Answered step by step

Verified Expert Solution

Question

1 Approved Answer

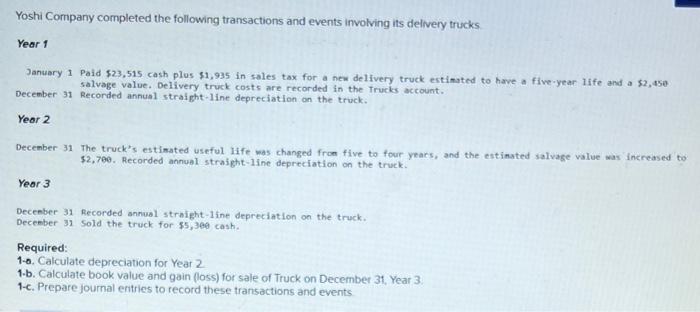

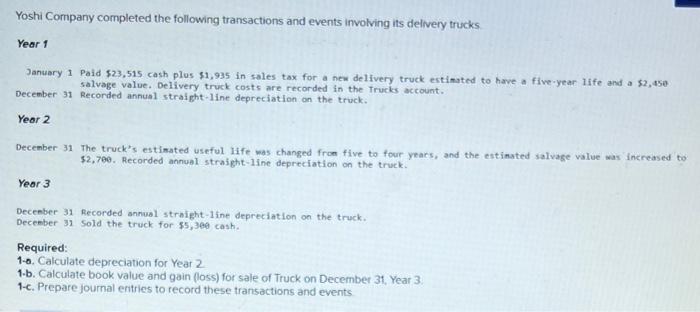

#5 Yoshi Compary completed the following transactions and events involving its delivery trucks Year 1 January 1 Paid $23,515 cash plus $1,935 in sales tax

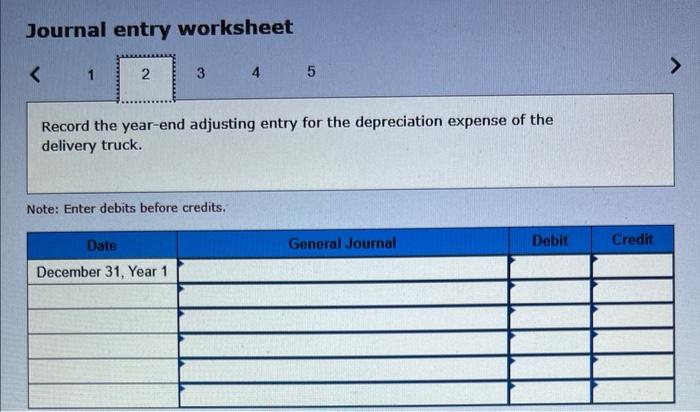

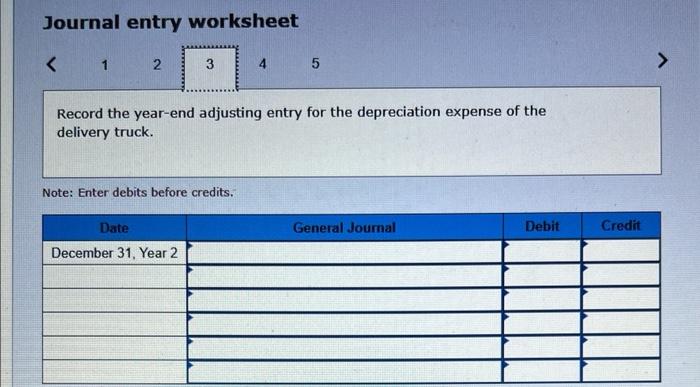

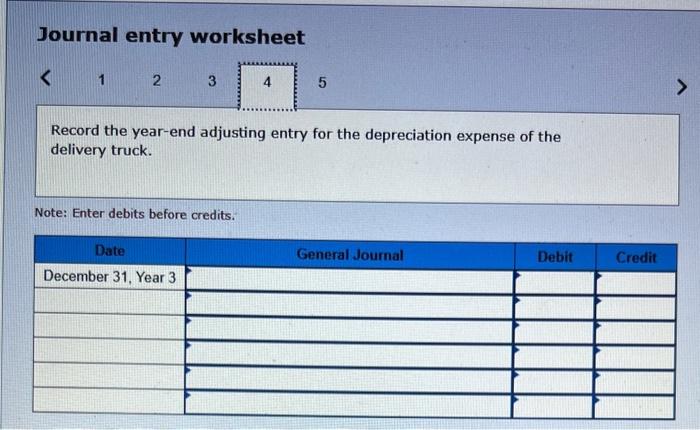

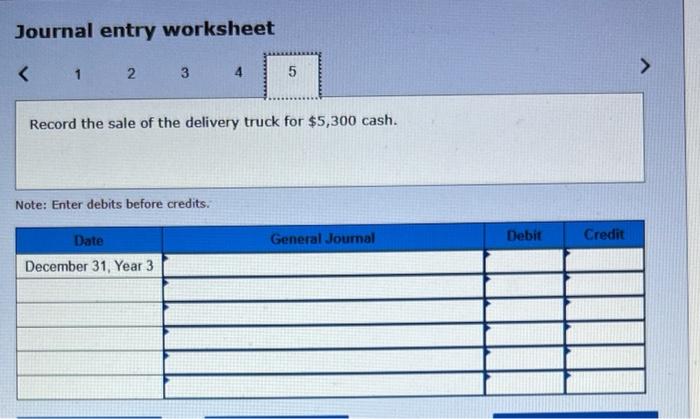

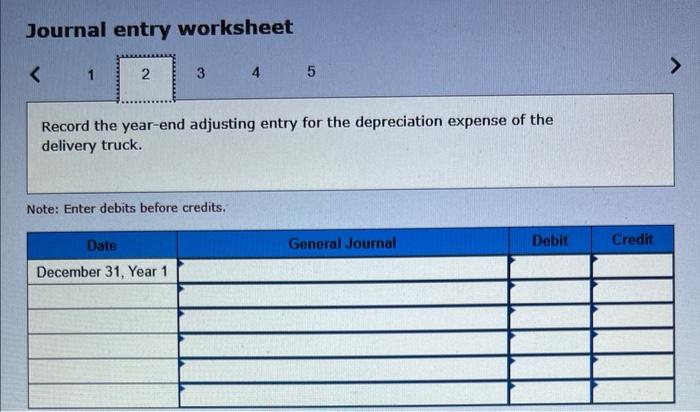

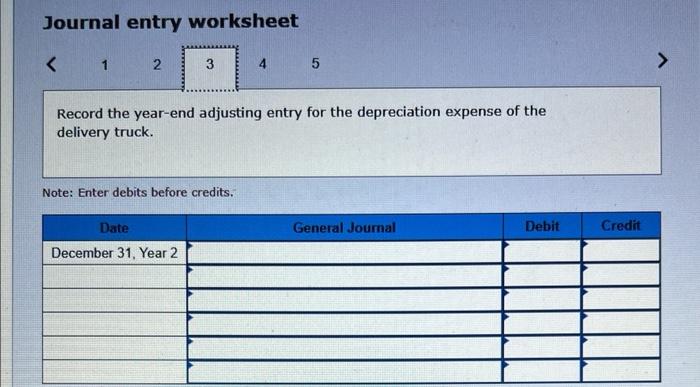

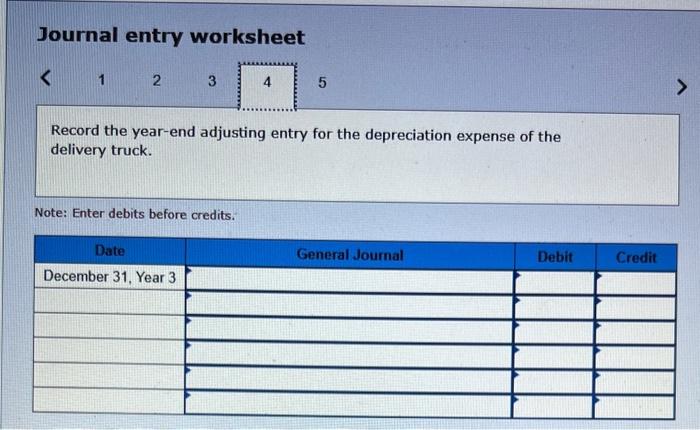

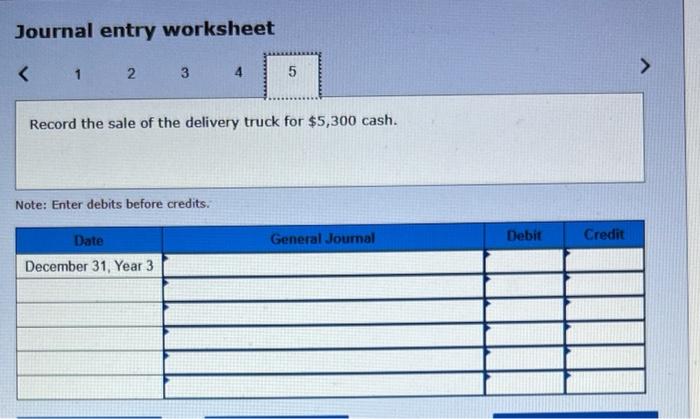

#5

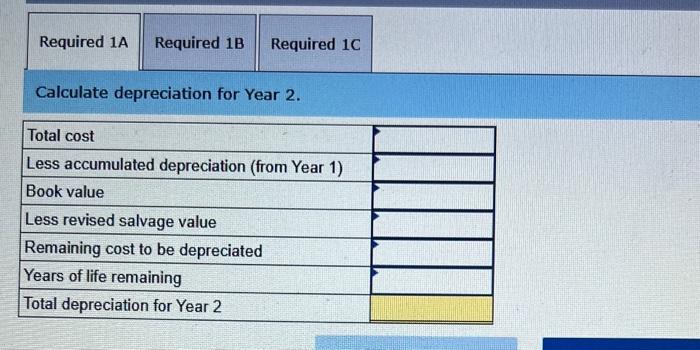

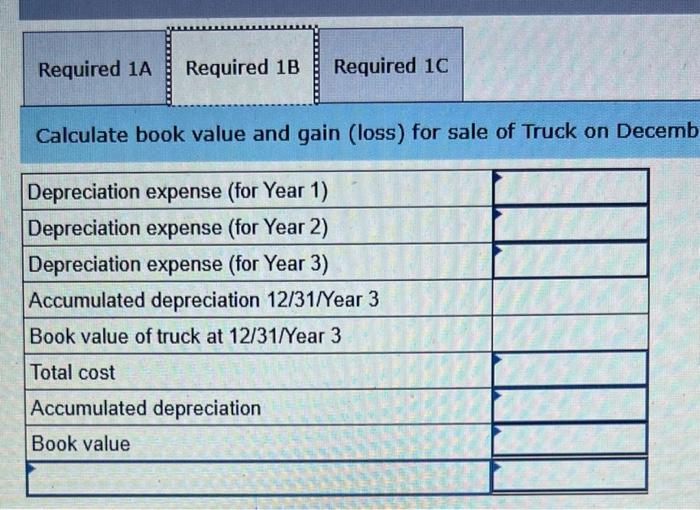

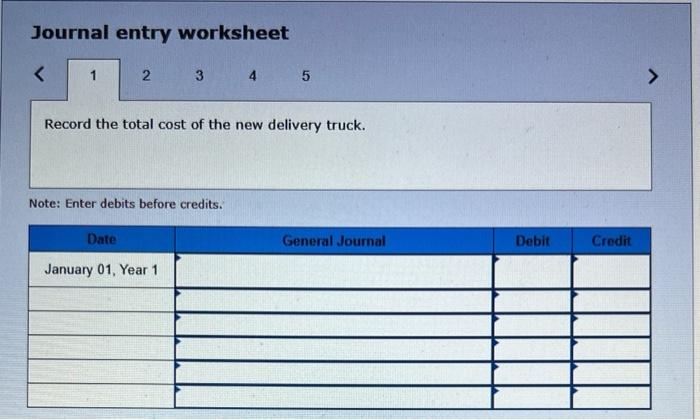

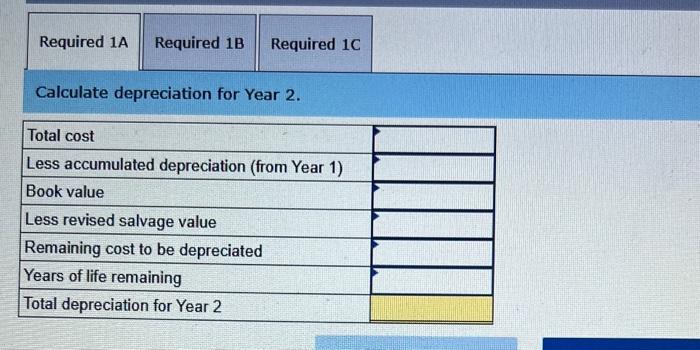

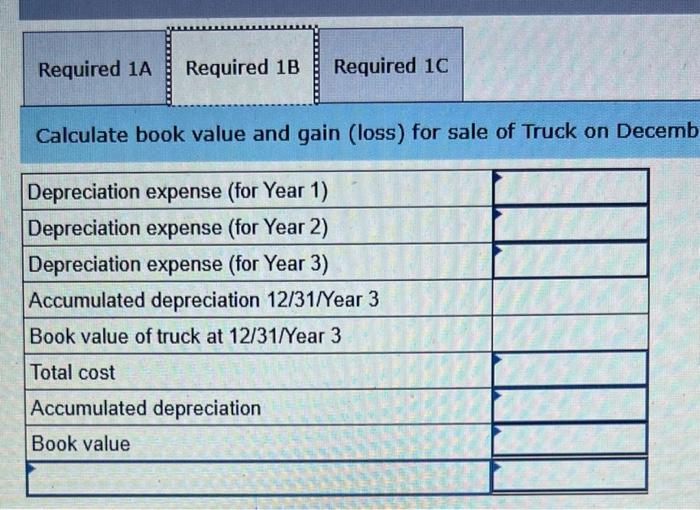

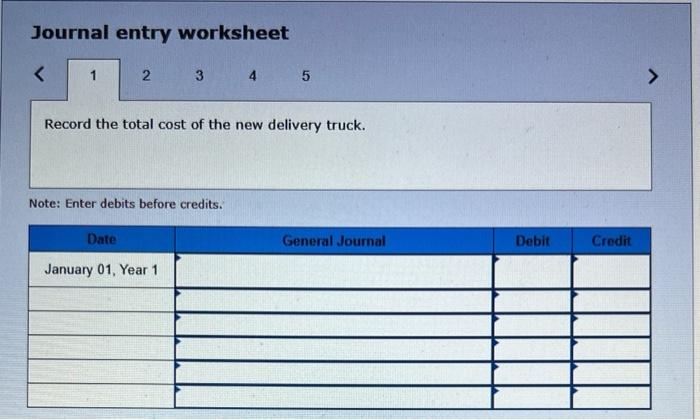

Yoshi Compary completed the following transactions and events involving its delivery trucks Year 1 January 1 Paid $23,515 cash plus $1,935 in sales tax for a new delivery truck estimated to have a five-year 1 ife and a $2, 45a salvage value. Delivery truck costs are recorded in the Trucks account. December 31 Recorded annual straight-line depreciation on the truck. Yeor 2 December 31 The truck's estimated useful Hife was changed from five to four yeacs, and the estimated salvage walue was increased to 32,790. Recorded annual straight-1ine depreciation on the truck. Year 3 Deceeber 31 Recorded annual straight-1ine depreciation on the truck. Decenber 31 Sold the truck for 55,309 cash. Required: 1-a. Calculate depreciation for Year 2 1-b. Calculate book value and gain (loss) for sale of Truck on December 31, Year 3. 1-c. Prepare journal entries to record these transactions and events Calculate depreciation for Year 2. Calculate book value and gain (loss) for sale of Truck on Decem Journal entry worksheet 5 Note: Enter debits before credits. Journal entry worksheet 5 Record the year-end adjusting entry for the depreciation expense of the delivery truck. Note: Enter debits before credits. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of the delivery truck. Note: Enter debits before credits. Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of the delivery truck. Note: Enter debits before credits. Journal entry worksheet Record the sale of the delivery truck for $5,300 cash. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started