Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. There are three different potential states of the economy next year. The chart below shows you the returns for stocks O and U

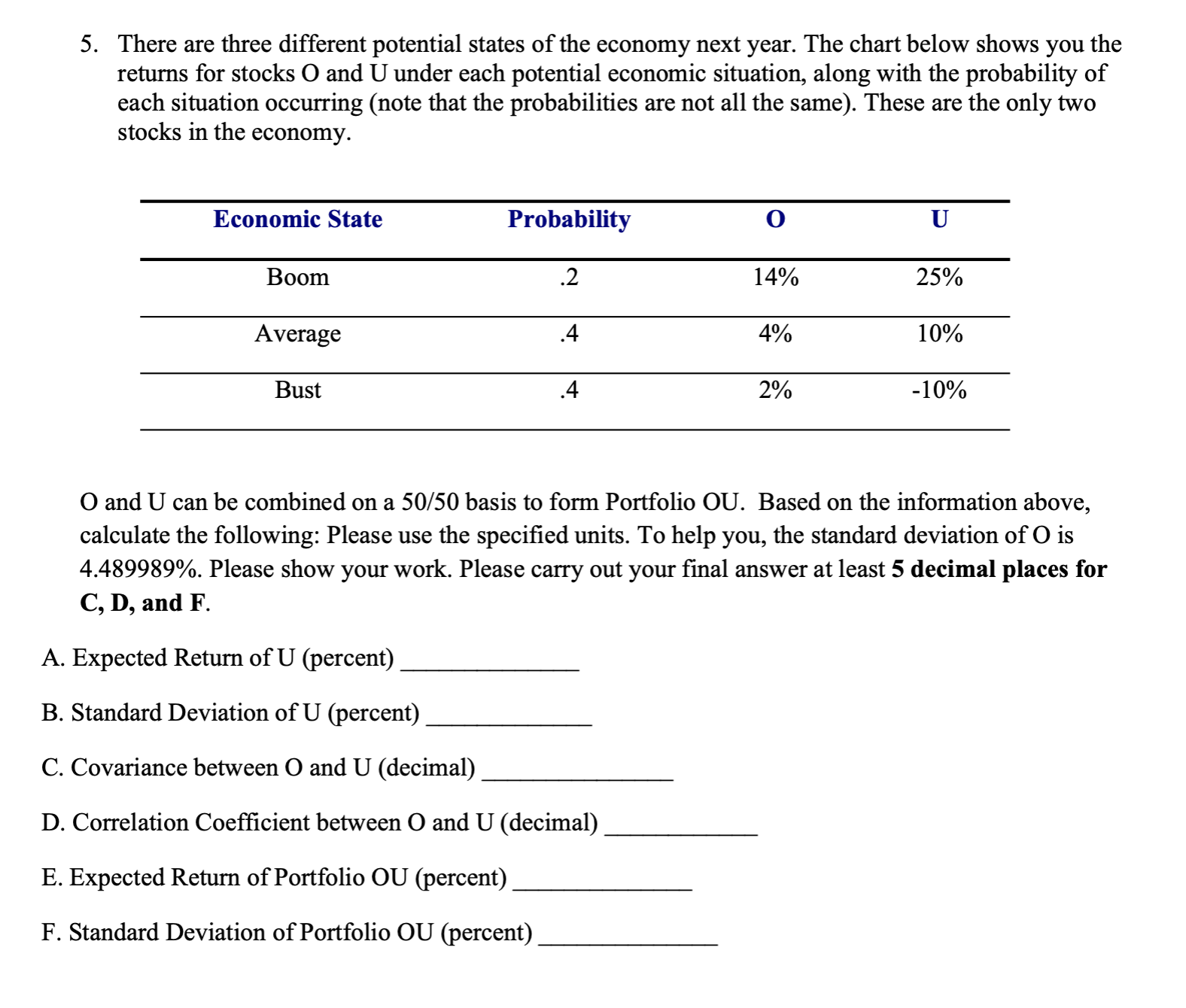

5. There are three different potential states of the economy next year. The chart below shows you the returns for stocks O and U under each potential economic situation, along with the probability of each situation occurring (note that the probabilities are not all the same). These are the only two stocks in the economy. Economic State Probability 0 U Boom .2 14% 25% Average .4 4% 10% Bust .4 2% -10% O and U can be combined on a 50/50 basis to form Portfolio OU. Based on the information above, calculate the following: Please use the specified units. To help you, the standard deviation of O is 4.489989%. Please show your work. Please carry out your final answer at least 5 decimal places for C, D, and F. A. Expected Return of U (percent) B. Standard Deviation of U (percent) C. Covariance between O and U (decimal) D. Correlation Coefficient between O and U (decimal) E. Expected Return of Portfolio OU (percent) F. Standard Deviation of Portfolio OU (percent)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested values well use the formulas for expected return standard deviation covar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started