5. Use the 2014 and 2015 balance sheetsband Nike 2015 income statement to construct a statement of cash flows. Describe Nikes opetations, financing and investment deisions.

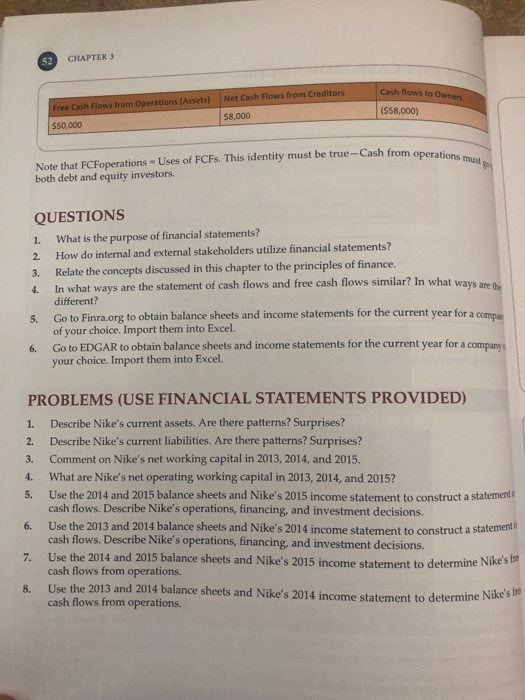

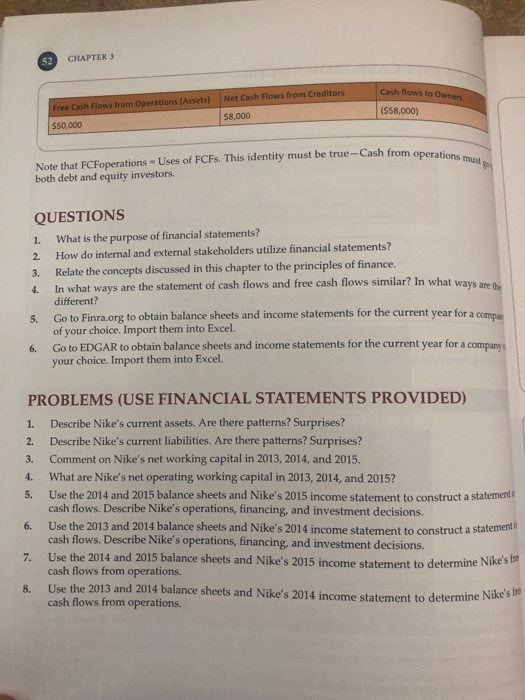

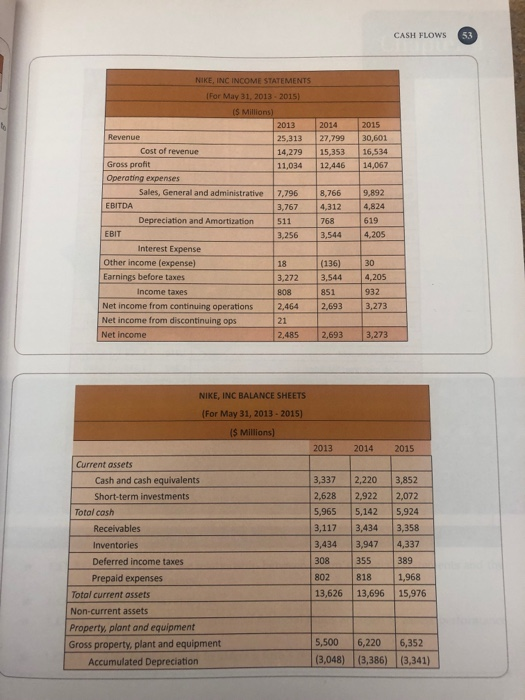

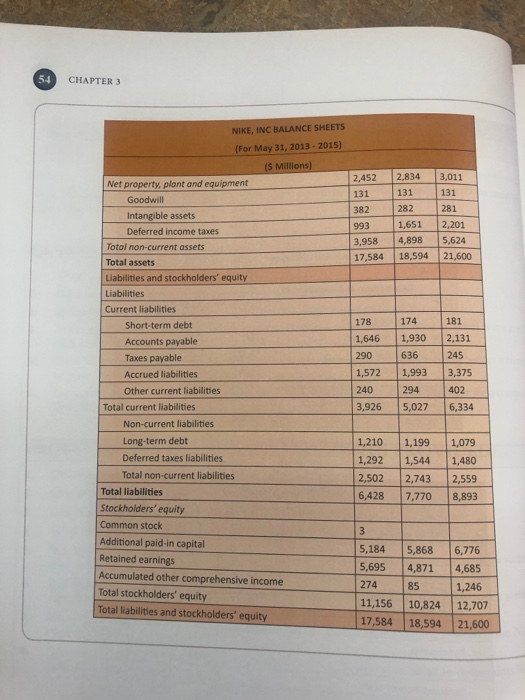

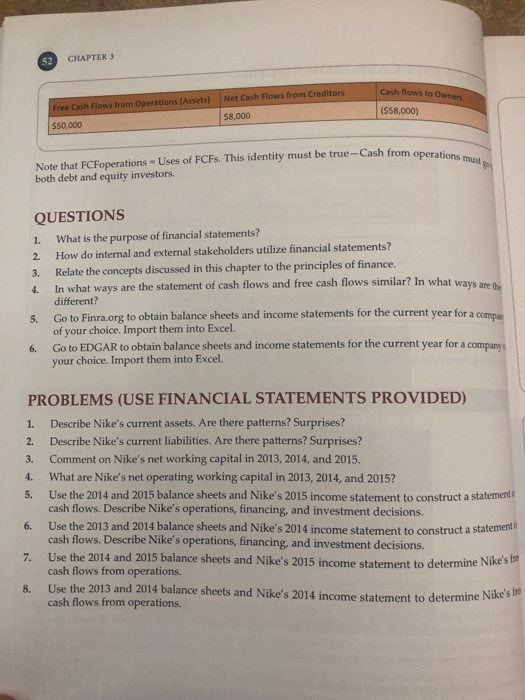

CHAPTER 3 Net Cash Flows from Creditors Free Cash Flows from Operations (Assets) $50,000 Cash flows to Owners ($58,000) $8,000 operations must Note that FCFoperations - Uses of FCFs. This identity must be true-Cash from operati both debt and equity investors. QUESTIONS 1. What is the purpose of financial statements? 2. How do internal and external stakeholders utilize financial statements? 3. Relate the concepts discussed in this chapter to the principles of finance. 4. In what ways are the statement of cash flows and free cash flows similar? In what was different? 5. Go to Finra.org to obtain balance sheets and income statements for the current year for a com of your choice. Import them into Excel. 6. Go to EDGAR to obtain balance sheets and income statements for the current year for a company your choice. Import them into Excel. PROBLEMS (USE FINANCIAL STATEMENTS PROVIDED) 1. Describe Nike's current assets. Are there patterns? Surprises? 2. Describe Nike's current liabilities. Are there patterns? Surprises? 3. Comment on Nike's net working capital in 2013, 2014, and 2015. 4. What are Nike's net operating working capital in 2013, 2014, and 2015? 5. Use the 2014 and 2015 balance sheets and Nike's 2015 income statement to construct a statemen cash flows. Describe Nike's operations, financing, and investment decisions. 6. Use the 2013 and 2014 balance sheets and Nike's 2014 income statement to construct a statemem cash flows. Describe Nike's operations, financing and investment decisions. 7 Use the 2014 and 2015 balance sheets and Nike's 2015 income statement to determine Nike cash flows from operations. 8. Use the 2013 and 2014 balance sheets and Nike's 2014 income statement to determine NIKE cash flows from operations. tement to determine Nike's fro CASH FLOWS 53 2014 27,799 15,353 12,446 2015 30,601 16,534 14,067 NIKE, INC INCOME STATEMENTS For May 31, 2013 - 2015) (5 Millions) 2013 Revenue 25,313 Cost of revenue 14,279 Gross profit 11.034 Operating expenses Sales, General and administrative 7,796 EBITDA 3,767 Depreciation and Amortization 511 EBIT 3,256 Interest Expense Other income (expense) 18 Earnings before taxes 3,272 Income taxes 808 Net income from continuing operations 2,464 Net income from discontinuing ops Net Income 2,485 8,766 4,312 768 3,544 9,892 4,824 619 4,205 4 (136) 3.544 851 2,693 30 ,205 932 3,273 2,693 3,273 NIKE, INC BALANCE SHEETS (For May 31, 2013 - 2015) IS Millions) 2013 2014 2015 Current assets Cash and cash equivalents Short-term investments Total cash Receivables Inventories Deferred income taxes Prepaid expenses Total current assets Non-current assets Property, plant and equipment Gross property, plant and equipment Accumulated Depreciation 3,337 2,628 5,965 3,117 3,434 308 802 13,626 2,220 2,922 5,142 3,434 3,947 355 818 13,696 3,852 2,072 5,924 3,358 4,337 389 1,968 15,976 5,500 (3,048) 6,220 (3,386) 6,352 (3,341) CHAPTER 3 2.834 2,452 131 382 282 1.651 993 3,958 17,584 4,898 18,594 NIKE, INC BALANCE SHEETS (For May 31, 2013 - 2015) (5 Millions) Net property, plant and equipment Goodwill Intangible assets Deferred income taxes Total non-current assets Total assets Liabilities and stockholders' equity Liabilities Current liabilities Short-term debt Accounts payable Taxes payable Accrued liabilities Other current liabilities Total current liabilities Non-current liabilities Long-term debt Deferred taxes liabilities Total non-current liabilities Total liabilities Stockholders' equity Common stock Additional paid in capital Retained earnings 178 1,646 290 1,572 240 3,926 174 1,930 636 1,993 294 5,027 2,131 245 3,375 402 6,334 1,210 1,292 2,502 6,428 1,199 1,544 2,743 7,770 1,079 1,480 2,559 8,893 5,868 4,871 Accumulated other comprehensive income Total stockholders' equity Total liabilities and stockholders' equity 3 5,184 5,695 274 11,156 17,584 85 6,776 4,685 1,246 12,707 21,600 10,824 18,594