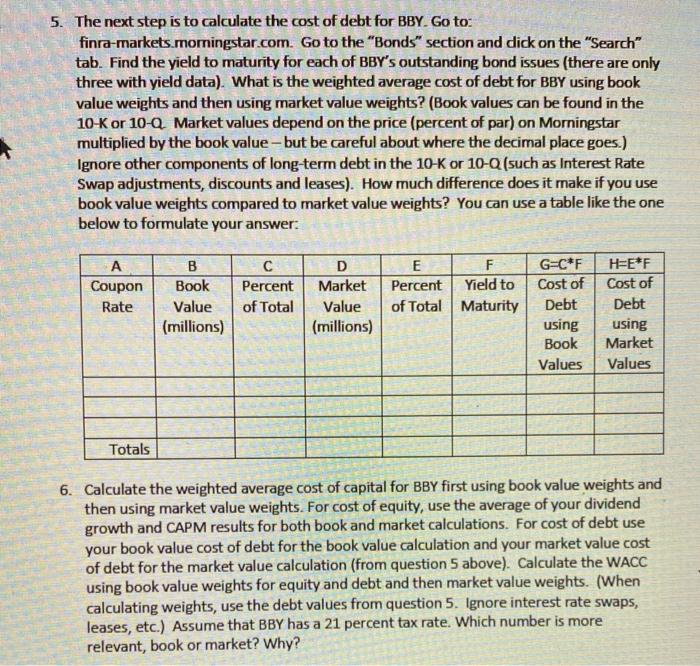

5. The next step is to calculate the cost of debt for BBY. Go to: finra-markets.momingstar.com. Go to the "Bonds" section and dick on the "Search" tab. Find the yield to maturity for each of BBY's outstanding bond issues (there are only three with yield data). What is the weighted average cost of debt for BBY using book value weights and then using market value weights? (Book values can be found in the 10-K or 10-Q, Market values depend on the price (percent of par) on Morningstar multiplied by the book value - but be careful about where the decimal place goes.) Ignore other components of long-term debt in the 10-K or 10-Q (such as Interest Rate Swap adjustments, discounts and leases). How much difference does it make if you use book value weights compared to market value weights? You can use a table like the one below to formulate your answer. A Coupon Rate B Book Value (millions) Percent of Total D Market Value (millions) E F Percent Yield to of Total Maturity G=CF Cost of Debt using Book Values HEE*F Cost of Debt using Market Values Totals 6. Calculate the weighted average cost of capital for BBY first using book value weights and then using market value weights. For cost of equity, use the average of your dividend growth and CAPM results for both book and market calculations. For cost of debt use your book value cost of debt for the book value calculation and your market value cost of debt for the market value calculation (from question 5 above). Calculate the WACC using book value weights for equity and debt and then market value weights. (When calculating weights, use the debt values from question 5. Ignore interest rate swaps, leases, etc.) Assume that BBY has a 21 percent tax rate. Which number is more relevant, book or market? Why? 5. The next step is to calculate the cost of debt for BBY. Go to: finra-markets.momingstar.com. Go to the "Bonds" section and dick on the "Search" tab. Find the yield to maturity for each of BBY's outstanding bond issues (there are only three with yield data). What is the weighted average cost of debt for BBY using book value weights and then using market value weights? (Book values can be found in the 10-K or 10-Q, Market values depend on the price (percent of par) on Morningstar multiplied by the book value - but be careful about where the decimal place goes.) Ignore other components of long-term debt in the 10-K or 10-Q (such as Interest Rate Swap adjustments, discounts and leases). How much difference does it make if you use book value weights compared to market value weights? You can use a table like the one below to formulate your answer. A Coupon Rate B Book Value (millions) Percent of Total D Market Value (millions) E F Percent Yield to of Total Maturity G=CF Cost of Debt using Book Values HEE*F Cost of Debt using Market Values Totals 6. Calculate the weighted average cost of capital for BBY first using book value weights and then using market value weights. For cost of equity, use the average of your dividend growth and CAPM results for both book and market calculations. For cost of debt use your book value cost of debt for the book value calculation and your market value cost of debt for the market value calculation (from question 5 above). Calculate the WACC using book value weights for equity and debt and then market value weights. (When calculating weights, use the debt values from question 5. Ignore interest rate swaps, leases, etc.) Assume that BBY has a 21 percent tax rate. Which number is more relevant, book or market? Why