Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Victory Manufacturing Sdn Bhd You are the audit assistant assigned to the audit of Victory Manufacturing Sdn Bhd. The audit senior has asked

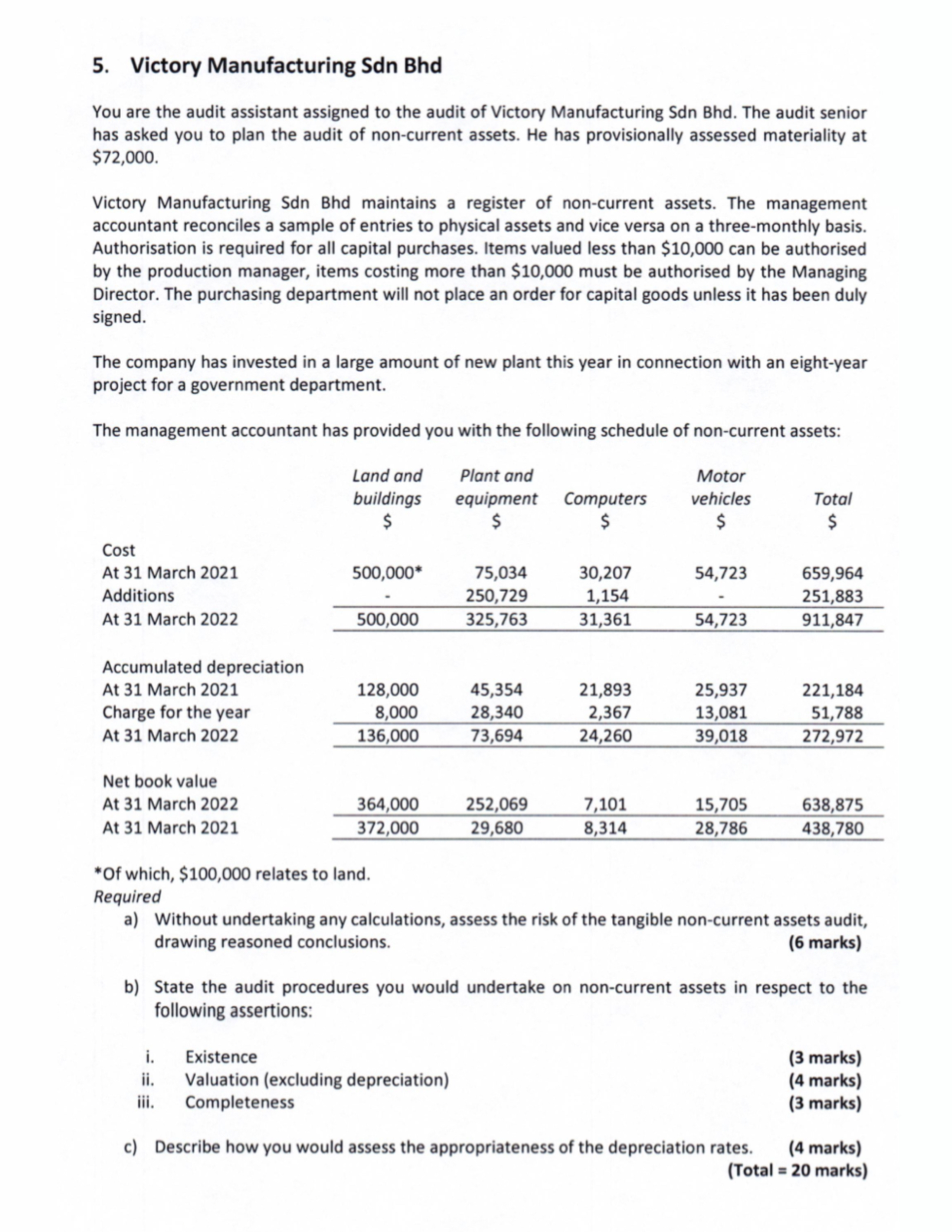

5. Victory Manufacturing Sdn Bhd You are the audit assistant assigned to the audit of Victory Manufacturing Sdn Bhd. The audit senior has asked you to plan the audit of non-current assets. He has provisionally assessed materiality at $72,000. Victory Manufacturing Sdn Bhd maintains a register of non-current assets. The management accountant reconciles a sample of entries to physical assets and vice versa on a three-monthly basis. Authorisation is required for all capital purchases. Items valued less than $10,000 can be authorised by the production manager, items costing more than $10,000 must be authorised by the Managing Director. The purchasing department will not place an order for capital goods unless it has been duly signed. The company has invested in a large amount of new plant this year in connection with an eight-year project for a government department. The management accountant has provided you with the following schedule of non-current assets: Land and buildings Plant and equipment Computers Motor vehicles Total $ $ $ $ $ Cost At 31 March 2021 500,000* 75,034 30,207 54,723 659,964 Additions 250,729 1,154 251,883 At 31 March 2022 500,000 325,763 31,361 54,723 911,847 Accumulated depreciation At 31 March 2021 128,000 45,354 21,893 25,937 221,184 Charge for the year 8,000 28,340 2,367 13,081 51,788 At 31 March 2022 136,000 73,694 24,260 39,018 272,972 Net book value At 31 March 2022 364,000 252,069 7,101 15,705 638,875 At 31 March 2021 372,000 29,680 8,314 28,786 438,780 *Of which, $100,000 relates to land. Required a) Without undertaking any calculations, assess the risk of the tangible non-current assets audit, drawing reasoned conclusions. (6 marks) b) State the audit procedures you would undertake on non-current assets in respect to the following assertions: i. Existence (3 marks) ii. iii. Valuation (excluding depreciation) Completeness (4 marks) (3 marks) c) Describe how you would assess the appropriateness of the depreciation rates. (4 marks) (Total = 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started