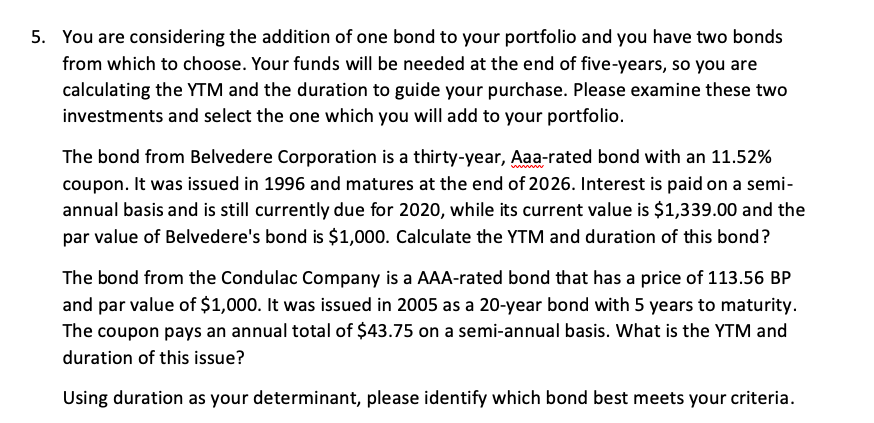

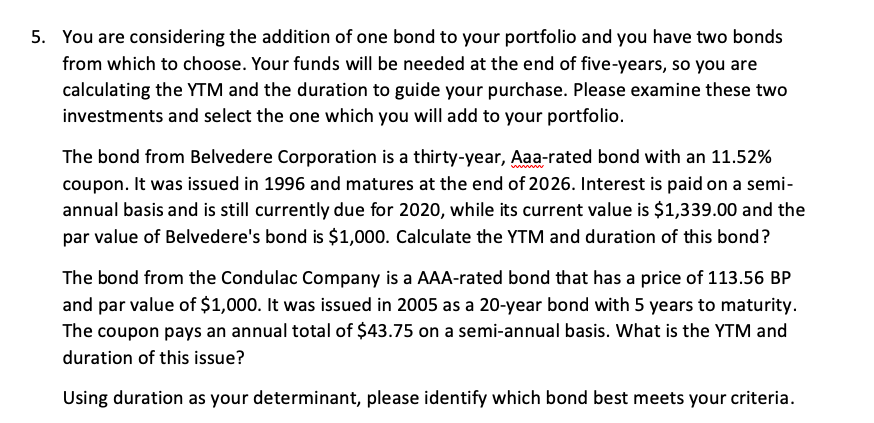

5. You are considering the addition of one bond to your portfolio and you have two bonds from which to choose. Your funds will be needed at the end of five-years, so you are calculating the YTM and the duration to guide your purchase. Please examine these two investments and select the one which you will add to your portfolio. The bond from Belvedere Corporation is a thirty-year, Aaa-rated bond with an 11.52% coupon. It was issued in 1996 and matures at the end of 2026. Interest is paid on a semi- annual basis and is still currently due for 2020, while its current value is $1,339.00 and the par value of Belvedere's bond is $1,000. Calculate the YTM and duration of this bond? The bond from the Condulac Company is a AAA-rated bond that has a price of 113.56 BP and par value of $1,000. It was issued in 2005 as a 20-year bond with 5 years to maturity. The coupon pays an annual total of $43.75 on a semi-annual basis. What is the YTM and duration of this issue? Using duration as your determinant, please identify which bond best meets your criteria. 5. You are considering the addition of one bond to your portfolio and you have two bonds from which to choose. Your funds will be needed at the end of five-years, so you are calculating the YTM and the duration to guide your purchase. Please examine these two investments and select the one which you will add to your portfolio. The bond from Belvedere Corporation is a thirty-year, Aaa-rated bond with an 11.52% coupon. It was issued in 1996 and matures at the end of 2026. Interest is paid on a semi- annual basis and is still currently due for 2020, while its current value is $1,339.00 and the par value of Belvedere's bond is $1,000. Calculate the YTM and duration of this bond? The bond from the Condulac Company is a AAA-rated bond that has a price of 113.56 BP and par value of $1,000. It was issued in 2005 as a 20-year bond with 5 years to maturity. The coupon pays an annual total of $43.75 on a semi-annual basis. What is the YTM and duration of this issue? Using duration as your determinant, please identify which bond best meets your criteria