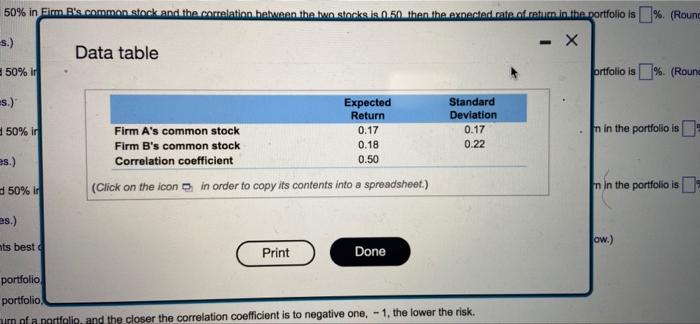

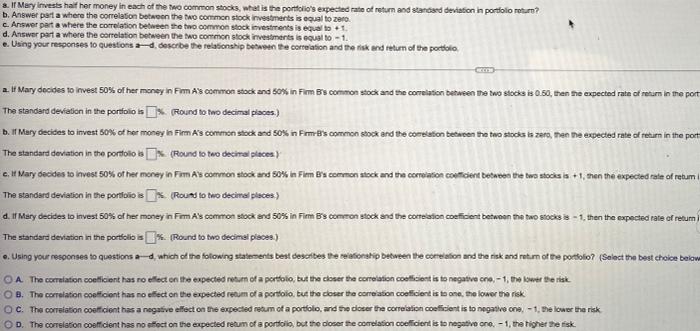

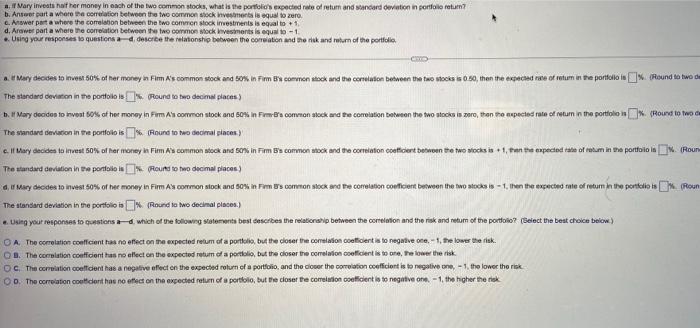

- 50% in Eim.Bs.common stock and the correlation between the two stocks is 0.50 then the expected rate of return in the portfolio is % (Round s.) Data table 50% id ortfolio is % (Round s.) Expected Standard Return Deviation 50% in Firm A's common stock 0.17 0.17 m in the portfolio is Firm B's common stock 0.18 0.22 es.) Correlation coefficient 0.50 50% ir (Click on the icon in order to copy its contents into a spreadsheet.) in in the portfolio is es.) ow.) ats best Print Done portfolio portfolio of a portfolio, and the closer the correlation coefficient is to negative one, - 1, the lower the risk. 8. Mary invests half her money in each of the two common stocks, wet is the portfolio's expected rate of return and standard deviation in portfolio metu? b. Answer part a where the correlation between the two common stock investments is equal to zero c. Answer part a where the correlation between the two common stock investments is equal to 1. d. Answer part a where the correlation between the two common stock investments is equal to - 1 e. Using your responses to questions describe the relationship between the correlation and the risk and return of the portfolio is 2. Mary decides to invest 50% of her money in Fim A's common stock and 50% in Fim By common stock and the correlation between the two stocks is 0.50, then the expected rate of return in the port The standard deviation in the portfolios % (Round to two decimal places.) b. ll Mary decides to invest 80% of her money la Fim A's common stock and 50% in Fem's common stock and the correlation between the two stocks is zero, then the expected rate of return in the port The standard deviation in the portfolio I (Round to wo decimal places) c. Mary decides to invest 50% of her money in Fim A's common stock and 50% in Firm B's common stock and the correlation coefficient between the two stocks la +1, then the expected rate of retum The standard deviation in the portfolio Ex Rour to ho decine places) d. 1 Mary decides to invest 50% of her money in Fm As common stock and 50% in Fim Bs common stock and the correlation coeficient between the two stocks 3 1, then the expected rate of renum The standard deviation in the portfolios * Round to bws decimi pisces) .. Using your responses to questions - which of the following statements best desabes the relationship between the correlation and the risk and return of the portfolio? (Select the best choice below O A The correlation coefficient has to effect on the expected return of a portfolio, but the closer the correlation coeficient is to negative cne-1, the lower the risk OB. The correlation coefficient has no effect on the expected retum of a portiola, but the closer the correlation coeficient is to one, the lower the risk OC. The correlation coefficient has a negative effect on the expected retum of a portfolio, and he doser the correlation coeficient is to negative one, -1, the lower the risk OD. The correlation coefficient has notect on the expected retum of a portfolio, but the closer the corelation coefficient is to negative one. -1, the higher the risk Mwy decides to meet 50% of her money in my common stock and boom l'a common dock and recorrelation between the 10.60, pece rate of mine portfolio Mod The standard conton in the portfotos (Round to two decimal place) Mary decide to uvos % of her money in rem Asa common mock and som n Pemer's cermon vosk and the correlation between the two shocks is pove, then the expected to er man in the partono s pound The standard deviation in the portfolio Pound to two decimal places) 6. May decide to veke som other memy in From A's common stock and boy in rem l's common stock and the correlation contient between the two tocka 1, then the expectant role of enten in the portion The standard deviation in the portoko la I Route 10 ho decimal places) 6. Mary decides to invest 80% of her money in From A's common slock and son in Pom B's communaltek and the cerelation coeficient between no ho todas las -1, then the expected tate of retum. In the portfolio la The standard deviation in the portfolio Cm Round to have decimal places) thing your responses to questions, which of the tooowing statements best describes the restoratip between the commission and there and return of the portoe? (Select the best choice bele DA The correlation coefficient has no effect on the expected rotum of a porto, but the core correlation coeficient is to negative on-1, the lower the O a. The correlation coeficient has no effect on the expected retum ofaportou the closer the comition coefficient is to one, the lower the risk OC. The correlation coefficient has a negative effect on the expected return of a portfolio and the door the comition contisto negative one. -1, the lower the risk OD. The corelation coefficient has no effect on the expected tom of a pertolo, but the closer to contation coefficient is to negative one-1.the higher the risk a. I Mary decides to invest 50% of her money in Fim A's common stock and 50% in Firm B's common stock and the correlation between the two stocks is 0.50, then th The standard deviation in the portfolio is % (Round to two decimal places.) b. I Mary decides to invest 50% of her money in Firm A's common stock and 50% in Firm-B's common stock and the correlation between the two stocks is zero, then the The standard deviation in the portfolio is % (Round to two decimal places.) c. Mary decides to invest 50% of her money in Fim A's common stock and 50% in Firm B's common stock and the correlation coefficient between the two stocks is + The standard deviation in the portfolio is % (Round to two decimal places) d. If Mary decides to invest 50% of her money in Firm A's common stock and 50% in Fim B's common stock and the correlation coefficient between the two stocks is The standard deviation in the portfolio is 0% (Round to two decimal places.) e. Using your responses to questions - which of the following statements best describes the relationship between the correlation and the risk and return of the port O A The correlation coefficient has no effect on the expected return of a portfolio, but the closer the correlation coefficient is to negative one, -1, the lower the risk. OB. The correlation coefficient has no effect on the expected return of a portfolio, but the closer the correlation coefficient is to one, the lower the risk OC. The correlation coefficient has a negative effect on the expected rotum of a portfolio, and the closer the correlation coefficient is to negative one. - 1, the lower OD. The correlation coefficient has no effect on the expected return of a portfolio, but the closer the correlation coefficient is to negative one, - 1, the higher the risk Mary invests at her money in each of the two common stocks, what is the portfolio's expected rate of return and standard deviation in portfoloratum b. Answer part a where the correlation between the two con dock investimental equal to zero c. Answer part a where the correlation between the two common stock investments is equal to + 1 d. Arawer part a where the correlation between the two common lock investments is equal to 1 Using your responses to questions a describe the relationship between the correlation and the risk and turn of the portfolio CHO ay decides to west 50% of her money on Film A's common stock and in Fim Becommon stock and the correladon besween the two wocks 0.so, then the expected rate of votum in the portello C Round to two The standard deviation in the portfolio Round to two decimal places) b. Mary decides to events of her money in Fim A's common stock and 50% in Firm's common slock and te corelation between the two stock is zero, then to mpected rate of retum in the portoli (Roured to me The standard deviation in the portfolio 5 % Round to two decimal placer.) c. Mary decides to mest 50% of her money in Fim As common stock and ser in Fim 5's common mock and the correlation coeficient between the two socks 8 + 1, then the expected rate of retum in the portion M. (Roum The standard deviation in the portfolio 3 ROUS to wo decimal places) ay diodes to invest 50% of hee money in Fim As common stock and 50% in Form els common stock and the correlation coeficient between the two od 3-1. Then the expected ente of retum. In the porteio s Croan The standard deviation in the portfolio in C Round to ho decimal places) . Using your responses to questions which at the followg statements best describes the relatiorenip between the correlation and the risk and return of the portfolio? (Belect the best choice below) O A The correlation coefficient has no effect on the expected retum of a portfolio, but the closer the cominoefent is to negative one. - 1. the lower the lak Q3. The correlation coefficient has no effect on the expected retuma portfolio, but the closer the correlation coefficient is to be the lower the risk OG The correlation coefficient has a negative effect on the expected roturn of a portfolio and the cover the correlation coefficient is to negative one, - 1. the lower the risk OD. The correlation concert hos no effect on the expected return of a portfolio, but to cover the correlation coefficient is to negative one. -1, the higher the risk