Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. The returns on stocks A and B are 12% and 16%, respectively. The SD of the returns on stocks A and B are

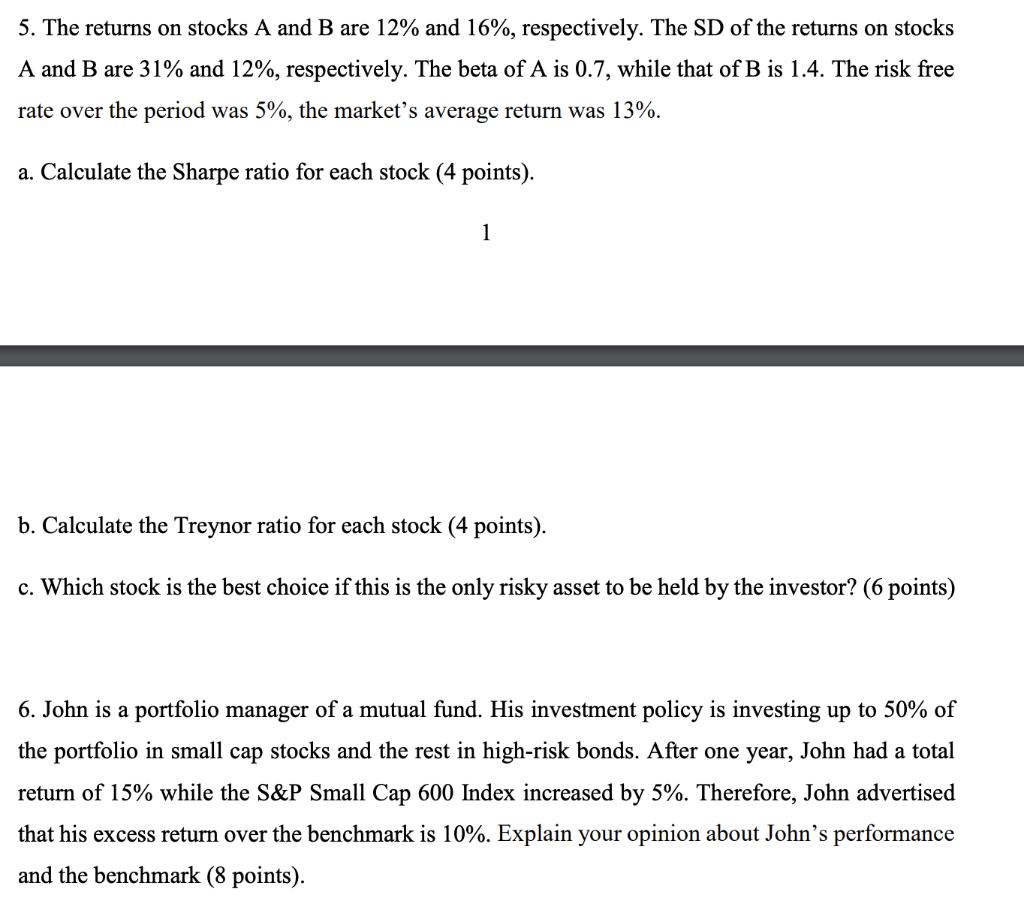

5. The returns on stocks A and B are 12% and 16%, respectively. The SD of the returns on stocks A and B are 31% and 12%, respectively. The beta of A is 0.7, while that of B is 1.4. The risk free rate over the period was 5%, the market's average return was 13%. a. Calculate the Sharpe ratio for each stock (4 points). 1 b. Calculate the Treynor ratio for each stock (4 points). c. Which stock is the best choice if this is the only risky asset to be held by the investor? (6 points) 6. John is a portfolio manager of a mutual fund. His investment policy is investing up to 50% of the portfolio in small cap stocks and the rest in high-risk bonds. After one year, John had a total return of 15% while the S&P Small Cap 600 Index increased by 5%. Therefore, John advertised that his excess return over the benchmark is 10%. Explain your opinion about John's performance and the benchmark (8 points).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started