Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. What is a disadvantage of the payback method? 10. One example of an effectiveness indicator (performance indicator) is: a. It ignores cash inflows earned

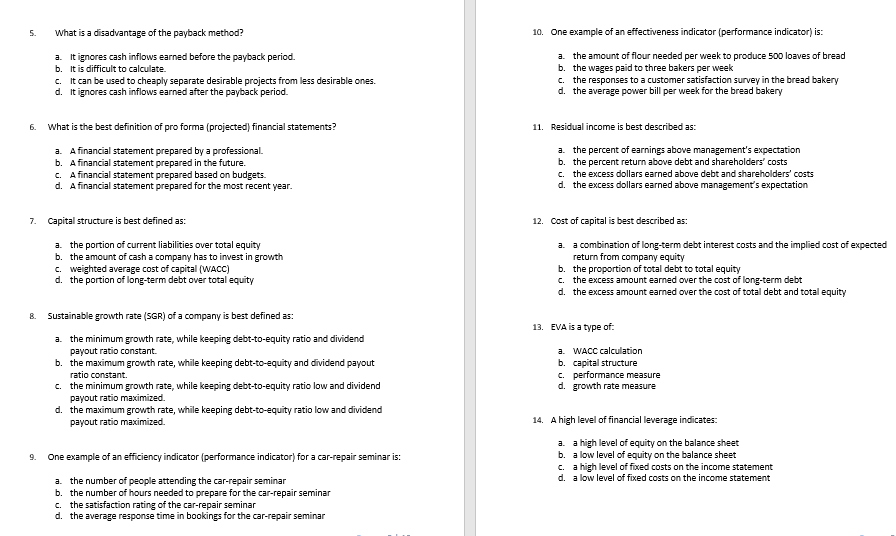

5. What is a disadvantage of the payback method? 10. One example of an effectiveness indicator (performance indicator) is: a. It ignores cash inflows earned before the payback period. a. the amount of flour needed per week to produce 500 loaves of bread b. It is difficult to calculate. b. the wages paid to three bakers per week c. It can be used to cheaply separate desirable projects from less desirable ones. c. the responses to a customer satisfaction survey in the bread bakery d. It ignores cash inflows earned after the payback period. d. the average power bill per week for the bread bakery 6. What is the best definition of pro forma (projected) financial statements? 11. Residual income is best described as: a. A financial statement prepared by a professional. a. the percent of earnings above management's expectation b. A financial statement prepared in the future. b. the percent return above debt and shareholders' costs c. A financial statement prepared based on budgets. c. the excess dollars earned above debt and shareholders' costs d. A financial statement prepared for the most recent year. d. the excess dollars earned above management's expectation 7. Capital structure is best defined as: 12. Cost of capital is best described as: a. the portion of current liabilities over total equity a. a combination of long-term debt interest costs and the implied cost of expected b. the amount of cash a company has to invest in growth return from company equity c. weighted average cost of capital (WACC) b. the proportion of total debt to total equity d. the portion of long-term debt over total equity c. the excess amount earned over the cost of long-term debt d. the excess amount eamed over the cost of total debt and total equity 8. Sustainable growth rate (SGR) of a company is best defined as: 13. EVA is a type of: a. the minimum growth rate, while keeping debt-to-equity ratio and dividend payout ratio constant. a. WACC calculation b. the maximum growth rate, while keeping debt-to-equity and dividend payout b. capital structure ratio constant. c. performance measure c. the minimum growth rate, while keeping debt-to-equity ratio low and dividend d. growth rate measure payout ratio maximized. d. the maximum growth rate, while keeping debt-to-equity ratio low and dividend payout ratio maximized. 14. A high level of financial leverage indicates: a. a high level of equity on the balance sheet 9. One example of an efficiency indicator (performance indicator) for a car-repair seminar is: b. a low level of equity on the balance sheet c. a high level of fixed costs on the income statement a. the number of people attending the car-repair seminar d. a low level of fixed costs on the income statement b. the number of hours needed to prepare for the car-repair seminar c. the satisfaction rating of the car-repair seminar d. the average response time in bookings for the car-repair seminar

5. What is a disadvantage of the payback method? 10. One example of an effectiveness indicator (performance indicator) is: a. It ignores cash inflows earned before the payback period. a. the amount of flour needed per week to produce 500 loaves of bread b. It is difficult to calculate. b. the wages paid to three bakers per week c. It can be used to cheaply separate desirable projects from less desirable ones. c. the responses to a customer satisfaction survey in the bread bakery d. It ignores cash inflows earned after the payback period. d. the average power bill per week for the bread bakery 6. What is the best definition of pro forma (projected) financial statements? 11. Residual income is best described as: a. A financial statement prepared by a professional. a. the percent of earnings above management's expectation b. A financial statement prepared in the future. b. the percent return above debt and shareholders' costs c. A financial statement prepared based on budgets. c. the excess dollars earned above debt and shareholders' costs d. A financial statement prepared for the most recent year. d. the excess dollars earned above management's expectation 7. Capital structure is best defined as: 12. Cost of capital is best described as: a. the portion of current liabilities over total equity a. a combination of long-term debt interest costs and the implied cost of expected b. the amount of cash a company has to invest in growth return from company equity c. weighted average cost of capital (WACC) b. the proportion of total debt to total equity d. the portion of long-term debt over total equity c. the excess amount earned over the cost of long-term debt d. the excess amount eamed over the cost of total debt and total equity 8. Sustainable growth rate (SGR) of a company is best defined as: 13. EVA is a type of: a. the minimum growth rate, while keeping debt-to-equity ratio and dividend payout ratio constant. a. WACC calculation b. the maximum growth rate, while keeping debt-to-equity and dividend payout b. capital structure ratio constant. c. performance measure c. the minimum growth rate, while keeping debt-to-equity ratio low and dividend d. growth rate measure payout ratio maximized. d. the maximum growth rate, while keeping debt-to-equity ratio low and dividend payout ratio maximized. 14. A high level of financial leverage indicates: a. a high level of equity on the balance sheet 9. One example of an efficiency indicator (performance indicator) for a car-repair seminar is: b. a low level of equity on the balance sheet c. a high level of fixed costs on the income statement a. the number of people attending the car-repair seminar d. a low level of fixed costs on the income statement b. the number of hours needed to prepare for the car-repair seminar c. the satisfaction rating of the car-repair seminar d. the average response time in bookings for the car-repair seminar Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started