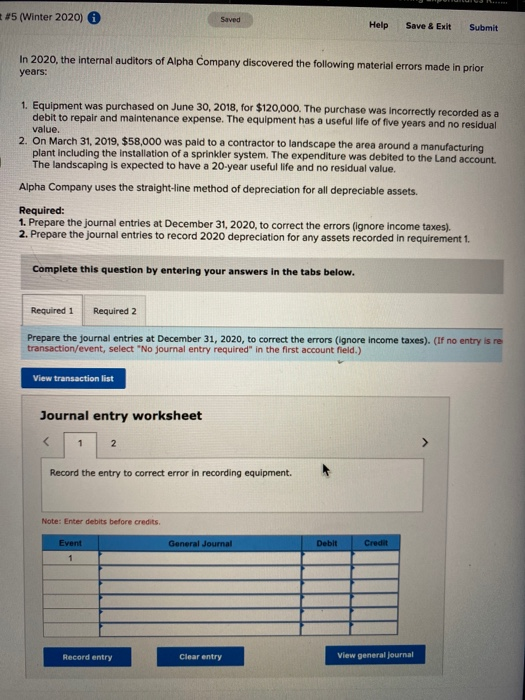

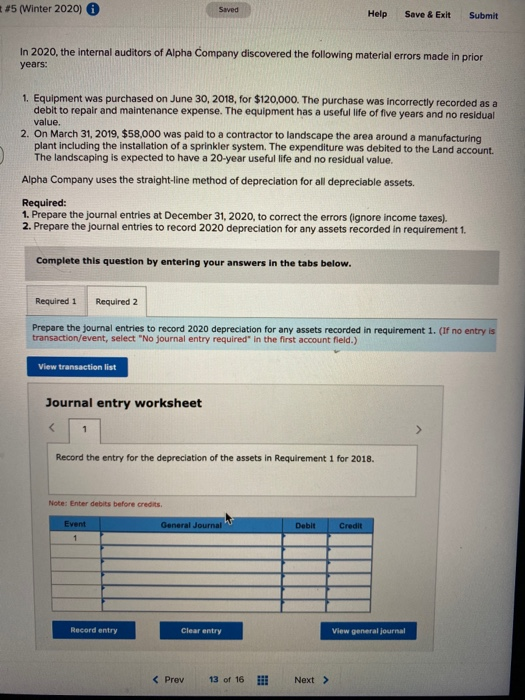

* #5 (Winter 2020) Help Save & Exit Submit In 2020, the internal auditors of Alpha Company discovered the following material errors made in prior years: 1. Equipment was purchased on June 30, 2018, for $120,000. The purchase was incorrectly recorded as a debit to repair and maintenance expense. The equipment has a useful life of five years and no residual value. 2. On March 31, 2019, $58,000 was paid to a contractor to landscape the area around a manufacturing plant including the installation of a sprinkler system. The expenditure was debited to the Land account. The landscaping is expected to have a 20-year useful life and no residual value. Alpha Company uses the straight-line method of depreciation for all depreciable assets. Required: 1. Prepare the journal entries at December 31, 2020, to correct the errors (ignore income taxes). 2. Prepare the journal entries to record 2020 depreciation for any assets recorded in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries at December 31, 2020, to correct the errors (ignore income taxes). (If no entry is re transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry to correct error in recording equipment. Note: Enter debits before credits Event General Journal Debit Credit Record entry Clear entry View general journal 15 (Winter 2020) Help Save & Exit Submit In 2020, the internal auditors of Alpha Company discovered the following material errors made in prior years: 1. Equipment was purchased on June 30, 2018, for $120,000. The purchase was incorrectly recorded as a debit to repair and maintenance expense. The equipment has a useful life of five years and no residual value. 2. On March 31, 2019, $58,000 was paid to a contractor to landscape the area around a manufacturing plant including the installation of a sprinkler system. The expenditure was debited to the Land account The landscaping is expected to have a 20-year useful life and no residual value. Alpha Company uses the straight-line method of depreciation for all depreciable assets. Required: 1. Prepare the journal entries at December 31, 2020. to correct the errors (ignore income taxes. 2. Prepare the journal entries to record 2020 depreciation for any assets recorded in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entries to record 2020 depreciation for any assets recorded in requirement 1. (If no entry is transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry for the depreciation of the assets in Requirement 1 for 2018. Note: Enter debits before credits Event General Journal Debit Credit Record entry Clear entry View general journal