Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. Which of the following statement is false? A. The committee report issued during the legislative process is a valuable source to taxpayers, the IRS,

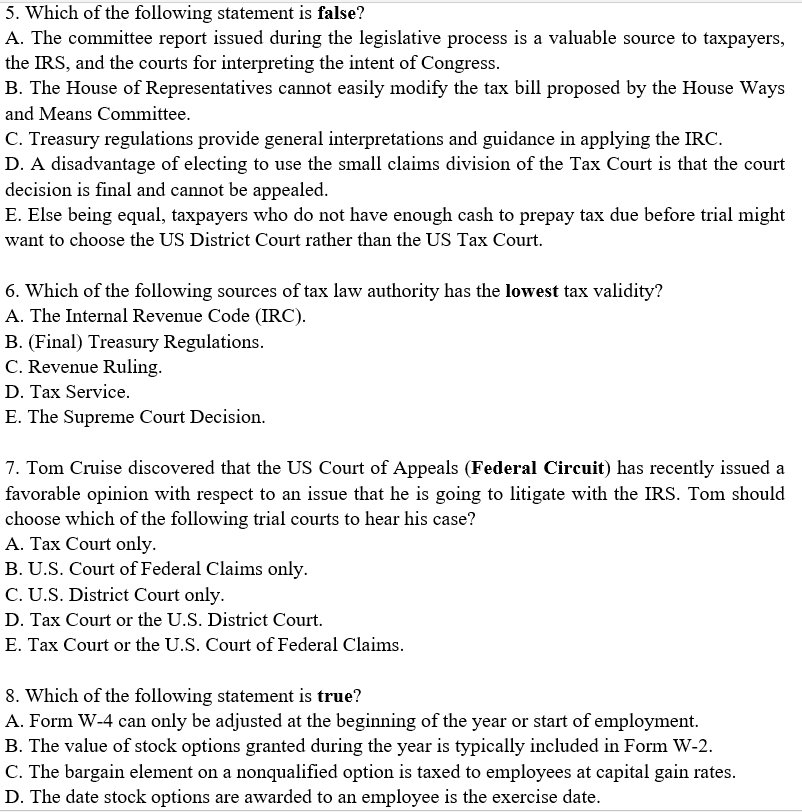

5. Which of the following statement is false? A. The committee report issued during the legislative process is a valuable source to taxpayers, the IRS, and the courts for interpreting the intent of Congress. B. The House of Representatives cannot easily modify the tax bill proposed by the House Ways and Means Committee. C. Treasury regulations provide general interpretations and guidance in applying the IRC. D. A disadvantage of electing to use the small claims division of the Tax Court is that the court decision is final and cannot be appealed. E. Else being equal, taxpayers who do not have enough cash to prepay tax due before trial might want to choose the US District Court rather than the US Tax Court. 6. Which of the following sources of tax law authority has the lowest tax validity? A. The Internal Revenue Code (IRC). B. (Final) Treasury Regulations. C. Revenue Ruling. D. Tax Service. E. The Supreme Court Decision. 7. Tom Cruise discovered that the US Court of Appeals (Federal Circuit) has recently issued a favorable opinion with respect to an issue that he is going to litigate with the IRS. Tom should choose which of the following trial courts to hear his case? A. Tax Court only. B. U.S. Court of Federal Claims only. C. U.S. District Court only. D. Tax Court or the U.S. District Court. E. Tax Court or the U.S. Court of Federal Claims. 8. Which of the following statement is true? A. Form W-4 can only be adjusted at the beginning of the year or start of employment. B. The value of stock options granted during the year is typically included in Form W-2. C. The bargain element on a nonqualified option is taxed to employees at capital gain rates. D. The date stock options are awarded to an employee is the exercise date

5. Which of the following statement is false? A. The committee report issued during the legislative process is a valuable source to taxpayers, the IRS, and the courts for interpreting the intent of Congress. B. The House of Representatives cannot easily modify the tax bill proposed by the House Ways and Means Committee. C. Treasury regulations provide general interpretations and guidance in applying the IRC. D. A disadvantage of electing to use the small claims division of the Tax Court is that the court decision is final and cannot be appealed. E. Else being equal, taxpayers who do not have enough cash to prepay tax due before trial might want to choose the US District Court rather than the US Tax Court. 6. Which of the following sources of tax law authority has the lowest tax validity? A. The Internal Revenue Code (IRC). B. (Final) Treasury Regulations. C. Revenue Ruling. D. Tax Service. E. The Supreme Court Decision. 7. Tom Cruise discovered that the US Court of Appeals (Federal Circuit) has recently issued a favorable opinion with respect to an issue that he is going to litigate with the IRS. Tom should choose which of the following trial courts to hear his case? A. Tax Court only. B. U.S. Court of Federal Claims only. C. U.S. District Court only. D. Tax Court or the U.S. District Court. E. Tax Court or the U.S. Court of Federal Claims. 8. Which of the following statement is true? A. Form W-4 can only be adjusted at the beginning of the year or start of employment. B. The value of stock options granted during the year is typically included in Form W-2. C. The bargain element on a nonqualified option is taxed to employees at capital gain rates. D. The date stock options are awarded to an employee is the exercise date Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started