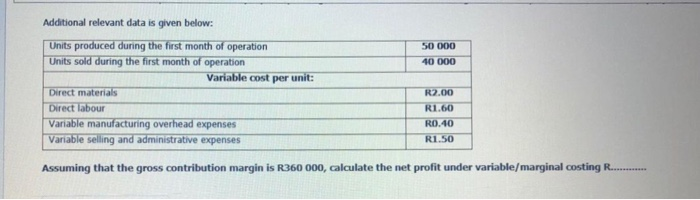

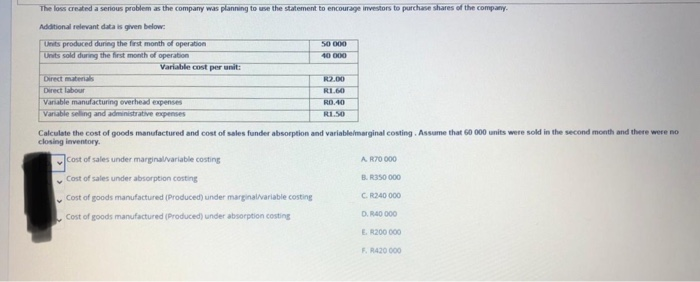

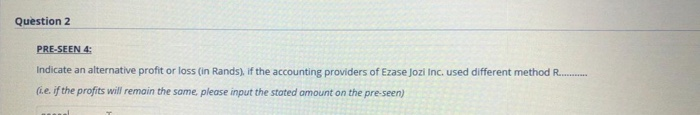

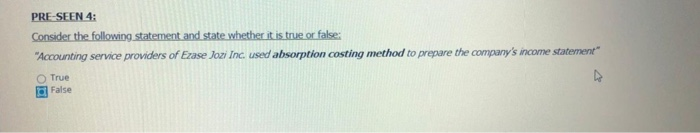

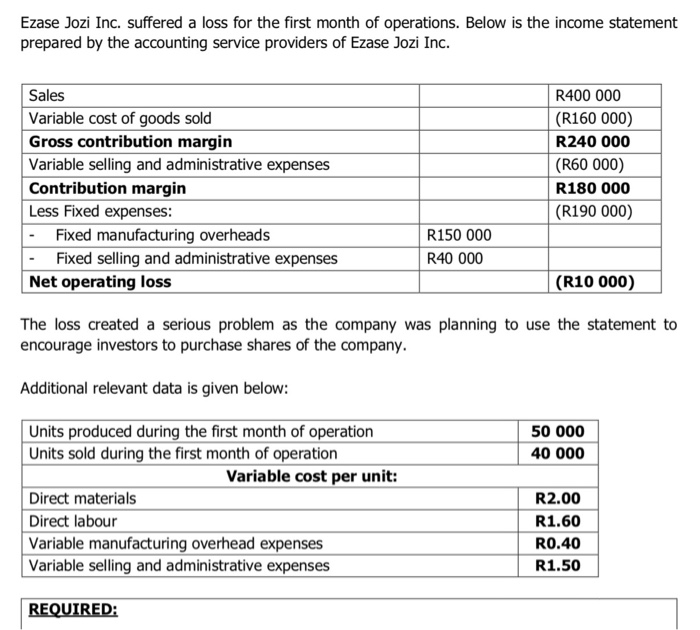

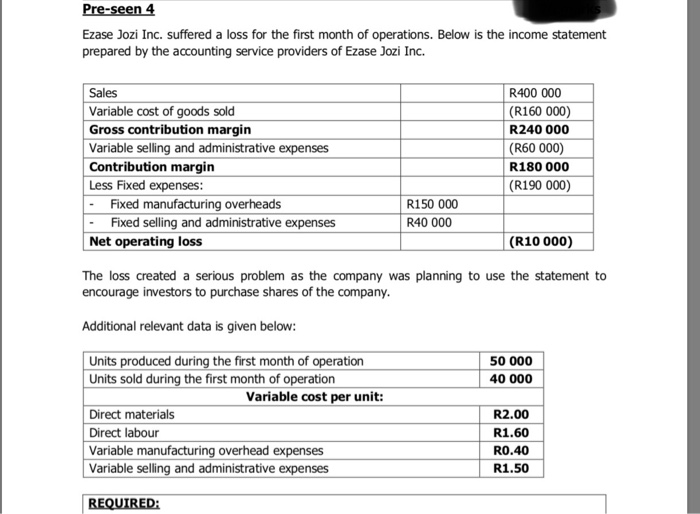

50 000 40 000 Additional relevant data is given below: Units produced during the first month of operation Units sold during the first month of operation Variable cost per unit: Direct materials Direct labour Variable manufacturing overhead expenses Variable selling and administrative expenses R2.00 R1.60 R0.40 R1.50 Assuming that the gross contribution margin is R360 000, calculate the net profit under variable/marginal costing .......... The loss created a serious problem as the company was planning to use the statement to encourage investors to purchase shares of the company. Additional relevant data is given below. Units produced during the first month of operation 50 000 Units sold during the first month of operation 40 000 Variable cost per unit: Direct materials R2.00 Direct Sour R1.60 Variable manufacturing overhead expenses Variable selling and administrative expenses 1.50 Calculate the cost of goods manufactured and cost of sales funder absorption and variable/marginal costing. Assume that 60 000 units were sold in the second month and there were no closing inventory cost of sales under marginal variable costing AR70 000 Cost of sales under absorption costing B. R350 000 Cost of goods manufactured Produced) under marginal variable costing C.R240 000 Cost of goods manufactured Produced) under absorption costing DR4 000 E 200 000 F. R420 000 V Question 2 PRE-SEEN 4: Indicate an alternative profit or loss (in Rands), if the accounting providers of Ezase Jozi Inc used different method R........... (i.e. if the profits will remain the same please input the stated amount on the pre-seen) PRE-SEEN 4: Consider the following statement and state whether it is true or false; "Accounting service providers of Ezase Jozi Inc used absorption costing method to prepare the company's income statement" True Ta False Ezase Jozi Inc. suffered a loss for the first month of operations. Below is the income statement prepared by the accounting service providers of Ezase Jozi Inc. Sales Variable cost of goods sold Gross contribution margin Variable selling and administrative expenses Contribution margin Less Fixed expenses: - Fixed manufacturing overheads Fixed selling and administrative expenses Net operating loss R400 000 (R160 000) R240 000 (R60 000) R180 000 (R190 000) R150 000 R40 000 (R10 000) The loss created a serious problem as the company was planning to use the statement to encourage investors to purchase shares of the company. Additional relevant data is given below: 50 000 40 000 Units produced during the first month of operation Units sold during the first month of operation Variable cost per unit: Direct materials Direct labour Variable manufacturing overhead expenses Variable selling and administrative expenses R2.00 R1.60 R0.40 R1.50 REQUIRED: Pre-seen 4 Ezase Jozi Inc. suffered a loss for the first month of operations. Below is the income statement prepared by the accounting service providers of Ezase Jozi Inc. Sales R400 000 Variable cost of goods sold (R160 000) Gross contribution margin R240 000 Variable selling and administrative expenses (R60 000) Contribution margin R180 000 Less Fixed expenses: (R190 000) - Fixed manufacturing overheads R150 000 Fixed selling and administrative expenses R40 000 Net operating loss (R10 000) The loss created a serious problem as the company was planning to use the statement to encourage investors to purchase shares of the company. Additional relevant data is given below: 50 000 40 000 Units produced during the first month of operation Units sold during the first month of operation Variable cost per unit: Direct materials Direct labour Variable manufacturing overhead expenses Variable selling and administrative expenses R2.00 R1.60 R0.40 R1.50 REQUIRED