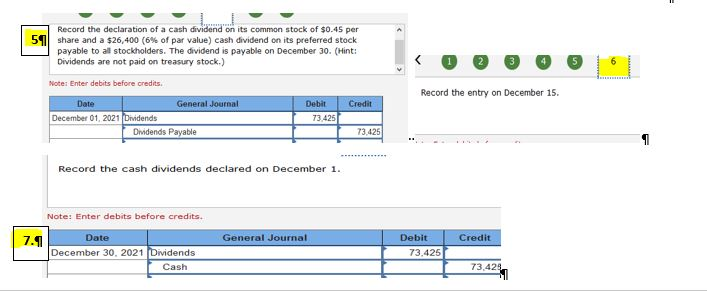

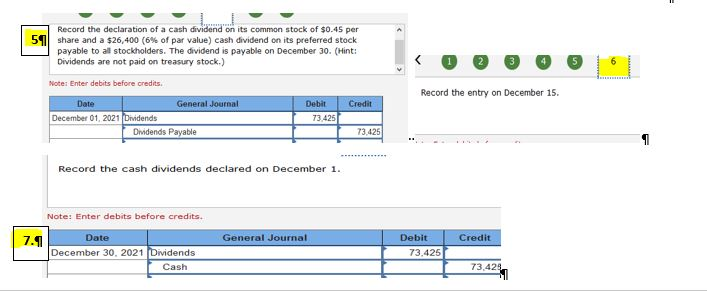

5. Want you to record the declaration; 6. record entry; and 7. record cash. Should 5 or 6 be no journal entry? I am confused as to why there are 2 steps here.

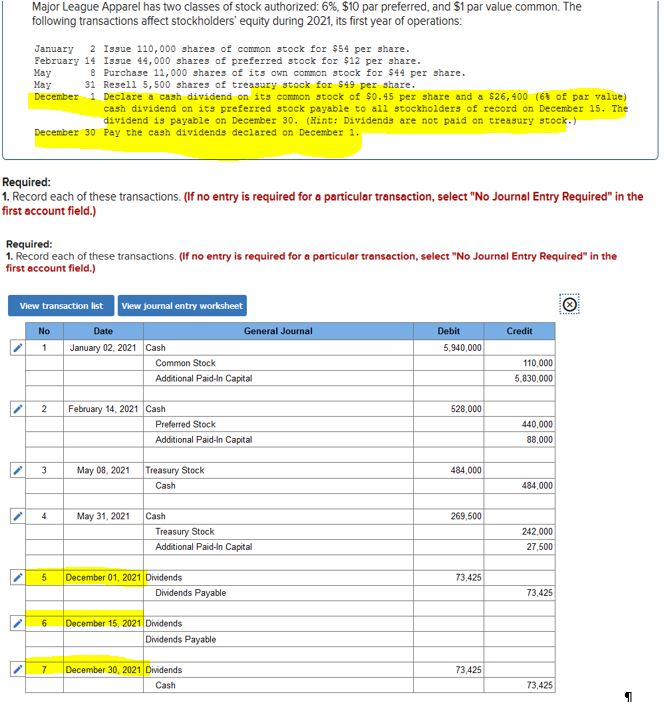

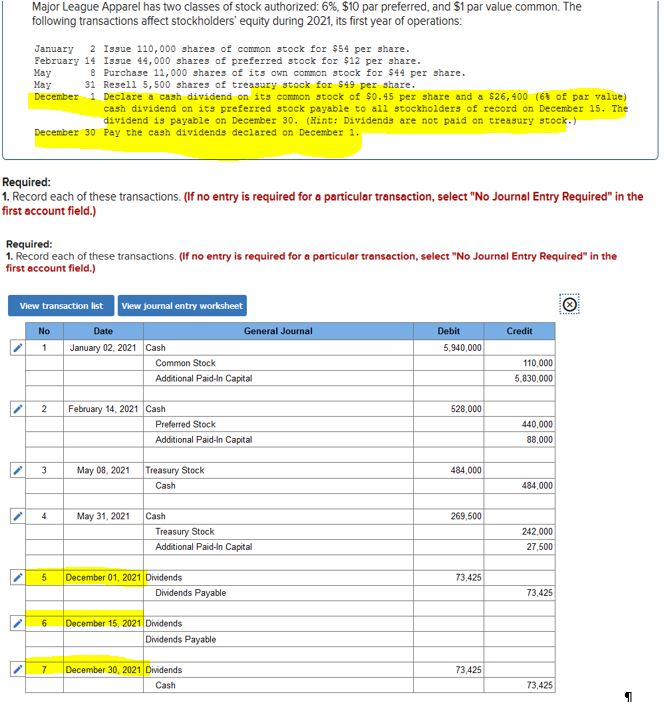

Major League Apparel has two classes of stock authorized: 6%, $10 par preferred, and $1 par value common. The following transactions affect stockholders' equity during 2021, its first year of operations: January 2 Issue 110,000 shares of common stock for $54 per share. February 14 Issue 44,000 shares of preferred stock for $12 per share. May Purchase 11,000 shares of its own common stock for $44 per share. May 31 Resell 5,500 shares of treasury stock for $49 per share. December 1 Declare a cash dividend on its common stock of $0.45 per share and a $26,400 (68 of par value) cash dividend on its preferred stock payable to all stockholders of record on December 15. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) December 30 Pay the cash dividends declared on December 1. Required: 1. Record each of these transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required in the first account field.) Required: 1. Record each of these transactions. (If no entry is required for a particular transaction, select "No Journal Entry Required in the first account field.) View transaction list View journal entry worksheet Credit No 1 Debit 5,940,000 1 Date General Journal January 02, 2021 Cash Common Stock Additional Paid-In Capital 110.000 5.830,000 1 2 528,000 February 14, 2021 Cash Preferred Stock Additional Paid-In Capital 440,000 88,000 23 May 08, 2021 484.000 Treasury Stock Cash 484,000 May 31, 2021 269,500 Cash Treasury Stock Additional Paid-In Capital 242,000 27,500 5 73,425 December 01, 2021 Dividends Dividends Payable 73 425 December 15, 2021 Dividends Dividends Payable 7 73,425 December 30, 2021 Dividends Cash 73.425 Record the declaration of a cash dividend on its common stock of $0.45 per share and a $26,400 (6% of par value) cash dividend on its preferred stock payable to all stockholders. The dividend is payable on December 30. (Hint: Dividends are not paid on treasury stock.) Note: Enter debits before credits. Record the entry on December 15. Debit Credit Date General Journal December 01, 2021 (Dividends Dividends Payable 73.4251 Record the cash dividends declared on December 1. Note: Enter debits before credits. General Journal Credit Date December 30, 2021 Dividends Cash Debit 73.425 [ 73.42%