Answered step by step

Verified Expert Solution

Question

1 Approved Answer

50. Joe's Quik Shop bought machinery for $42,000 on January 1, 2016. Joe estimated the useful life to be 5 years with no salvage value,

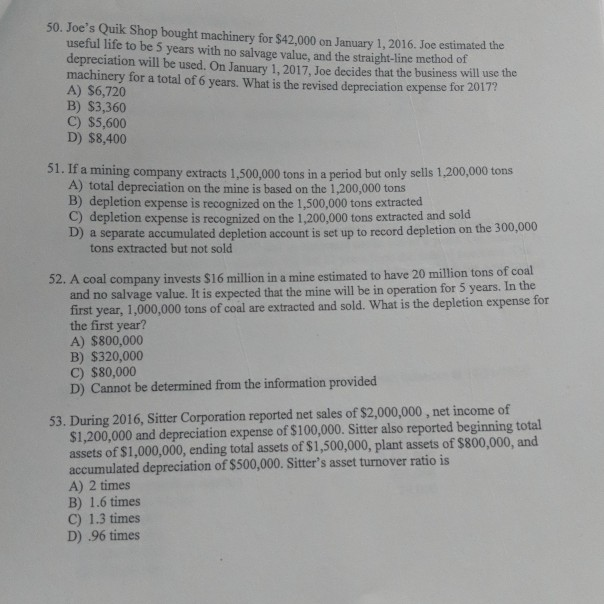

50. Joe's Quik Shop bought machinery for $42,000 on January 1, 2016. Joe estimated the useful life to be 5 years with no salvage value, and the straight-line method of depreciation will be used. On January 1, 2017, Joe decides that the business will use the machinery for a total of 6 years. What is the revised depreciation expense for 2017? A) $6,720 B) $3,360 C) $5,600 D) $8,400 S1. If a mining company extracts 1.500,000 tons in a period but only sells 1,200,000 tons A) total depreciation on the mine is based on the 1,200,000 tons B) depletion expense is recognized on the 1,500,000 tons extracted C depletion expense is recognized on the 1,200,000 tons extracted and sold D) a separate accumulated depletion account is set up to record depletion on the 300,000 tons extracted but not sold 52. A coal company invests $16 million in a mine estimated to have 20 million tons of coal and no salvage value. It is expected that the mine will be in operation for 5 years. In the first 1,000,000 tons of coal are extracted and sold. What is the depletion expense for year, the first year? A) $800,000 B) $320,000 C) $80,000 D) Cannot be determined from the information provided 53. During 2016, Sitter Corporation reported net sales of $2,000,000 , net income of $1,200,000 and depreciation expense of $100,000. Sitter also reported beginning total assets of $1,000,000, ending total assets of $1,500,000, plant assets of $800,000, and accumulated depreciation of $500,000. Sitter's asset turnover ratio is A) 2 times B) 1.6 times C) 1.3 times D) .96 times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started