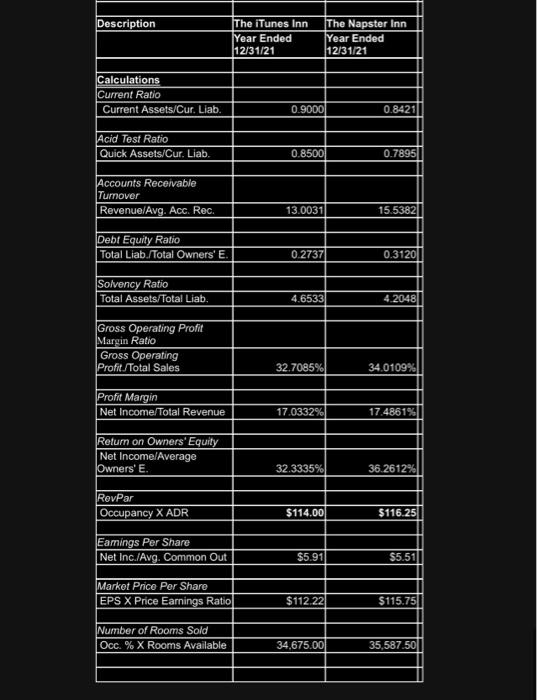

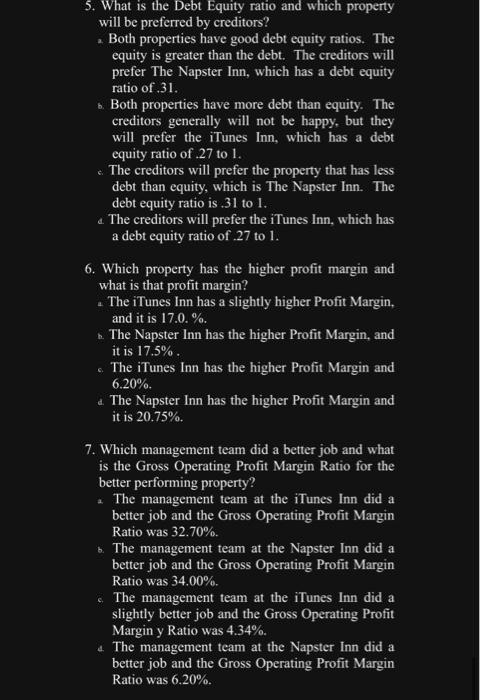

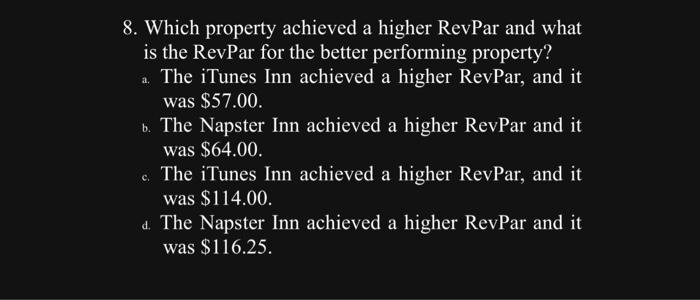

5. What is the Debt Equity ratio and which property will be preferred by creditors? a. Both properties have good debt equity ratios. The equity is greater than the debt. The creditors will prefer The Napster Inn, which has a debt equity ratio of .31 . b. Both properties have more debt than equity. The creditors generally will not be happy, but they will prefer the iTunes Inn, which has a debt equity ratio of .27 to 1 . c. The creditors will prefer the property that has less debt than equity, which is The Napster Inn. The debt equity ratio is 31 to 1 . a. The creditors will prefer the iTunes Inn, which has a debt equity ratio of .27 to 1 . 6. Which property has the higher profit margin and what is that profit margin? a. The iTunes Inn has a slightly higher Profit Margin, and it is 17.0.%. b. The Napster Inn has the higher Profit Margin, and it is 17.5%. c. The iTunes Inn has the higher Profit Margin and 6.20% d. The Napster Inn has the higher Profit Margin and it is 20.75%. 7. Which management team did a better job and what is the Gross Operating Profit Margin Ratio for the better performing property? a The management team at the iTunes Inn did a better job and the Gross Operating Profit Margin Ratio was 32.70%. b. The management team at the Napster Inn did a better job and the Gross Operating Profit Margin Ratio was 34.00%. c. The management team at the iTunes Inn did a slightly better job and the Gross Operating Profit Margin y Ratio was 4.34%. 4. The management team at the Napster Inn did a better job and the Gross Operating Profit Margin Ratio was 6.20%. 8. Which property achieved a higher RevPar and what is the RevPar for the better performing property? a. The iTunes Inn achieved a higher RevPar, and it was $57.00. b. The Napster Inn achieved a higher RevPar and it was $64.00. c. The iTunes Inn achieved a higher RevPar, and it was $114.00. d. The Napster Inn achieved a higher RevPar and it was $116.25. 5. What is the Debt Equity ratio and which property will be preferred by creditors? a. Both properties have good debt equity ratios. The equity is greater than the debt. The creditors will prefer The Napster Inn, which has a debt equity ratio of .31 . b. Both properties have more debt than equity. The creditors generally will not be happy, but they will prefer the iTunes Inn, which has a debt equity ratio of .27 to 1 . c. The creditors will prefer the property that has less debt than equity, which is The Napster Inn. The debt equity ratio is 31 to 1 . a. The creditors will prefer the iTunes Inn, which has a debt equity ratio of .27 to 1 . 6. Which property has the higher profit margin and what is that profit margin? a. The iTunes Inn has a slightly higher Profit Margin, and it is 17.0.%. b. The Napster Inn has the higher Profit Margin, and it is 17.5%. c. The iTunes Inn has the higher Profit Margin and 6.20% d. The Napster Inn has the higher Profit Margin and it is 20.75%. 7. Which management team did a better job and what is the Gross Operating Profit Margin Ratio for the better performing property? a The management team at the iTunes Inn did a better job and the Gross Operating Profit Margin Ratio was 32.70%. b. The management team at the Napster Inn did a better job and the Gross Operating Profit Margin Ratio was 34.00%. c. The management team at the iTunes Inn did a slightly better job and the Gross Operating Profit Margin y Ratio was 4.34%. 4. The management team at the Napster Inn did a better job and the Gross Operating Profit Margin Ratio was 6.20%. 8. Which property achieved a higher RevPar and what is the RevPar for the better performing property? a. The iTunes Inn achieved a higher RevPar, and it was $57.00. b. The Napster Inn achieved a higher RevPar and it was $64.00. c. The iTunes Inn achieved a higher RevPar, and it was $114.00. d. The Napster Inn achieved a higher RevPar and it was $116.25