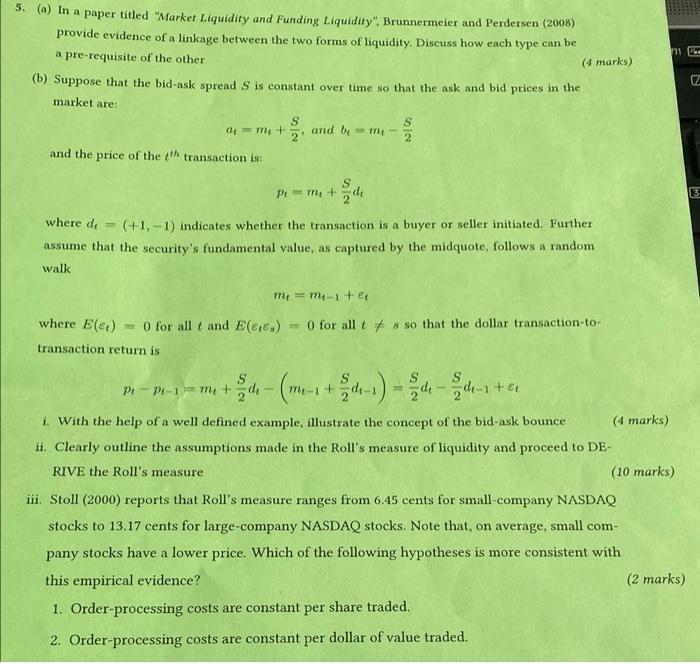

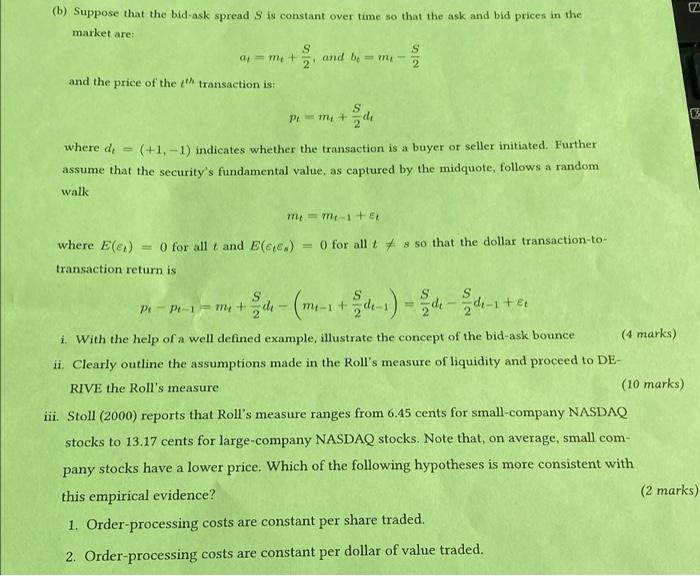

5. (w) In a paper titled "Market Liquidity and Funding Liquidity". Brunnermeier and Perdersen (2008) provide evidence of a linkage between the two forms of liquidity. Discuss how each type can be a pre-requisite of the other (4 marks) (b) Suppose that the bid-ask spread S is constant over time so that the ask and bid prices in the mi A market are: S 2 S Op = m+ , and be = m- and the price of the transaction is: s pime + c where de (+1, -1) indicates whether the transaction is a buyer or seller initiated. Further assume that the security's fundamental value, as captured by the midquote, follows a random walk me = m-1 + where Elet) = 0 for all and E(66) - O for all ts so that the dollar transaction-to- transaction return is S PL P-1-me+ 3de -1+ - 2. 1) - 2 ch - chita i. With the help of a well defined example, illustrate the concept of the bid-ask bounce (4 marks) ii. Clearly outline the assumptions made in the Roll's measure of liquidity and proceed to DE- RIVE the Roll's measure (10 marks) iii. Stoll (2000) reports that Roll's measure ranges from 6.45 cents for small company NASDAQ stocks to 13.17 cents for large-company NASDAQ stocks. Note that, on average, small com- pany stocks have a lower price. Which of the following hypotheses is more consistent with this empirical evidence? (2 marks) 1. Order-processing costs are constant per share traded. 2. Order-processing costs are constant per dollar of value traded. a Z (b) Suppose that the bid-ask spread S is constant over time so that the ask and bid prices in the market are and be mi S 2 S ame+ 2 and the price of the th transaction ist pe=m+1 (+1,-1) indicates whether the transaction is a buyer or seller initiated. Further assume that the security's fundamental value, as captured by the midquote, follows a random walk where di mem-1 + E where E(@) O for all t and E(646x) = 0 for all t * s so that the dollar transaction-to- transaction return is Pe P1m ma-p-1 = m +d-(m-1 + de 1) - de me- i. With the help of a well defined example, illustrate the concept of the bid-ask bounce (4 marks) ii. Clearly outline the assumptions made in the Roll's measure of liquidity and proceed to DE- RIVE the Roll's measure (10 marks) iii. Stoll (2000) reports that Roll's measure ranges from 6.45 cents for small-company NASDAQ stocks to 13.17 cents for large company NASDAQ stocks. Note that, on average, small com- pany stocks have a lower price. Which of the following hypotheses is more consistent with this empirical evidence? (2 marks) 1. Order-processing costs are constant per share traded. 2. Order-processing costs are constant per dollar of value traded. 5. (w) In a paper titled "Market Liquidity and Funding Liquidity". Brunnermeier and Perdersen (2008) provide evidence of a linkage between the two forms of liquidity. Discuss how each type can be a pre-requisite of the other (4 marks) (b) Suppose that the bid-ask spread S is constant over time so that the ask and bid prices in the mi A market are: S 2 S Op = m+ , and be = m- and the price of the transaction is: s pime + c where de (+1, -1) indicates whether the transaction is a buyer or seller initiated. Further assume that the security's fundamental value, as captured by the midquote, follows a random walk me = m-1 + where Elet) = 0 for all and E(66) - O for all ts so that the dollar transaction-to- transaction return is S PL P-1-me+ 3de -1+ - 2. 1) - 2 ch - chita i. With the help of a well defined example, illustrate the concept of the bid-ask bounce (4 marks) ii. Clearly outline the assumptions made in the Roll's measure of liquidity and proceed to DE- RIVE the Roll's measure (10 marks) iii. Stoll (2000) reports that Roll's measure ranges from 6.45 cents for small company NASDAQ stocks to 13.17 cents for large-company NASDAQ stocks. Note that, on average, small com- pany stocks have a lower price. Which of the following hypotheses is more consistent with this empirical evidence? (2 marks) 1. Order-processing costs are constant per share traded. 2. Order-processing costs are constant per dollar of value traded. a Z (b) Suppose that the bid-ask spread S is constant over time so that the ask and bid prices in the market are and be mi S 2 S ame+ 2 and the price of the th transaction ist pe=m+1 (+1,-1) indicates whether the transaction is a buyer or seller initiated. Further assume that the security's fundamental value, as captured by the midquote, follows a random walk where di mem-1 + E where E(@) O for all t and E(646x) = 0 for all t * s so that the dollar transaction-to- transaction return is Pe P1m ma-p-1 = m +d-(m-1 + de 1) - de me- i. With the help of a well defined example, illustrate the concept of the bid-ask bounce (4 marks) ii. Clearly outline the assumptions made in the Roll's measure of liquidity and proceed to DE- RIVE the Roll's measure (10 marks) iii. Stoll (2000) reports that Roll's measure ranges from 6.45 cents for small-company NASDAQ stocks to 13.17 cents for large company NASDAQ stocks. Note that, on average, small com- pany stocks have a lower price. Which of the following hypotheses is more consistent with this empirical evidence? (2 marks) 1. Order-processing costs are constant per share traded. 2. Order-processing costs are constant per dollar of value traded