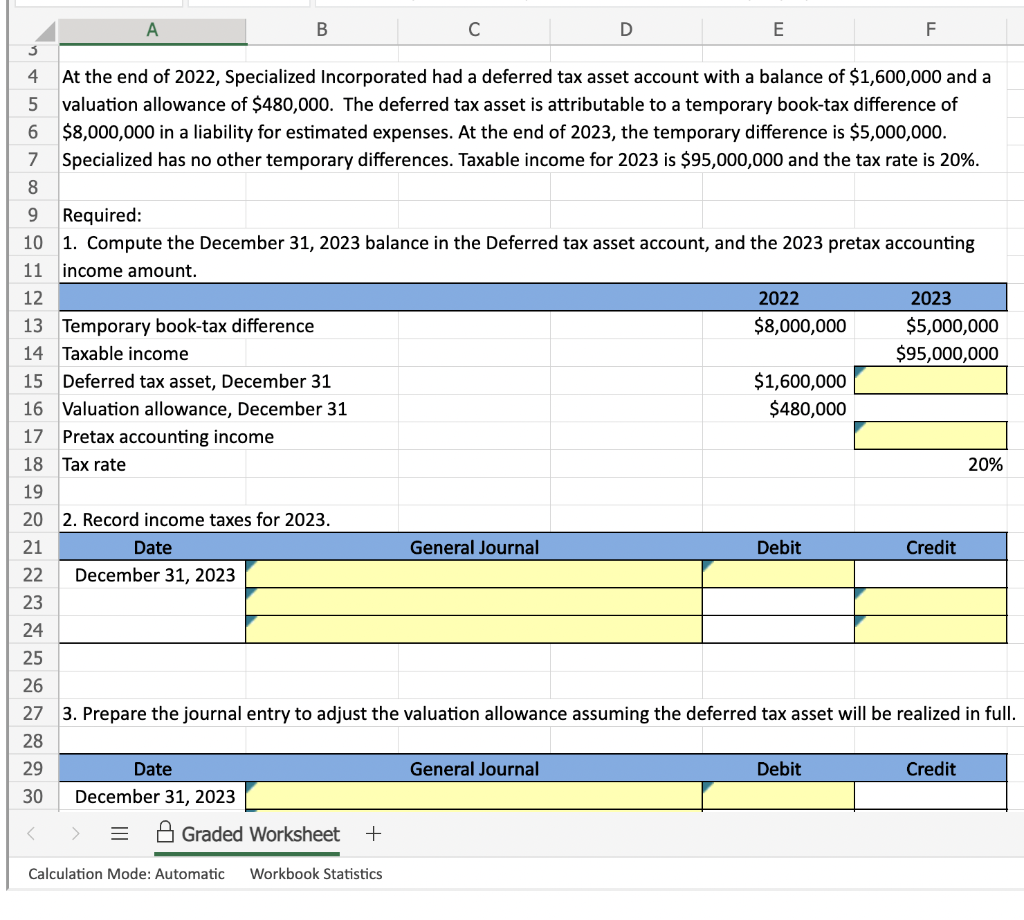

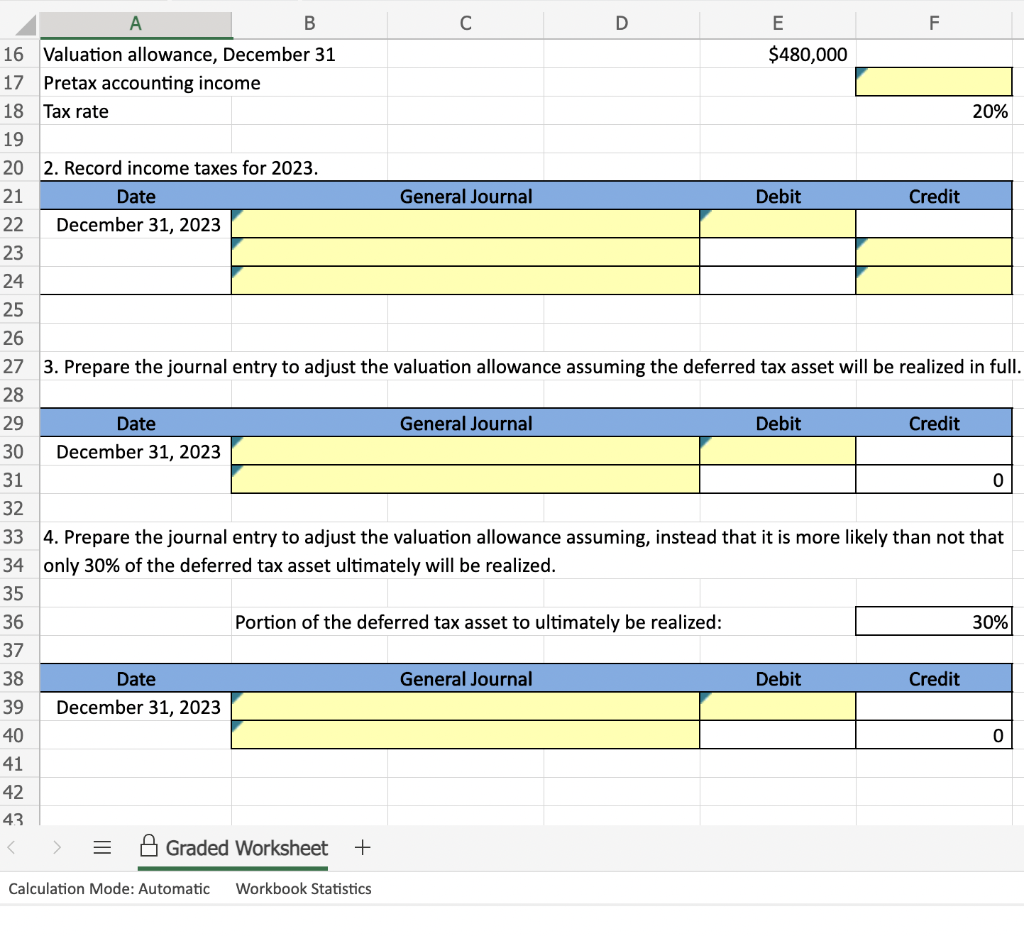

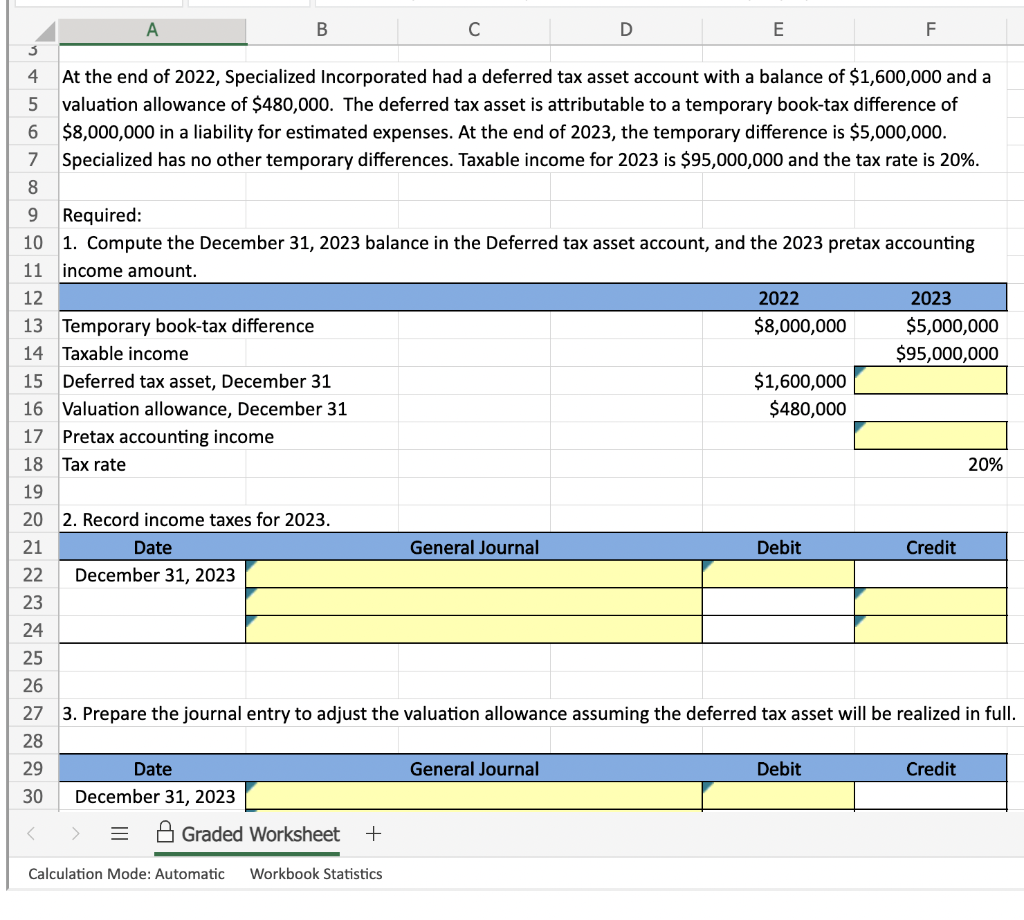

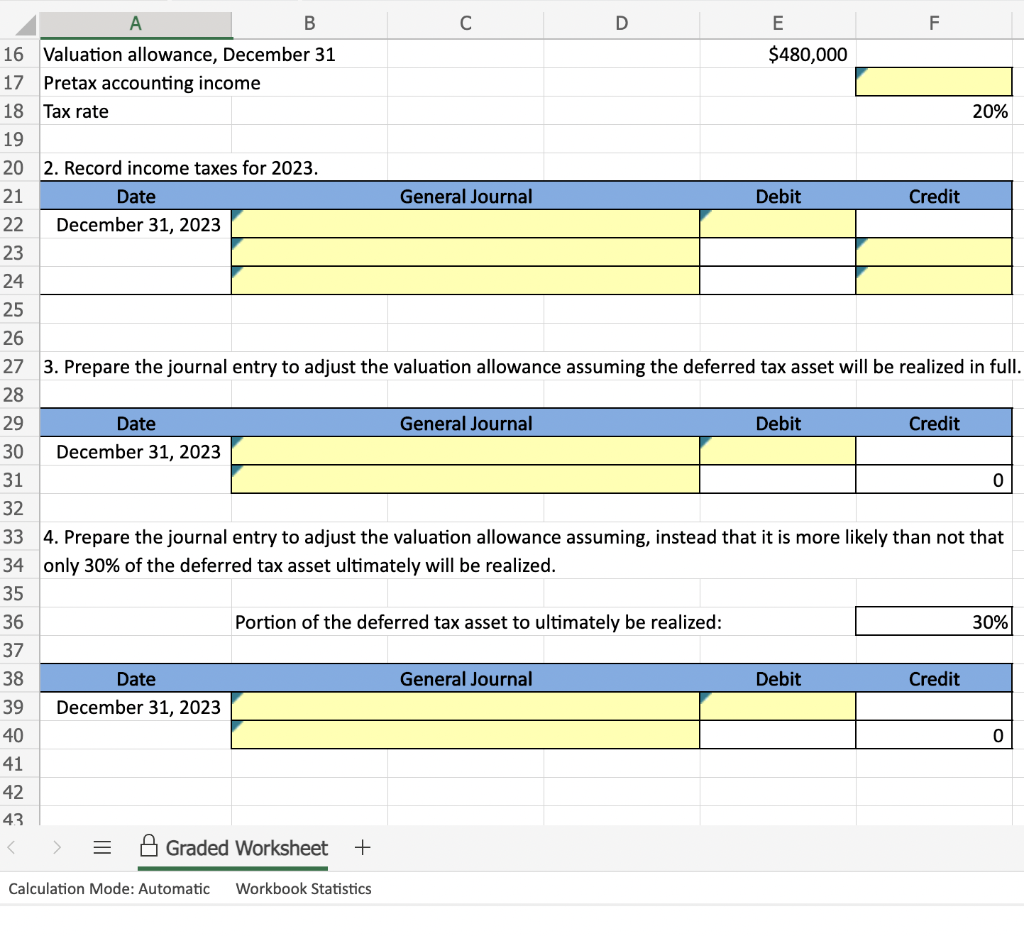

5 valuation allowance of $480,000. The deferred tax asset is attributable to a temporary book-tax difference of 6$8,000,000 in a liability for estimated expenses. At the end of 2023 , the temporary difference is $5,000,000. 7 Specialized has no other temporary differences. Taxable income for 2023 is $95,000,000 and the tax rate is 20%. 9 Required: 10 1. Compute the December 31, 2023 balance in the Deferred tax asset account, and the 2023 pretax accounting 11 income amount. 3. Prepare the journal entry to adjust the valuation allowance assuming the deferred tax asset will be realized in full. \begin{tabular}{|c|c|c|c|c|} \hline 29 & Date & General Journal & Debit & \multicolumn{2}{c|}{ Credit } \\ \hline 30 & December 31, 2023 & & \\ \hline \end{tabular} Graded Worksheet + Calculation Mode: Automatic Workbook Statistics 3. Prepare the journal entry to adjust the valuation allowance assuming the deferred tax asset will be realized in full. 4. Prepare the journal entry to adjust the valuation allowance assuming, instead that it is more likely than not that only 30% of the deferred tax asset ultimately will be realized. Portion of the deferred tax asset to ultimately be realized: \begin{tabular}{l|c|c|c|c|c|} \hline 38 & \multicolumn{1}{c|}{ Date } & \multicolumn{1}{c|}{ General Journal } & \multicolumn{2}{c|}{ Debit } & \\ \hline 39 & December 31, 2023 & & \\ \hline 40 & & & & \\ \hline \end{tabular} > Graded Worksheet + Calculation Mode: Automatic Workbook Statistics 5 valuation allowance of $480,000. The deferred tax asset is attributable to a temporary book-tax difference of 6$8,000,000 in a liability for estimated expenses. At the end of 2023 , the temporary difference is $5,000,000. 7 Specialized has no other temporary differences. Taxable income for 2023 is $95,000,000 and the tax rate is 20%. 9 Required: 10 1. Compute the December 31, 2023 balance in the Deferred tax asset account, and the 2023 pretax accounting 11 income amount. 3. Prepare the journal entry to adjust the valuation allowance assuming the deferred tax asset will be realized in full. \begin{tabular}{|c|c|c|c|c|} \hline 29 & Date & General Journal & Debit & \multicolumn{2}{c|}{ Credit } \\ \hline 30 & December 31, 2023 & & \\ \hline \end{tabular} Graded Worksheet + Calculation Mode: Automatic Workbook Statistics 3. Prepare the journal entry to adjust the valuation allowance assuming the deferred tax asset will be realized in full. 4. Prepare the journal entry to adjust the valuation allowance assuming, instead that it is more likely than not that only 30% of the deferred tax asset ultimately will be realized. Portion of the deferred tax asset to ultimately be realized: \begin{tabular}{l|c|c|c|c|c|} \hline 38 & \multicolumn{1}{c|}{ Date } & \multicolumn{1}{c|}{ General Journal } & \multicolumn{2}{c|}{ Debit } & \\ \hline 39 & December 31, 2023 & & \\ \hline 40 & & & & \\ \hline \end{tabular} > Graded Worksheet + Calculation Mode: Automatic Workbook Statistics