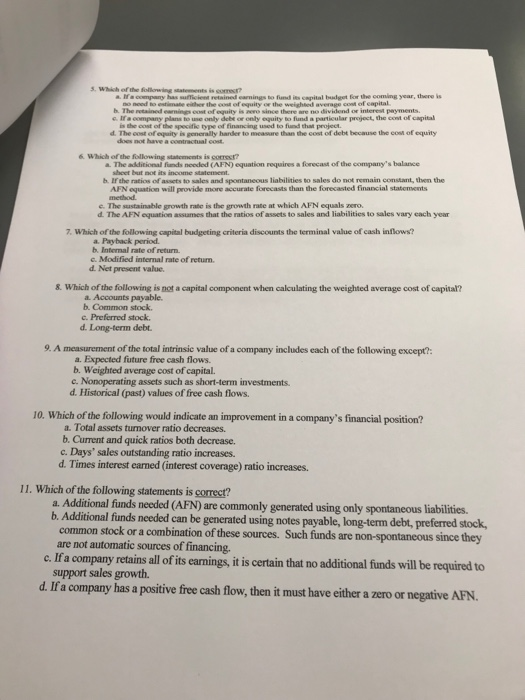

5. Which ofthe following statments is comest? a.lf.company has suffleient retained earnings to find its capital budget fr the coming year, there is cost of capital no nood to estimate eilher the oont of equity or the weighted or interest payments e. Ifa company plans to use only debt or only equity to fund a particular projoct, the cont of capital d. The oost of equity is generally harder to measure than the cost of debt because the cosm of equity does not have a contrachal cost. 6. Which of the following statements is correst? a The additional funds needed (AFN) equation requires a forecast of the company's balance sheet but b. If the ratios of assets to sales and spontaneous liabilities to sales do not remain constant, then the AFN equation will provide more accurate forecasts than the forecasted financial statements c. The sustainable growth rate is the growth rate at which AFN equals zero. d. The AFN equation assumes that the ratios of assets to sales and liabilities to sales vary each year a. Payback period. d. Net present value 7. Which of the following capital budgeting criteria discounts the terminal value of cash inflows? b. Internal rate of return. e. Modified internal rate of retum. 8. Which of the following is not a capital component when calculating the weighted average cost of capital? a. Accounts payable b. Common stock c. Preferred stock. d. Long-term debt. 9. A measurement of the total intrinsic value of a company includes each of the following except? a. Expected future free cash flows. b. Weighted average cost of capital. c. Nonoperating assets such as short-term investments d. Historical (past) values of free cash flows. 10. Which of the following would indicate an improvement in a company's financial position? a. Total assets turnover ratio decreases. b. Current and quick ratios both decrease. c. Days' sales outstanding ratio increases. d. Times interest earned (interest coverage) ratio increases. 11. Which of the following statements is correct? a Additional funds neoded (AFN) are commonly generated using only spontaneous liabilities. b. Additional funds needed can be generated using notes payable, long-term debt, preferred stock, c lfa comp any retains all of its earnings, it is certain that no additional funds will be required to d.If a company has a positive free cash flow, then it must have either a zero or negative AFN. common stock or a combination of these sources. Such funds are non-spontaneous since they are not automatic sources of financing. support sales growth