Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Which of the following is true concerning dividends? A The system to eliminate double taxation assumes that the corporate tax rate is 15% when

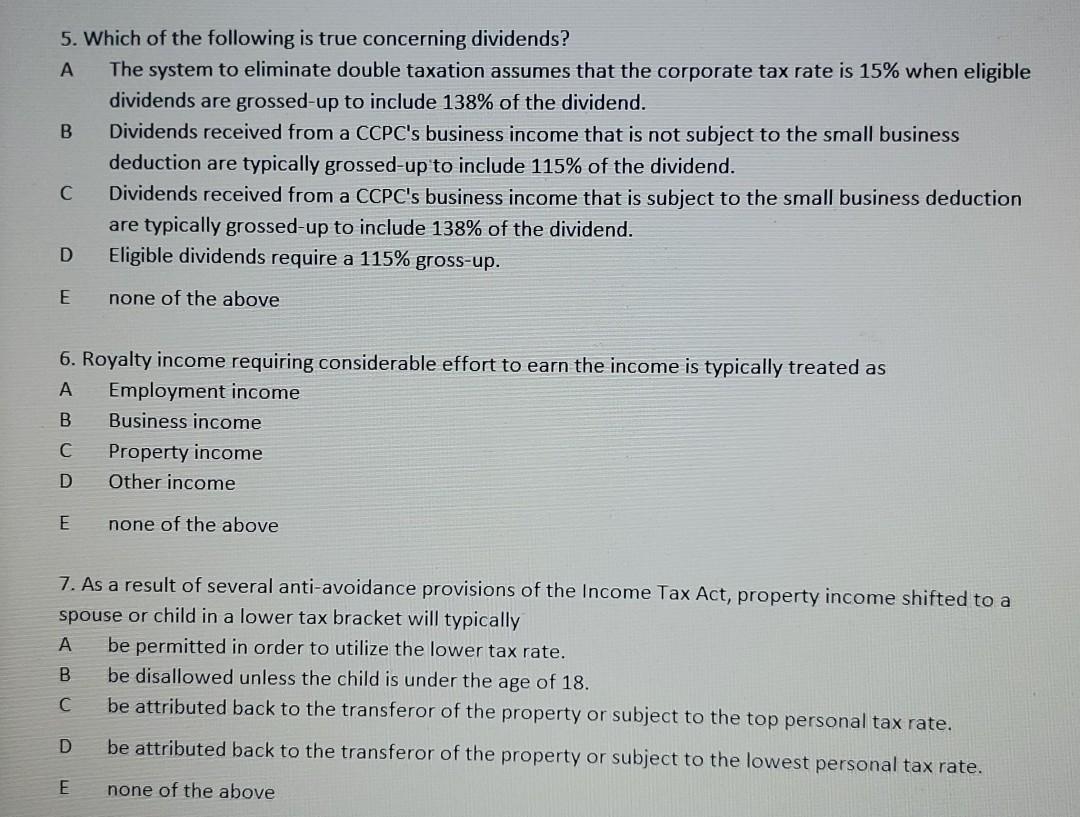

5. Which of the following is true concerning dividends? A The system to eliminate double taxation assumes that the corporate tax rate is 15% when eligible dividends are grossed-up to include 138% of the dividend. B Dividends received from a CCPC's business income that is not subject to the small business deduction are typically grossed-up to include 115% of the dividend. C Dividends received from a CCPC's business income that is subject to the small business deduction are typically grossed-up to include 138% of the dividend. D Eligible dividends require a 115% gross-up. E none of the above 6. Royalty income requiring considerable effort to earn the income is typically treated as A Employment income B Business income C Property income D Other income E none of the above 7. As a result of several anti-avoidance provisions of the Income Tax Act, property income shifted to a spouse or child in a lower tax bracket will typically A be permitted in order to utilize the lower tax rate. B be disallowed unless the child is under the age of 18. C be attributed back to the transferor of the property or subject to the top personal tax rate. D be attributed back to the transferor of the property or subject to the lowest personal tax rate. E none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started