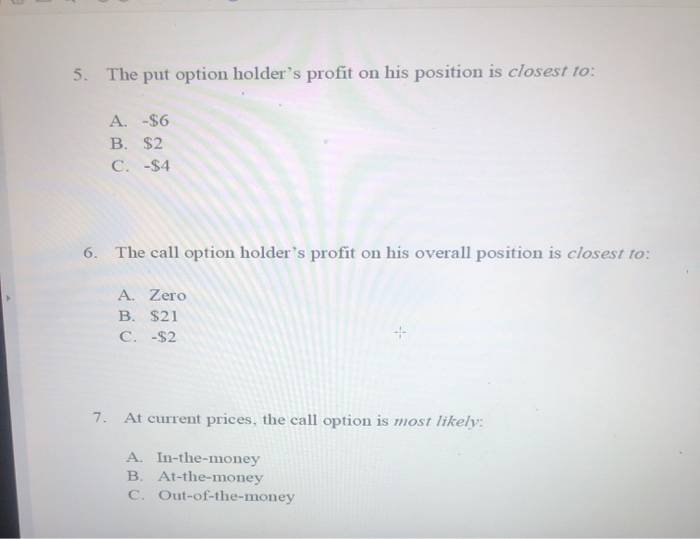

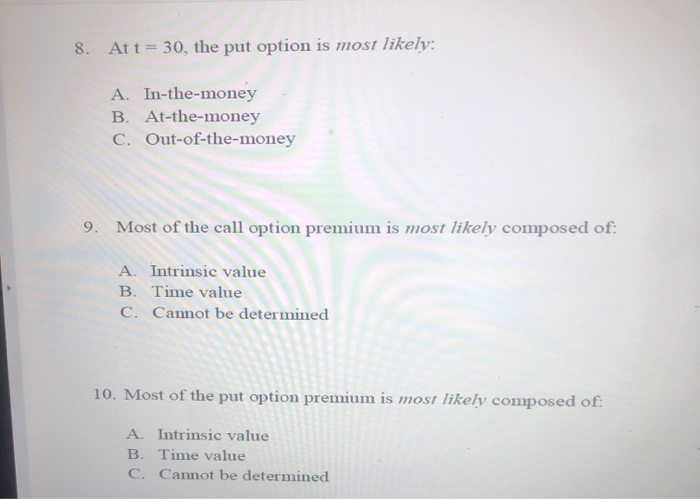

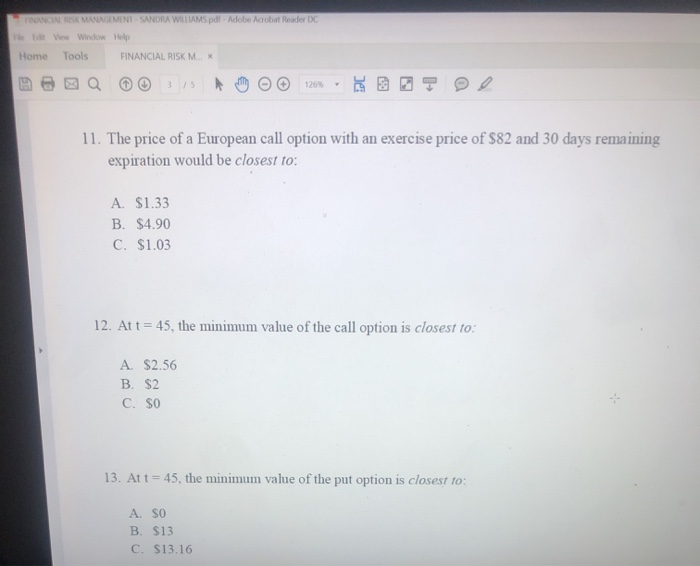

5. The put option holder's profit on his position is closest to: A. -$6 B. $2 C. -$4 6. The call option holder's profit on his overall position is closest to: A. Zero B. $21 C. -$2 7. At current prices, the call option is most likely: A. In-the-money B. At-the-money C. Out-of-the-money 8. At t= 30, the put option is most likely: A. In-the-money B. At-the-money C. Out-of-the-money 9. Most of the call option premium is most likely composed of: A. Intrinsic value B. Time value C. Cannot be determined 10. Most of the put option premium is most likely composed of: A. Intrinsic value B. Time value C. Cannot be determined TANGERANGIMINI SANDRA WILLIAMS pd! Adobe Acrobat Reader DC View Widow Help Home Tools FINANCIAL RISK M.. * 11. The price of a European call option with an exercise price of $82 and 30 days remaining expiration would be closest to: A $1.33 B. $4.90 C. $1.03 12. At t = 45, the minimum value of the call option is closest to: A $2.56 B. $2 C. $0 13. Att = 45, the minimum value of the put option is closest to: A. SO B. $13 C. S13.16 5. The put option holder's profit on his position is closest to: A. -$6 B. $2 C. -$4 6. The call option holder's profit on his overall position is closest to: A. Zero B. $21 C. -$2 7. At current prices, the call option is most likely: A. In-the-money B. At-the-money C. Out-of-the-money 8. At t= 30, the put option is most likely: A. In-the-money B. At-the-money C. Out-of-the-money 9. Most of the call option premium is most likely composed of: A. Intrinsic value B. Time value C. Cannot be determined 10. Most of the put option premium is most likely composed of: A. Intrinsic value B. Time value C. Cannot be determined TANGERANGIMINI SANDRA WILLIAMS pd! Adobe Acrobat Reader DC View Widow Help Home Tools FINANCIAL RISK M.. * 11. The price of a European call option with an exercise price of $82 and 30 days remaining expiration would be closest to: A $1.33 B. $4.90 C. $1.03 12. At t = 45, the minimum value of the call option is closest to: A $2.56 B. $2 C. $0 13. Att = 45, the minimum value of the put option is closest to: A. SO B. $13 C. S13.16