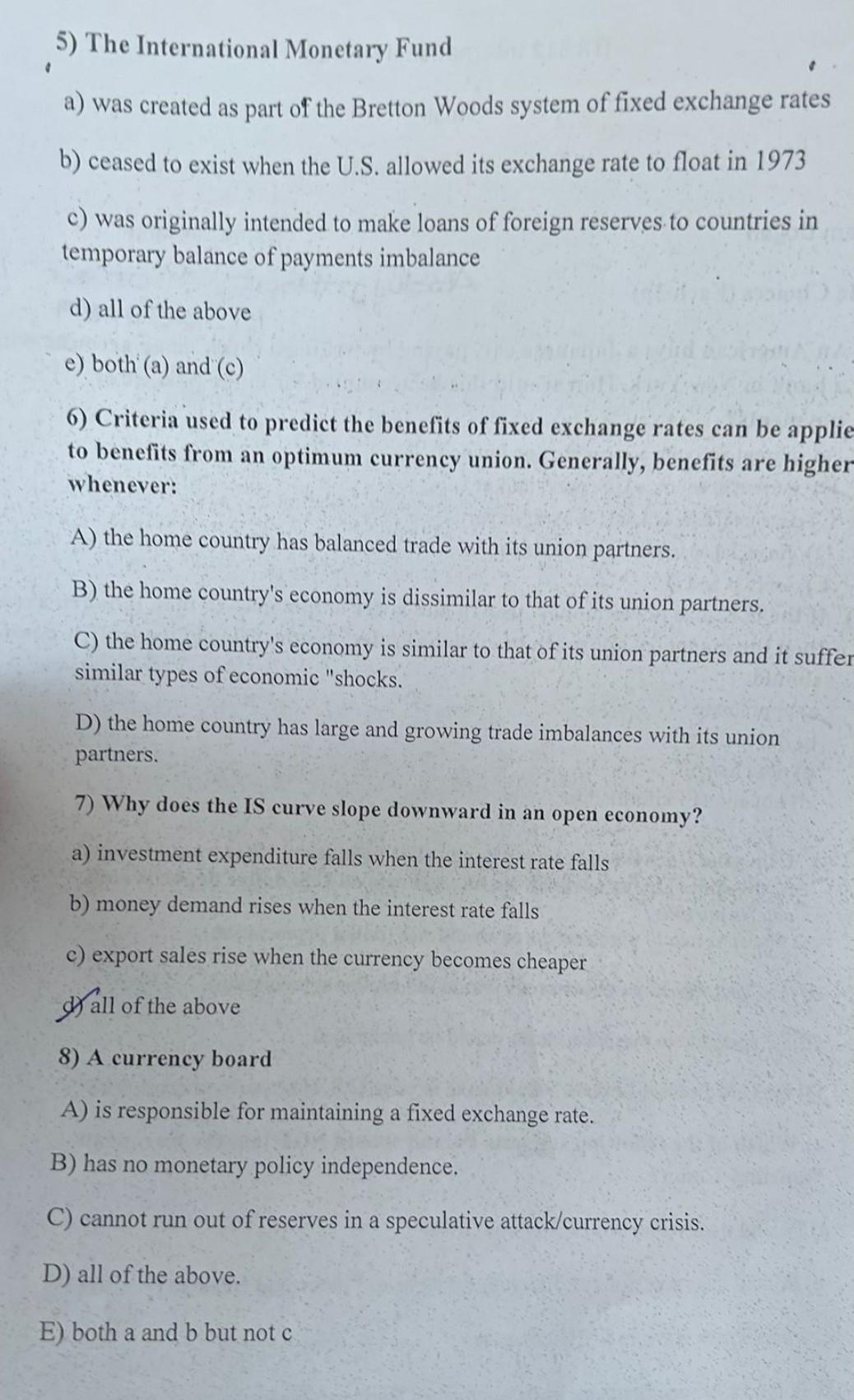

5) The International Monetary Fund a) was created as part of the Bretton Woods system of fixed exchange rates b) ceased to exist when the U.S. allowed its exchange rate to float in 1973 c) was originally intended to make loans of foreign reserves to countries in temporary balance of payments imbalance d) all of the above e) both (a) and (c) 6) Criteria used to predict the benefits of fixed exchange rates can be applie to benefits from an optimum currency union. Generally, benefits are higher whenever: A) the home country has balanced trade with its union partners. B) the home country's economy is dissimilar to that of its union partners. C) the home country's economy is similar to that of its union partners and it suffer similar types of economic "shocks. D) the home country has large and growing trade imbalances with its union partners. 7) Why does the IS curve slope downward in an open economy? a) investment expenditure falls when the interest rate falls b) money demand rises when the interest rate falls c) export sales rise when the currency becomes cheaper all of the above 8) A currency board A) is responsible for maintaining a fixed exchange rate. B) has no monetary policy independence. C) cannot run out of reserves in a speculative attack/currency crisis. D) all of the above. E) both a and b but not c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started