Answered step by step

Verified Expert Solution

Question

1 Approved Answer

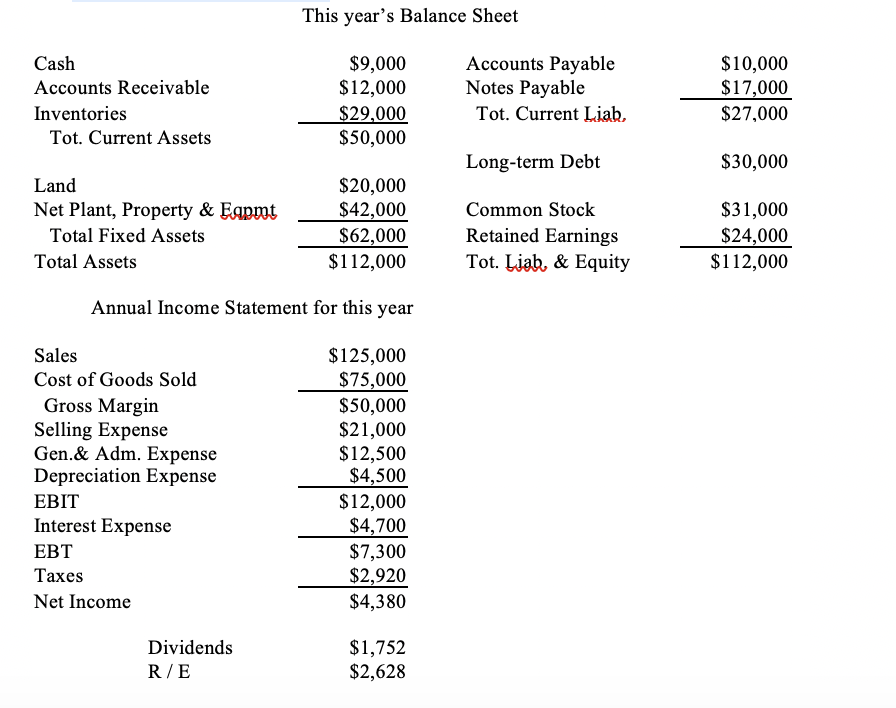

5. The most recent balance sheet and income statement for Popart Inc. are given below. Prepare pro forma financial statements for the next year and

5. The most recent balance sheet and income statement for Popart Inc. are given below. Prepare pro forma financial statements for the next year and calculate the amount of additional long-term borrowing that would be necessary to fund the firms projected growth.

- Sales are projected to grow by 20% next year.

- Costs are expected to grow with sales. However, depreciation expense will not change next year.

- Cash, inventories, accounts payable, and PP&E also vary with sales. The value of land will remain constant in the coming year.

- The firm plans to enforce a collection policy that will keep Days Sales in Receivables ratio at 30 days.

- The company intends to keep its dividend payout ratio constant.

- The companys creditors require it to maintain a Current Ratio of at least 1.80.

- The company prefers to use as much short-term debt (Notes Payable) as possible. If short- term debt capacity is not sufficient, it will raise the additional needed funds through long-term borrowing (Long-term Debt). The interest rate applicable to both short and long-term debt is 10%.

- The firms tax rate is 40%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started