Answered step by step

Verified Expert Solution

Question

1 Approved Answer

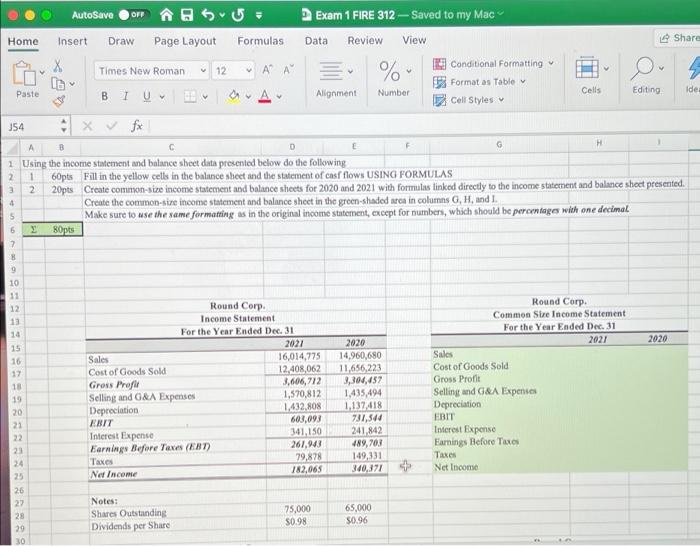

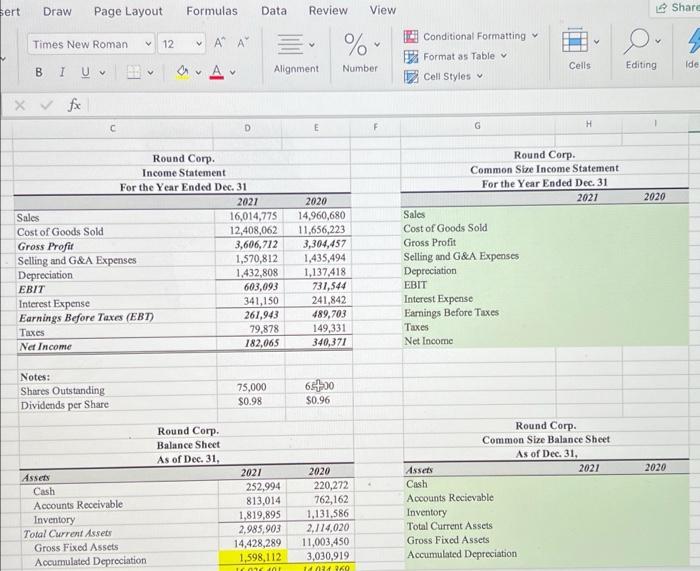

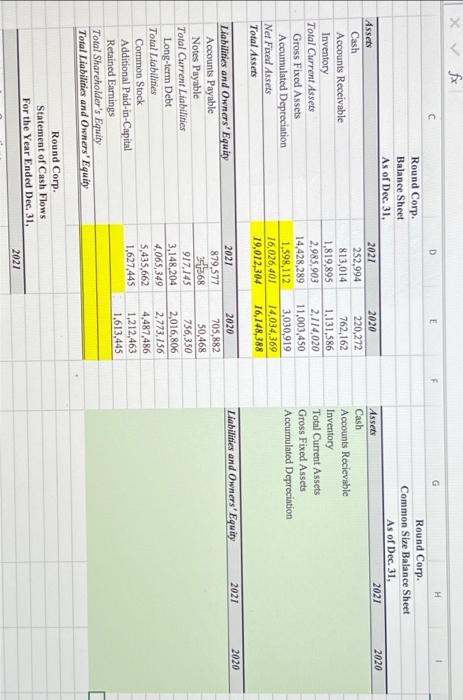

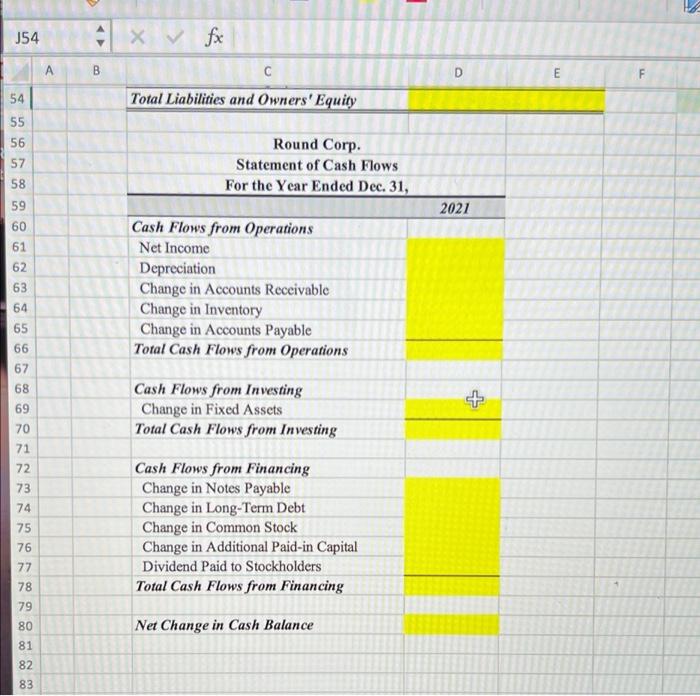

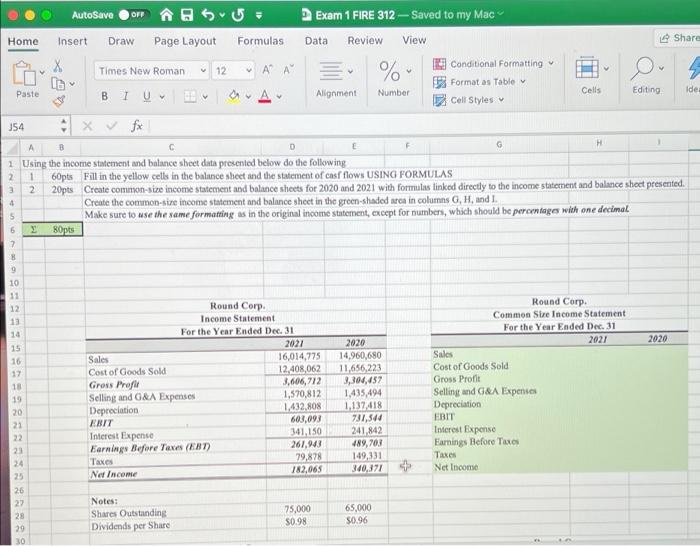

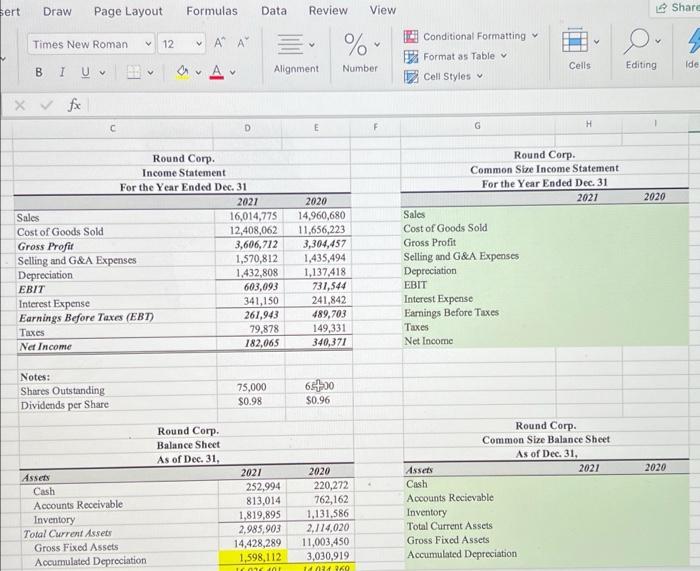

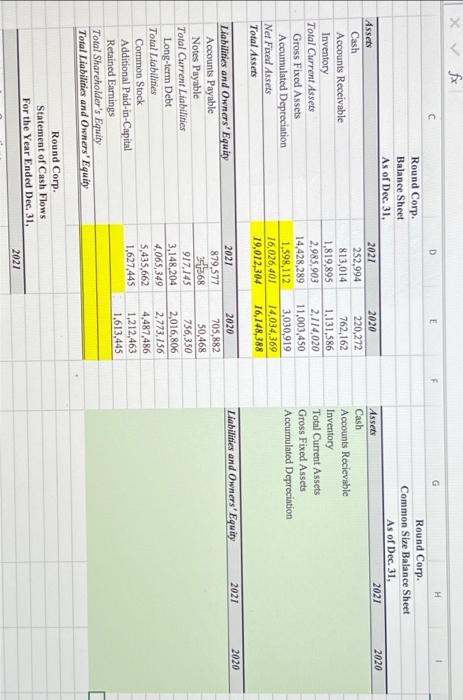

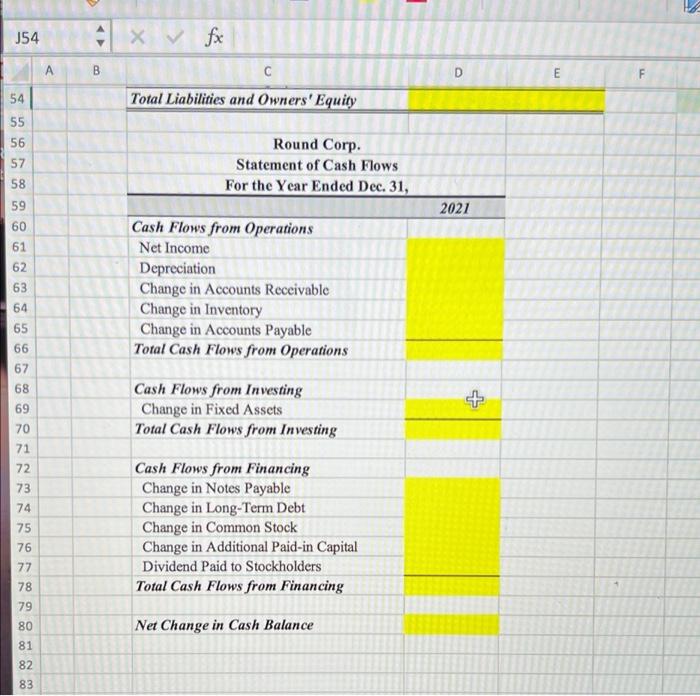

Please use formula Home 34 Pastel Share Conditional Formatting 12 A A %* 4 Format as Table Number Alignment Cells Editing Idea Cell Styles J54

Please use formula

Home 34 Pastel Share Conditional Formatting 12 A A %* 4 Format as Table Number Alignment Cells Editing Idea Cell Styles J54 x fx A B C F H 1 Using the income statement and balance sheet data presented below do the following 2 1 60pts Fill in the yellow cells in the balance sheet and the statement of casf flows USING FORMULAS 2 20pts Create common-size income statement and balance sheets for 2020 and 2021 with formulas linked directly to the income statement and balance sheet presented. Create the common-size income statement and balance sheet in the green-shaded area in columns G, H, and 1. Make sure to use the same formatting as in the original income statement, except for numbers, which should be percentages with one decimal 6 80pts 7 8 9 10 11 Round Corp. 12 Round Corp. Income Statement Common Size Income Statement 13 For the Year Ended Dec. 31 14 2021 15 For the Year Ended Dec. 311 2021 16,014,775 12,408,062 16 2020 14,960,680 11,656,223 17 18 3,606,712 3,304,457 19 1,570,812 1,435,494 1,432,808 1,137,418 20 603,093 731,544 21 341,150 241,842 22 261,943 489,703 23 79,878 149,331 24 182,065 340,371 25 26 27 28 29 30 AutoSave OFF Draw Times New Roman B I U. Insert 16 Page Layout = Formulas Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes (EBT) Taxes Net Income Notes: Shares Outstanding Dividends per Share Exam 1 FIRE 312 - Saved to my Mac Data Review View 75,000 $0.98 65,000 $0.96 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income 2020 sert Formulas. Page Layout 12 V A A A Draw Times New Roman B I U v fx Round Corp. Income Statement For the Year Ended Dec. 31 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes (EBT) Taxes Net Income Notes: Shares Outstanding Dividends per Share Assets Cash Accounts Receivable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation D Round Corp. Balance Sheet As of Dec. 31, Data Review 75,000 $0.98 2021 = Alignment 2021 16,014,775 12,408,062 11,656,223 2020 14,960,680 3,606,712 3,304,457 1,570,812 1,435,494 1,432,808 1,137,418 603,093 731,544 341,150 241,842 261,943 489,703 79,878 149,331 182,065 340,371 65,00 $0.96 2020 % Number View 252,994 220,272 813,014 762,162 1,819,895 1,131,586. 2,985,903 2,114,020 14,428,289 11,003,450 1,598,112 3,030,919 16.076 40 14.034 360 Conditional Formatting Format as Table Cell Styles Cells G H Round Corp. Common Size Income Statement For the Year Ended Dec. 31 2021 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income Assets Cash Accounts Recievable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation Round Corp. Common Size Balance Sheet As of Dec. 31, 2021 Ov Editing 2020 2020 Share Ide fx C Accounts Receivable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Total Assets Liabilities and Owners' Equity Accounts Payable Notes Payable Total Current Liabilities Long-term Debt- Total Liabilities Common Stock Additional Paid-in-Capital Retained Earnings Total Shareholder's Equity Total Liabilities and Owners' Equity Assets Cash Round Corp. Balance Sheet As of Dec. 31, Round Corp. Statement of Cash Flows i For the Year Ended Dec. 31, D 2021 2020 252,994 220,272 813,014 762,162 1,819,895 1,131,586 2,985,903 2,114,020 14,428,289 11,003,450 1,598,1121 3,030,919 16,026,401 14,034,369 19,012,304 16,148,388 2021 2020 879,577 705,882 34368 50,468 917,145 756,350 3,148,204 2,016,806 4,065,349 2,773,156 5,435,662 4,487,486 1,627,445 1,212,463 1,613,445 2021 G H Round Corp. Common Size Balance Sheet As of Dec. 31, 2021 2021 Assets Cash Accounts Recievable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation Liabilities and Owners' Equity 2020 2020 J54 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 5678918 77 80 81 82 83 A B x fx C Total Liabilities and Owners' Equity Round Corp. Statement of Cash Flows For the Year Ended Dec. 31, Cash Flows from Operations Net Income Depreciation Change in Accounts Receivable Change in Inventory Change in Accounts Payable Total Cash Flows from Operations Cash Flows from Investing Change in Fixed Assets Total Cash Flows from Investing Cash Flows from Financing Change in Notes Payable Change in Long-Term Debt Change in Common Stock Change in Additional Paid-in Capital Dividend Paid to Stockholders Total Cash Flows from Financing Net Change in Cash Balance D 2021 E F Home 34 Pastel Share Conditional Formatting 12 A A %* 4 Format as Table Number Alignment Cells Editing Idea Cell Styles J54 x fx A B C F H 1 Using the income statement and balance sheet data presented below do the following 2 1 60pts Fill in the yellow cells in the balance sheet and the statement of casf flows USING FORMULAS 2 20pts Create common-size income statement and balance sheets for 2020 and 2021 with formulas linked directly to the income statement and balance sheet presented. Create the common-size income statement and balance sheet in the green-shaded area in columns G, H, and 1. Make sure to use the same formatting as in the original income statement, except for numbers, which should be percentages with one decimal 6 80pts 7 8 9 10 11 Round Corp. 12 Round Corp. Income Statement Common Size Income Statement 13 For the Year Ended Dec. 31 14 2021 15 For the Year Ended Dec. 311 2021 16,014,775 12,408,062 16 2020 14,960,680 11,656,223 17 18 3,606,712 3,304,457 19 1,570,812 1,435,494 1,432,808 1,137,418 20 603,093 731,544 21 341,150 241,842 22 261,943 489,703 23 79,878 149,331 24 182,065 340,371 25 26 27 28 29 30 AutoSave OFF Draw Times New Roman B I U. Insert 16 Page Layout = Formulas Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes (EBT) Taxes Net Income Notes: Shares Outstanding Dividends per Share Exam 1 FIRE 312 - Saved to my Mac Data Review View 75,000 $0.98 65,000 $0.96 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income 2020 sert Formulas. Page Layout 12 V A A A Draw Times New Roman B I U v fx Round Corp. Income Statement For the Year Ended Dec. 31 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes (EBT) Taxes Net Income Notes: Shares Outstanding Dividends per Share Assets Cash Accounts Receivable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation D Round Corp. Balance Sheet As of Dec. 31, Data Review 75,000 $0.98 2021 = Alignment 2021 16,014,775 12,408,062 11,656,223 2020 14,960,680 3,606,712 3,304,457 1,570,812 1,435,494 1,432,808 1,137,418 603,093 731,544 341,150 241,842 261,943 489,703 79,878 149,331 182,065 340,371 65,00 $0.96 2020 % Number View 252,994 220,272 813,014 762,162 1,819,895 1,131,586. 2,985,903 2,114,020 14,428,289 11,003,450 1,598,112 3,030,919 16.076 40 14.034 360 Conditional Formatting Format as Table Cell Styles Cells G H Round Corp. Common Size Income Statement For the Year Ended Dec. 31 2021 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Depreciation EBIT Interest Expense Earnings Before Taxes Taxes Net Income Assets Cash Accounts Recievable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation Round Corp. Common Size Balance Sheet As of Dec. 31, 2021 Ov Editing 2020 2020 Share Ide fx C Accounts Receivable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Total Assets Liabilities and Owners' Equity Accounts Payable Notes Payable Total Current Liabilities Long-term Debt- Total Liabilities Common Stock Additional Paid-in-Capital Retained Earnings Total Shareholder's Equity Total Liabilities and Owners' Equity Assets Cash Round Corp. Balance Sheet As of Dec. 31, Round Corp. Statement of Cash Flows i For the Year Ended Dec. 31, D 2021 2020 252,994 220,272 813,014 762,162 1,819,895 1,131,586 2,985,903 2,114,020 14,428,289 11,003,450 1,598,1121 3,030,919 16,026,401 14,034,369 19,012,304 16,148,388 2021 2020 879,577 705,882 34368 50,468 917,145 756,350 3,148,204 2,016,806 4,065,349 2,773,156 5,435,662 4,487,486 1,627,445 1,212,463 1,613,445 2021 G H Round Corp. Common Size Balance Sheet As of Dec. 31, 2021 2021 Assets Cash Accounts Recievable Inventory Total Current Assets Gross Fixed Assets Accumulated Depreciation Liabilities and Owners' Equity 2020 2020 J54 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 5678918 77 80 81 82 83 A B x fx C Total Liabilities and Owners' Equity Round Corp. Statement of Cash Flows For the Year Ended Dec. 31, Cash Flows from Operations Net Income Depreciation Change in Accounts Receivable Change in Inventory Change in Accounts Payable Total Cash Flows from Operations Cash Flows from Investing Change in Fixed Assets Total Cash Flows from Investing Cash Flows from Financing Change in Notes Payable Change in Long-Term Debt Change in Common Stock Change in Additional Paid-in Capital Dividend Paid to Stockholders Total Cash Flows from Financing Net Change in Cash Balance D 2021 E F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started