Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(50 points) The BestDrinkEver (BDE) Inc. is planning to introduce avocado flavored water to its flavored water product line. They started to plan for this

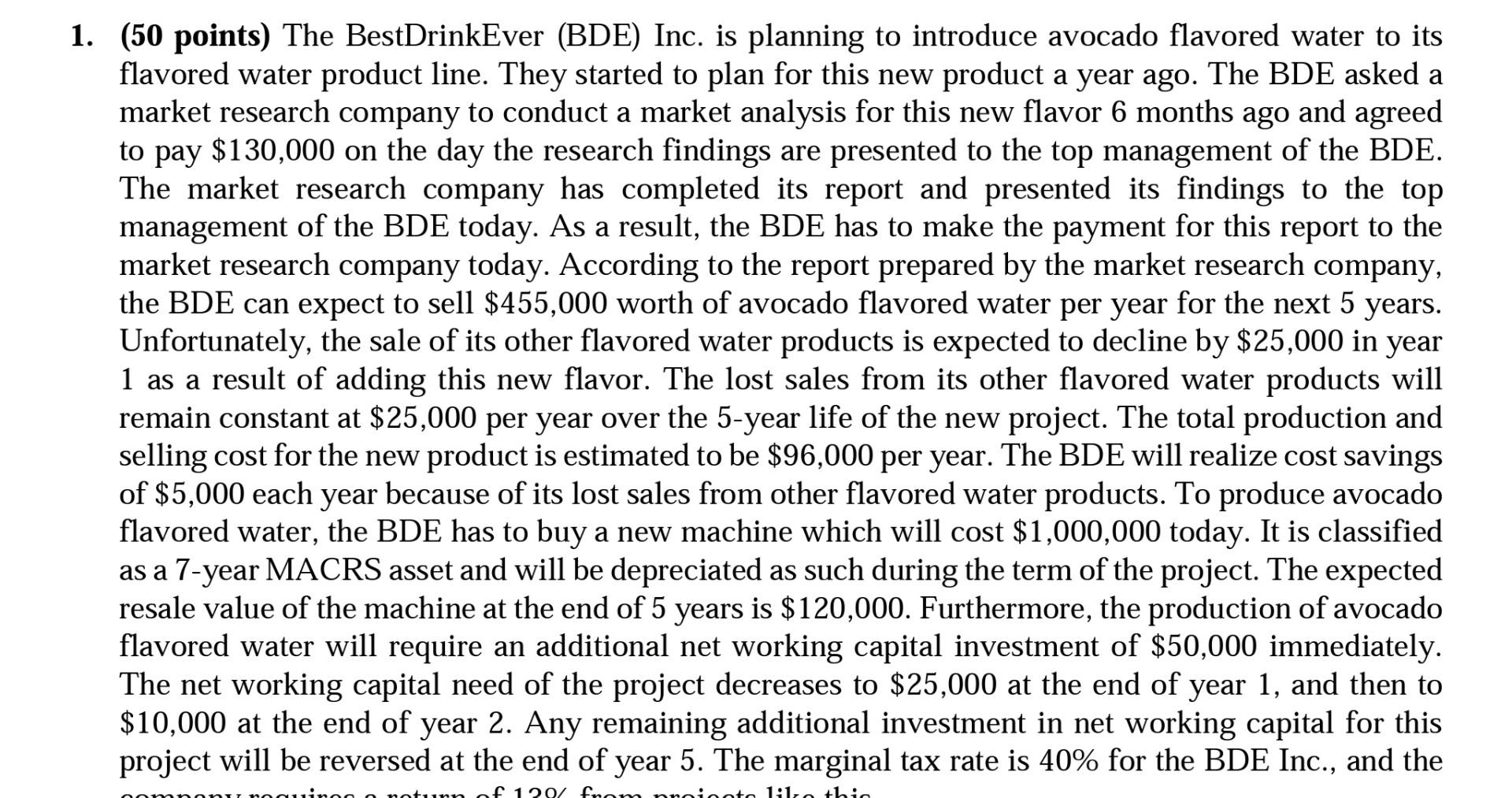

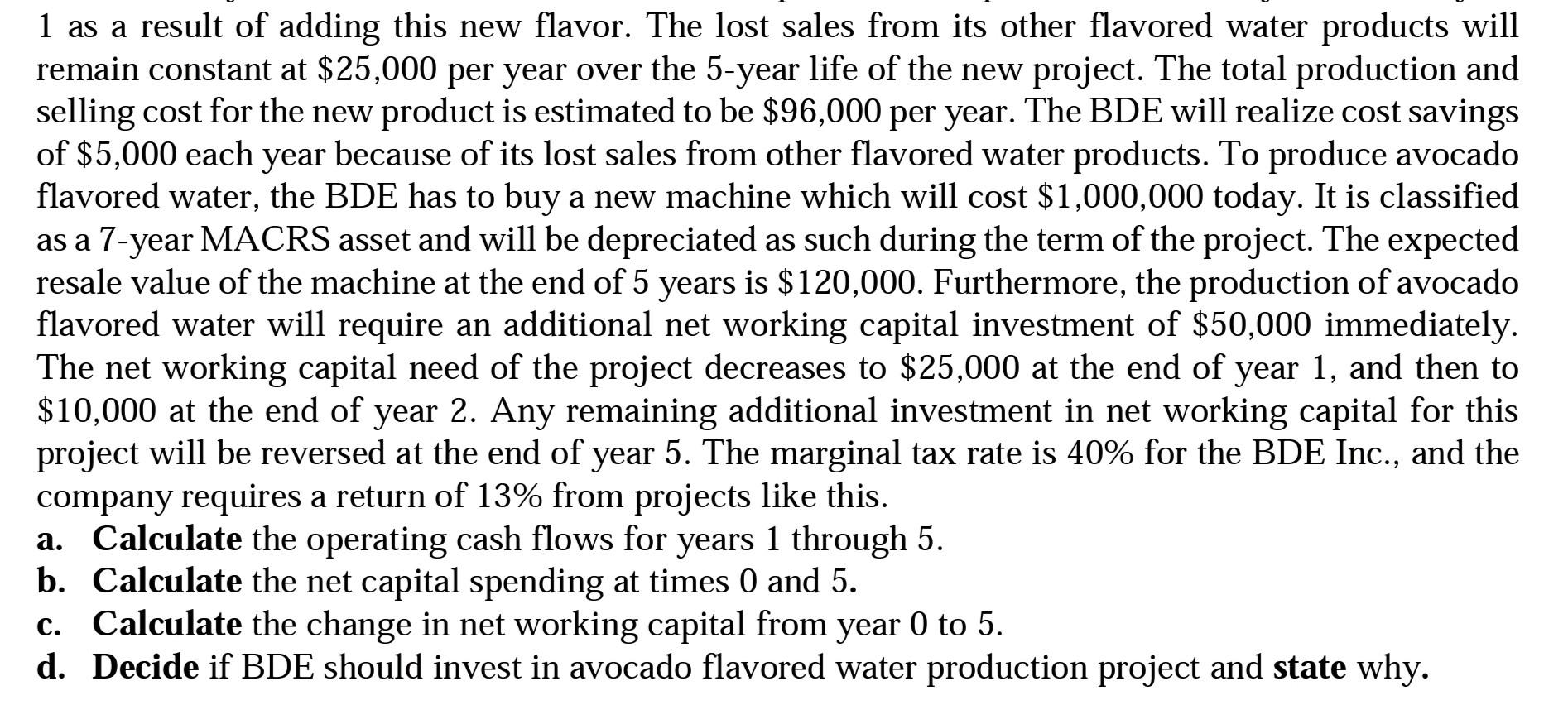

(50 points) The BestDrinkEver (BDE) Inc. is planning to introduce avocado flavored water to its flavored water product line. They started to plan for this new product a year ago. The BDE asked a market research company to conduct a market analysis for this new flavor 6 months ago and agreed to pay $130,000 on the day the research findings are presented to the top management of the BDE. The market research company has completed its report and presented its findings to the top management of the BDE today. As a result, the BDE has to make the payment for this report to the market research company today. According to the report prepared by the market research company, the BDE can expect to sell $455,000 worth of avocado flavored water per year for the next 5 years. Unfortunately, the sale of its other flavored water products is expected to decline by $25,000 in year 1 as a result of adding this new flavor. The lost sales from its other flavored water products will remain constant at $25,000 per year over the 5-year life of the new project. The total production and selling cost for the new product is estimated to be $96,000 per year. The BDE will realize cost savings of $5,000 each year because of its lost sales from other flavored water products. To produce avocado flavored water, the BDE has to buy a new machine which will cost $1,000,000 today. It is classified as a 7-year MACRS asset and will be depreciated as such during the term of the project. The expected resale value of the machine at the end of 5 years is $120,000. Furthermore, the production of avocado flavored water will require an additional net working capital investment of $50,000 immediately. The net working capital need of the project decreases to $25,000 at the end of year 1 , and then to $10,000 at the end of year 2. Any remaining additional investment in net working capital for this project will be reversed at the end of year 5 . The marginal tax rate is 40% for the BDE Inc., and the 1 as a result of adding this new flavor. The lost sales from its other flavored water products will remain constant at $25,000 per year over the 5 -year life of the new project. The total production and selling cost for the new product is estimated to be $96,000 per year. The BDE will realize cost savings of $5,000 each year because of its lost sales from other flavored water products. To produce avocado flavored water, the BDE has to buy a new machine which will cost $1,000,000 today. It is classified as a 7-year MACRS asset and will be depreciated as such during the term of the project. The expected resale value of the machine at the end of 5 years is $120,000. Furthermore, the production of avocado flavored water will require an additional net working capital investment of $50,000 immediately. The net working capital need of the project decreases to $25,000 at the end of year 1 , and then to $10,000 at the end of year 2. Any remaining additional investment in net working capital for this project will be reversed at the end of year 5 . The marginal tax rate is 40% for the BDE Inc., and the company requires a return of 13% from projects like this. a. Calculate the operating cash flows for years 1 through 5 . b. Calculate the net capital spending at times 0 and 5 . c. Calculate the change in net working capital from year 0 to 5 . d. Decide if BDE should invest in avocado flavored water production project and state why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started