Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#5. XYZ Inc. has faced insolvency as it cannot pay back a certain amount of debt to its creditors. To resolve the issue, the firm

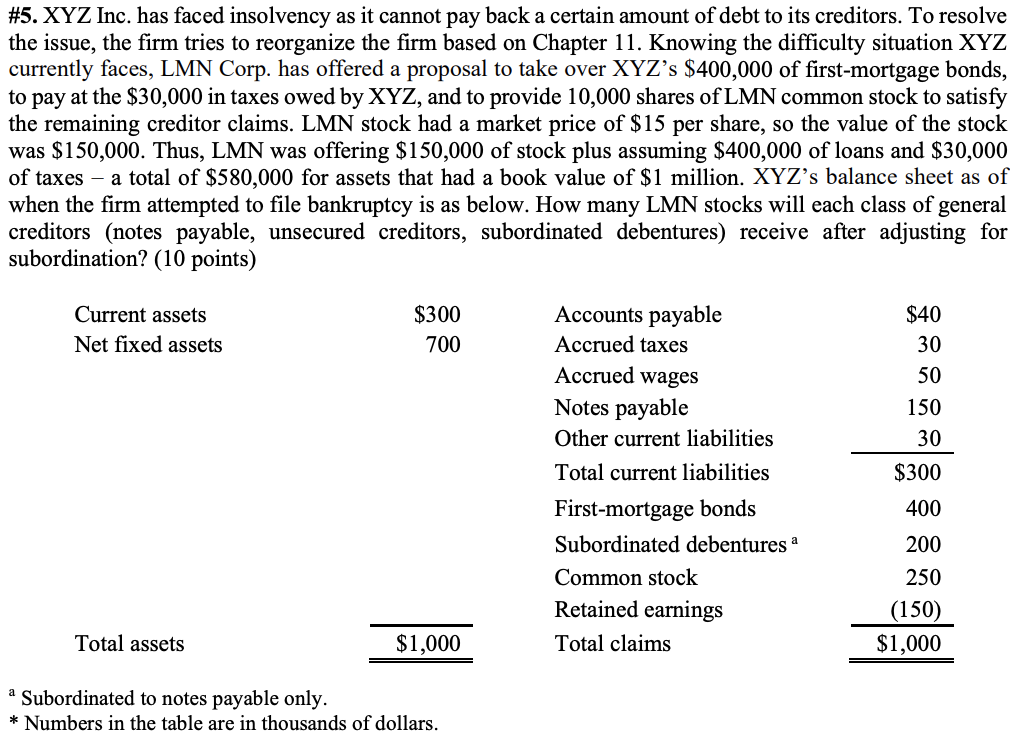

\#5. XYZ Inc. has faced insolvency as it cannot pay back a certain amount of debt to its creditors. To resolve the issue, the firm tries to reorganize the firm based on Chapter 11. Knowing the difficulty situation XYZ currently faces, LMN Corp. has offered a proposal to take over XYZ's $400,000 of first-mortgage bonds, to pay at the $30,000 in taxes owed by XYZ, and to provide 10,000 shares of LMN common stock to satisfy the remaining creditor claims. LMN stock had a market price of $15 per share, so the value of the stock was $150,000. Thus, LMN was offering $150,000 of stock plus assuming $400,000 of loans and $30,000 of taxes - a total of $580,000 for assets that had a book value of $1 million. XYZ's balance sheet as of when the firm attempted to file bankruptcy is as below. How many LMN stocks will each class of general creditors (notes payable, unsecured creditors, subordinated debentures) receive after adjusting for subordination? (10 points) a Subordinated to notes payable only. * Numbers in the table are in thousands of dollars

\#5. XYZ Inc. has faced insolvency as it cannot pay back a certain amount of debt to its creditors. To resolve the issue, the firm tries to reorganize the firm based on Chapter 11. Knowing the difficulty situation XYZ currently faces, LMN Corp. has offered a proposal to take over XYZ's $400,000 of first-mortgage bonds, to pay at the $30,000 in taxes owed by XYZ, and to provide 10,000 shares of LMN common stock to satisfy the remaining creditor claims. LMN stock had a market price of $15 per share, so the value of the stock was $150,000. Thus, LMN was offering $150,000 of stock plus assuming $400,000 of loans and $30,000 of taxes - a total of $580,000 for assets that had a book value of $1 million. XYZ's balance sheet as of when the firm attempted to file bankruptcy is as below. How many LMN stocks will each class of general creditors (notes payable, unsecured creditors, subordinated debentures) receive after adjusting for subordination? (10 points) a Subordinated to notes payable only. * Numbers in the table are in thousands of dollars Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started