Question

5) What would be a good basis to set materiality (Revenue, Assets, Equity, etc)? (Think about the definition of materiality, and what would be important

5) What would be a good basis to set materiality (Revenue, Assets, Equity, etc)? (Think about the definition of materiality, and what would be important to shareholders- do they care about profitability or how many assets the company has acquired.) (Think about if the company is a non-profit, a start-up, oriented towards building up assets, profitable, etc. Use these factors in your explanation.) (Pick 1 letter and & Explain why.) [EX: B. Net Income because.]

a. Revenue

b. Net Income

c. Total Assets

d. Total Equity

5.__________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

6) What percentage (higher percentage or a lower percentage) would you use for the benchmark you selected in Q5 above? (Pick an actual percentage ex: 5% or 1%, or 10%, based on the guidance below.) (EX: 5% of Net Income vs 10% of Net Income)? Explain why? Your choice should be based on the Inherent risk and control risk determined in questions 1-4 above. [Click on one of the boxes below to select your answer, check only one box.]

a. 5 percent of net income before taxes.

b. 10 percent of net income before taxes.

c. percent of total assets.

d. 1 percent of total assets.

e. percent of total revenues.

f. 1 percent of total revenues.

g. 1 percent of total equity.

h. Less than 1 percent of total Equity

7) What does picking a larger or smaller % for materiality mean to our detection risk? (Example if you picked 10% or 5% does that mean Detection risk is high or low.) (See slides for guidance on how to answer this question.) [Click on one of the boxes below to select your answer, check only one box.]

a. Picked a Larger % for materiality, this means Detection Risk is higher.

b. Picked a Smaller % for materiality, this means Detection Risk is lower.

8) Using the financial statements and the answers to the questions above calculate materiality for our audit of the company. (Calculate Overall materiality, Tolerable Misstatement (use 50% or 75% of overall Materiality), and Deminimis Materiality (use 5% or 10%). (Show your calculation and the number you calculated.)

- EX: Benchmark %(1%) * Assets ($25m)= $250K (Overall Materiality)

- EX:-Tolerable Misstatement = 50% * Overall Materiality [$250K* 50% = $125k]

- EX: Deminimis Materiality = 5% of Tolerable Misstatement [$125K * .05 = $6,250 ).

a. Overall Materiality=_______________________________________________________

b. Tolerable Misstatement=___________________________________________________

c. Deminimis Materiality=____________________________________________________

9) Look at the Income statements and answer the following questions: [Click on one of the boxes below to select your answer, check only one box.]

- i. Are any accounts larger or smaller than Overall Materiality?

A) YES

B) No

- ii. What does this mean do we have to audit all of these accounts?

A) YES

B) No

- iii. Are those accounts significant?

A) YES

B) No

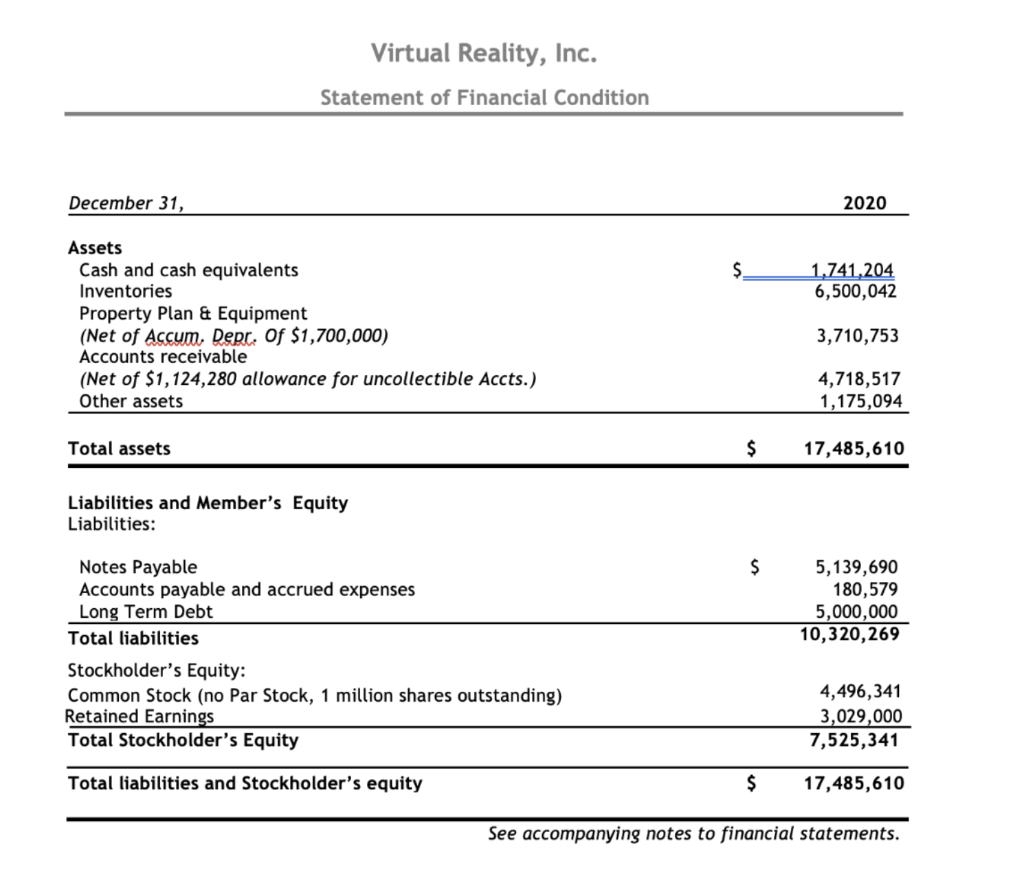

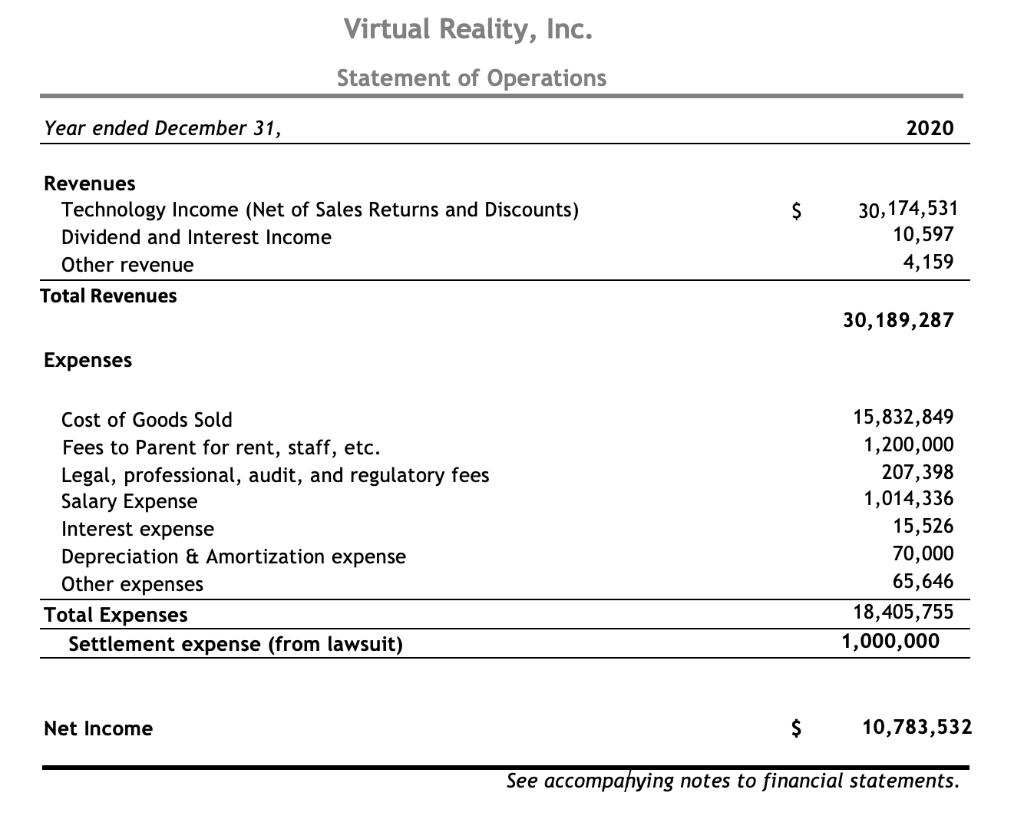

Virtual Reality, Inc. Statement of Financial Condition December 31, 2020 $. 1.741,204 6,500,042 Assets Cash and cash equivalents Inventories Property Plan & Equipment (Net of Accum. Depr. Of $1,700,000) Accounts receivable (Net of $1,124,280 allowance for uncollectible Accts.) Other assets 3,710,753 4,718,517 1,175,094 Total assets $ 17,485,610 Liabilities and Member's Equity Liabilities: $ Notes Payable Accounts payable and accrued expenses Long Term Debt Total liabilities 5,139,690 180,579 5,000,000 10,320,269 Stockholder's Equity: Common Stock (no Par Stock, 1 million shares outstanding) Retained Earnings Total Stockholder's Equity 4,496,341 3,029,000 7,525,341 Total liabilities and Stockholder's equity $ 17,485,610 See accompanying notes to financial statements. Virtual Reality, Inc. Statement of Operations Year ended December 31, 2020 $ Revenues Technology Income (Net of Sales Returns and Discounts) Dividend and Interest Income Other revenue Total Revenues 30,174,531 10,597 4,159 30,189,287 Expenses Cost of Goods Sold Fees to Parent for rent, staff, etc. Legal, professional, audit, and regulatory fees Salary Expense Interest expense Depreciation & Amortization expense Other expenses Total Expenses Settlement expense (from lawsuit) 15,832,849 1,200,000 207,398 1,014,336 15,526 70,000 65,646 18,405,755 1,000,000 Net Income $ 10,783,532 See accompanying notes to financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started