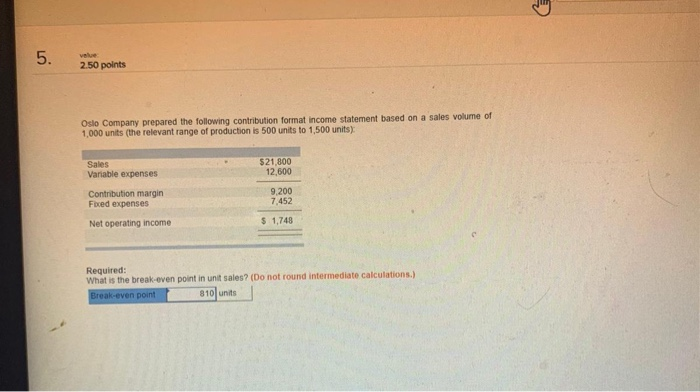

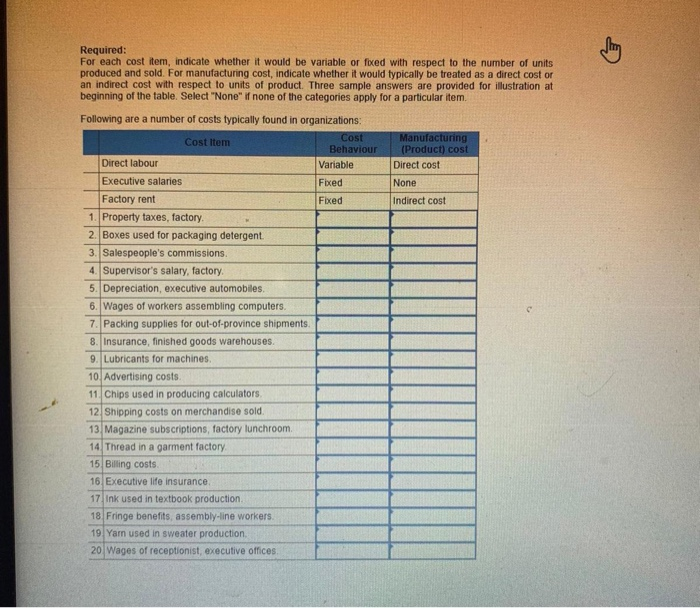

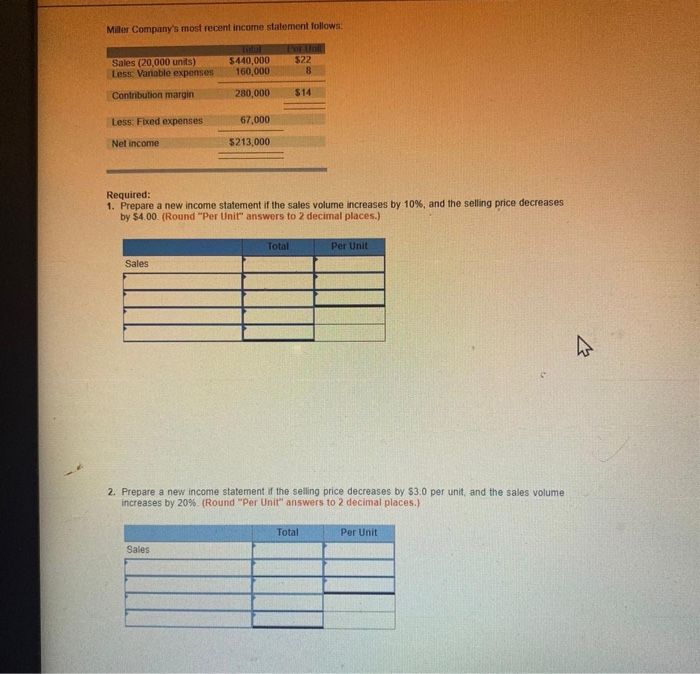

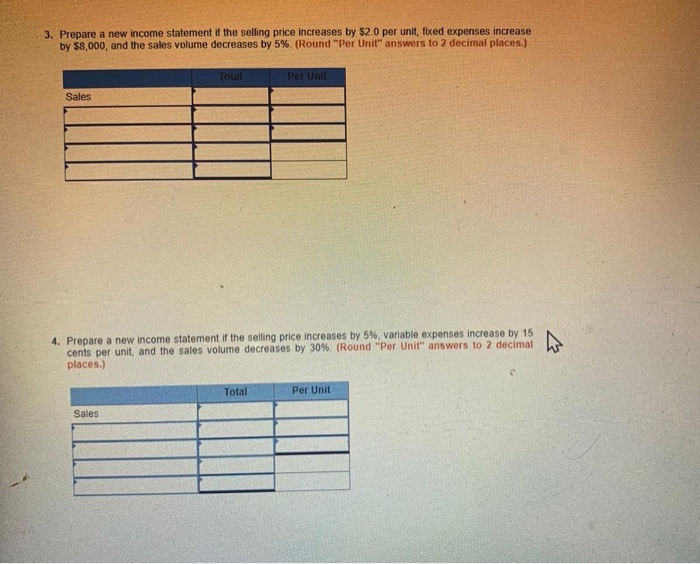

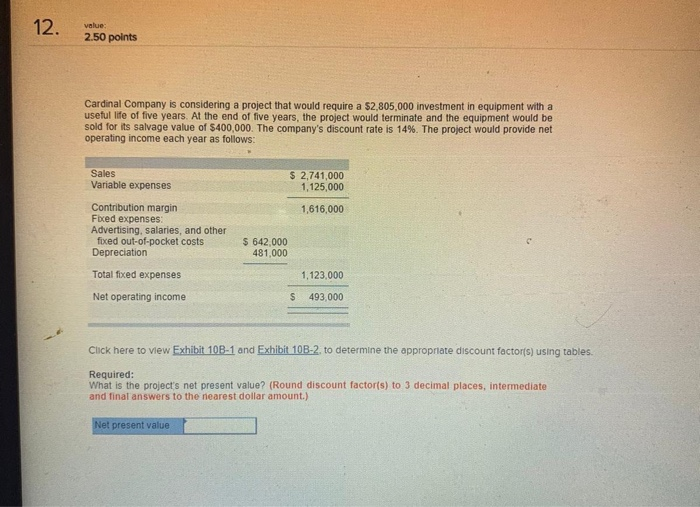

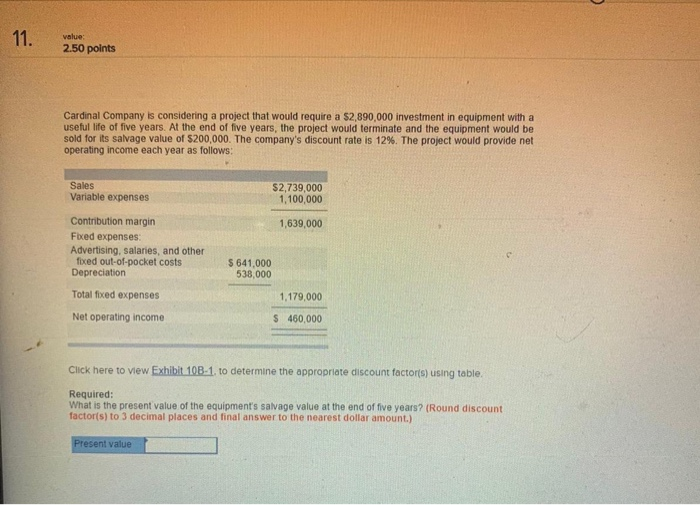

5. value 250 points Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales $21,800 12,600 Variable expenses Contribution margin Fibed expenses 9.200 7.452 Net operating income $ 1,748 Required: What is the break-even point in unit sales? (Do not round intermediate calculations.) Break-even point 810 units Required: For each cost tem, indicate whether it would be variable or foxed with respect to the number of units produced and sold. For manufacturing cost, indicate whether it would typically be treated as a direct cost or an indirect cost with respect to units of product. Three sample answers are provided for illustration at beginning of the table. Select "None" none of the categories apply for a particular item, Manufacturing (Product) cost Direct cost None Indirect cost Following are a number of costs typically found in organizations: Cost Item Cost Behaviour Direct labour Variable Executive salaries Fbced Factory rent Fixed 1. Property taxes, factory 2. Boxes used for packaging detergent. 3. Salespeople's commissions 4. Supervisor's salary, factory 5. Depreciation, executive automobiles 6. Wages of workers assembling computers. 7. Packing supplies for out-of-province shipments. 8. Insurance, finished goods warehouses. 9. Lubricants for machines 10 Advertising costs 11. Chips used in producing calculators 12 Shipping costs on merchandise sold 13 Magazine subscriptions, factory lunchroom 14 Thread in a garment factory 15 Billing costs. 16 Executive life insurance. 17 Ink used in textbook production 18 Fringe benefits assembly-line workers. 19 Yam used in sweater production 20 Wages of receptionist, executive offices Miller Company's most recent income statement follows: 522 Sales (20,000 units) Less Variable expenses 5440,000 160,000 Contribution margin 280,000 Less Foed expenses 67,000 Net income 5213,000 Required: 1. Prepare a new income statement if the sales volume increases by 10%, and the selling price decreases by $4.00. (Round "Per Unit" answers to 2 decimal places.) Total Per Unit Sales 2. Prepare a new income statement if the selling price decreases by $3.0 per unit, and the sales volume increases by 20% (Round "Per Unit" answers to 2 decimal places.) Total Per Unit 3. Prepare a new income statement if the selling price increases by $2.0 per unit, fixed expenses increase by $8,000, and the sales volume decreases by 5%. (Round "Per Unit" answers to 2 decimal places.) Total Per Unit 4. Prepare a new income statement if the selling price increases by 5%, variable expenses increase by 15 cents per unit, and the sales volume decreases by 30%. (Round "Per Unit" answers to 2 decimal places.) Total Per Unit Sales 12. value 2.50 points Cardinal Company is considering a project that would require a $2.805.000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $400,000. The company's discount rate is 14%. The project would provide net operating income each year as follows: Sales Variable expenses $ 2,741,000 1.125.000 1,616,000 Contribution margin Fbced expenses: Advertising, salaries, and other fixed out-of-pocket costs Depreciation $ 642.000 481,000 Total fixed expenses 1,123,000 493,000 Net operating income $ Click here to view Exhibit 10B-1 and Exhibit 10B-2. to determine the appropriate discount factors) using tables Required: What is the project's net present value? (Round discount factor(s) to 3 decimal places, intermediate and final answers to the nearest dollar amount.) Net present value 11. value 2.50 points Cardinal Company is considering a project that would require a $2.890,000 investment in equipment with a useful life of five years. At the end of five years, the project would terminate and the equipment would be sold for its salvage value of $200,000. The company's discount rate is 12%. The project would provide net operating income each year as follows: Sales Variable expenses $2,739,000 1,100,000 1,639,000 Contribution margin Fixed expenses Advertising, salaries, and other fixed out-of-pocket costs Depreciation $ 641,000 538,000 Total fixed expenses 1,179,000 Net operating income $ 460,000 Click here to view Exhibit 10B-1. to determine the appropriate discount factors) using table. Required: What is the present value of the equipment's salvage value at the end of five years? (Round discount factor(s) to 3 decimal places and final answer to the nearest dollar amount.) Present value