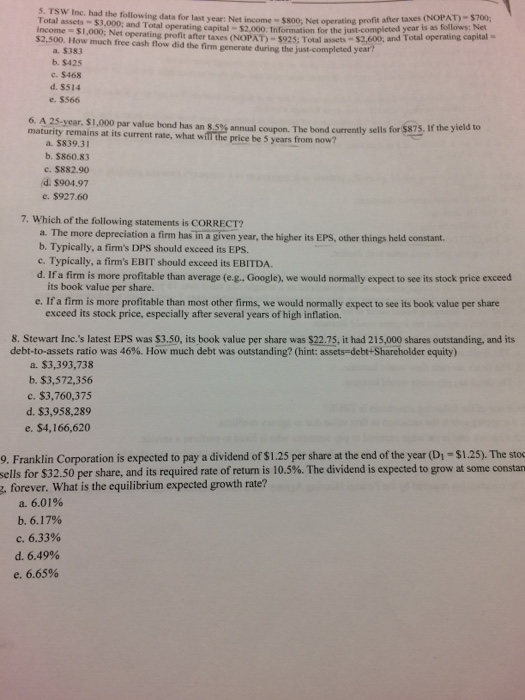

Question: 5. TSW Inc. had the following data for last year: Net income - $800; Net operating profit a Total assets -$3,000; and Total operating capital

5. TSW Inc. had the following data for last year: Net income - $800; Net operating profit a Total assets -$3,000; and Total operating capital -$2,000. Information for the income s1,000; Net operating profit after taxes (NOPAT)-$925; Total assets $2.500. How much free cash flow did the firm generate during the just-completed year fter taxes (NOPAT)-$700 just-completed year is as follows: Ne $925: Total assets $2,600, and Total operating capital a. $383 b. $425 c. $468 d. $514 e. $566 6 A 25-year, $1,000 par value bond has an 85% annual coupon. The bond currently maturity remains at its current rate, what will the price be 5 years from now? a. $839.31 b. $860.83 c. $882.90 d. $904.97 e. $927.60 7. Which of the following statements is CORRECT? a. The more depreciation a firm has in a given year, the higher its EPS, other things held constant b. Typically, a firm's DPS should exceed its EPS. c. Typically, a firm's EBIT should exceed its EBITDA. d. If a firm is more profitable than average (e.g., Google), we would normally expect to see its stock price exceed its book value per share. e. If a firm is more profitable than most other firms, we would normally expect to see its book value per share exceed its stock price, especially after several years of high inflation. 8. Stewart Inc.'s latest EPS was $3.50, its book value per share was $22.75, it had 215,000 shares outstanding, and its debt-to-assets ratio was 46%. How much debt was outstanding? (hint: assets-debt-shareholder equity) a. $3,393,738 b. $3,572,356 c. $3,760,375 d. $3,958,289 e. $4,166,620 9. Franklin Corporation is expected to pay a dividend of $1.25 per share at the end of the year (Di-$1.25). The stoc sells for $32.50 per share, and its required rate of return is 10.5%. The dividend is expected to grow at some constan g. forever. What is the equilibrium expected growth rate? a. 6.01% c. 6.33% d. 6.49% e. 6.65%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts