Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. The owner of a small pop up store is going out of business and wants to sell his assets and liabilities to liquidate his

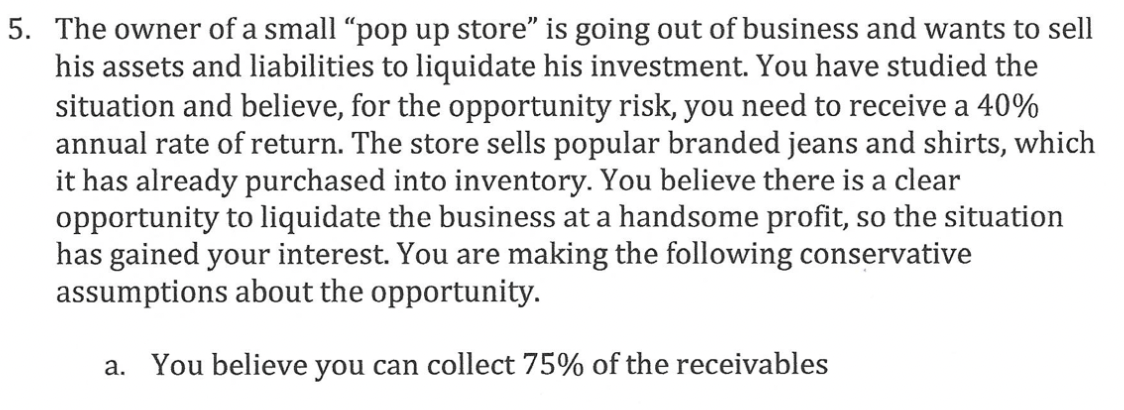

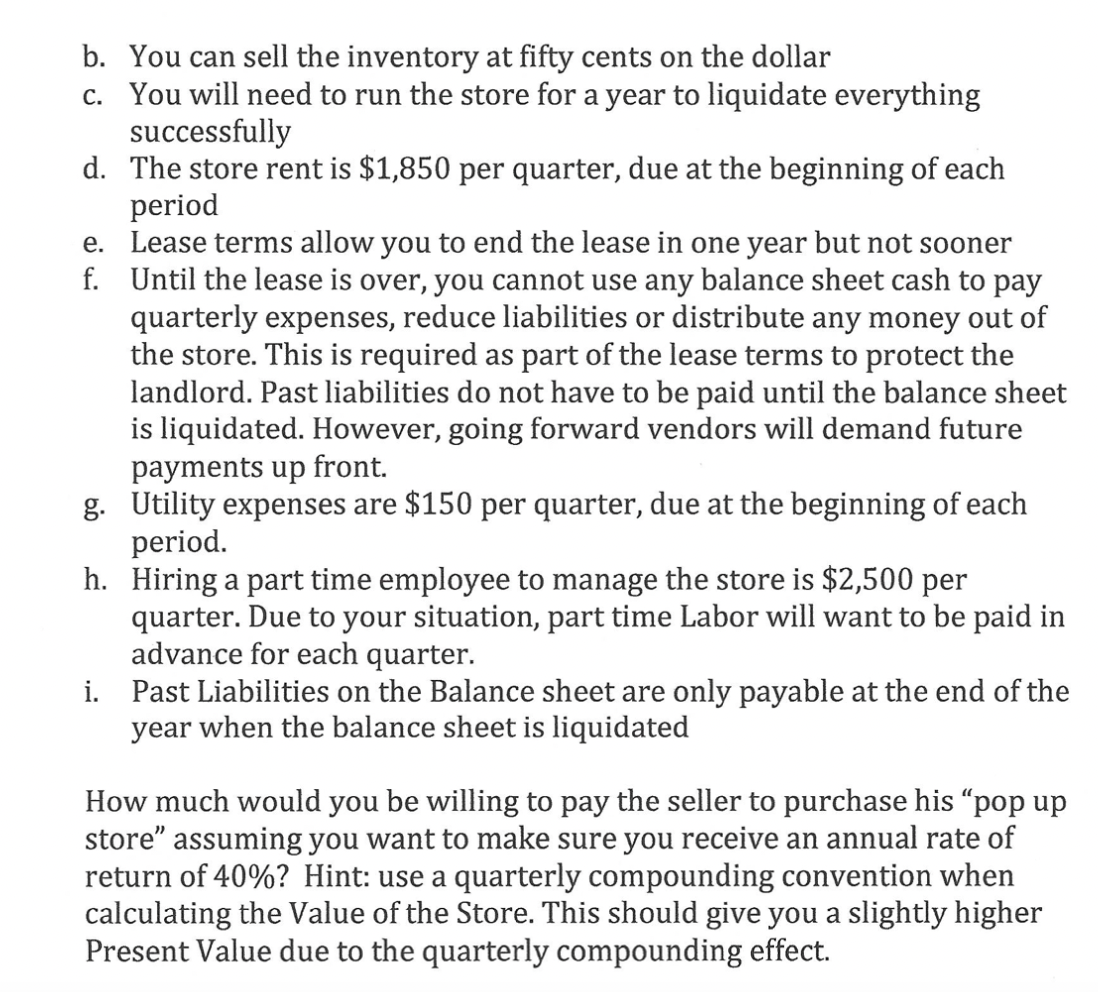

5. The owner of a small "pop up store" is going out of business and wants to sell his assets and liabilities to liquidate his investment. You have studied the situation and believe, for the opportunity risk, you need to receive a 40% annual rate of return. The store sells popular branded jeans and shirts, which it has already purchased into inventory. You believe there is a clear opportunity to liquidate the business at a handsome profit, so the situation has gained your interest. You are making the following conservative assumptions about the opportunity. a. You believe you can collect 75% of the receivables b. You can sell the inventory at fifty cents on the dollar c. You will need to run the store for a year to liquidate everything successfully d. The store rent is $1,850 per quarter, due at the beginning of each period e. Lease terms allow you to end the lease in one year but not sooner f. Until the lease is over, you cannot use any balance sheet cash to pay quarterly expenses, reduce liabilities or distribute any money out of the store. This is required as part of the lease terms to protect the landlord. Past liabilities do not have to be paid until the balance sheet is liquidated. However, going forward vendors will demand future payments up front. g. Utility expenses are $150 per quarter, due at the beginning of each period. h. Hiring a part time employee to manage the store is $2,500 per quarter. Due to your situation, part time Labor will want to be paid in advance for each quarter. i. Past Liabilities on the Balance sheet are only payable at the end of the year when the balance sheet is liquidated How much would you be willing to pay the seller to purchase his "pop up store" assuming you want to make sure you receive an annual rate of return of 40% ? Hint: use a quarterly compounding convention when calculating the Value of the Store. This should give you a slightly higher Present Value due to the quarterly compounding effect

5. The owner of a small "pop up store" is going out of business and wants to sell his assets and liabilities to liquidate his investment. You have studied the situation and believe, for the opportunity risk, you need to receive a 40% annual rate of return. The store sells popular branded jeans and shirts, which it has already purchased into inventory. You believe there is a clear opportunity to liquidate the business at a handsome profit, so the situation has gained your interest. You are making the following conservative assumptions about the opportunity. a. You believe you can collect 75% of the receivables b. You can sell the inventory at fifty cents on the dollar c. You will need to run the store for a year to liquidate everything successfully d. The store rent is $1,850 per quarter, due at the beginning of each period e. Lease terms allow you to end the lease in one year but not sooner f. Until the lease is over, you cannot use any balance sheet cash to pay quarterly expenses, reduce liabilities or distribute any money out of the store. This is required as part of the lease terms to protect the landlord. Past liabilities do not have to be paid until the balance sheet is liquidated. However, going forward vendors will demand future payments up front. g. Utility expenses are $150 per quarter, due at the beginning of each period. h. Hiring a part time employee to manage the store is $2,500 per quarter. Due to your situation, part time Labor will want to be paid in advance for each quarter. i. Past Liabilities on the Balance sheet are only payable at the end of the year when the balance sheet is liquidated How much would you be willing to pay the seller to purchase his "pop up store" assuming you want to make sure you receive an annual rate of return of 40% ? Hint: use a quarterly compounding convention when calculating the Value of the Store. This should give you a slightly higher Present Value due to the quarterly compounding effect Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started