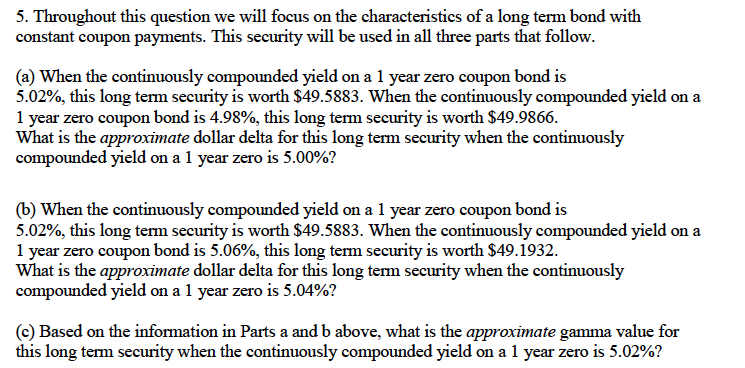

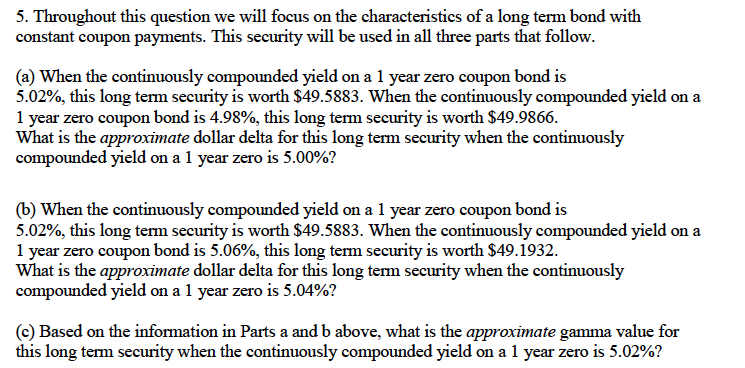

5. Throughout this question we will focus on the characteristics of a long term bond with constant coupon payments. This security will be used in all three parts that follow. (a) When the continuously compounded yield on a 1 year zero coupon bond is 5.02%, this long term security is worth $49.5883. When the continuously compounded yield on a 1 year zero coupon bond is 4.98%, this long term security is worth $49.9866. What is the approximate dollar delta for this long term security when the continuously compounded yield on a 1 year zero is 5.00%? (6) When the continuously compounded yield on a 1 year zero coupon bond is 5.02%, this long term security is worth $49.5883. When the continuously compounded yield on a 1 year zero coupon bond is 5.06%, this long term security is worth $49.1932. What is the approximate dollar delta for this long term security when the continuously compounded yield on a 1 year zero is 5.04%? (c) Based on the information in Parts a and b above, what is the approximate gamma value for this long term security when the continuously compounded yield on a 1 year zero is 5.02%? 5. Throughout this question we will focus on the characteristics of a long term bond with constant coupon payments. This security will be used in all three parts that follow. (a) When the continuously compounded yield on a 1 year zero coupon bond is 5.02%, this long term security is worth $49.5883. When the continuously compounded yield on a 1 year zero coupon bond is 4.98%, this long term security is worth $49.9866. What is the approximate dollar delta for this long term security when the continuously compounded yield on a 1 year zero is 5.00%? (6) When the continuously compounded yield on a 1 year zero coupon bond is 5.02%, this long term security is worth $49.5883. When the continuously compounded yield on a 1 year zero coupon bond is 5.06%, this long term security is worth $49.1932. What is the approximate dollar delta for this long term security when the continuously compounded yield on a 1 year zero is 5.04%? (c) Based on the information in Parts a and b above, what is the approximate gamma value for this long term security when the continuously compounded yield on a 1 year zero is 5.02%