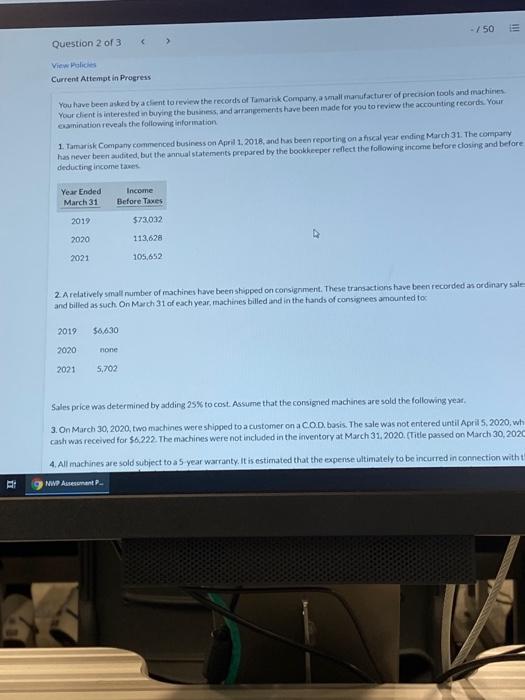

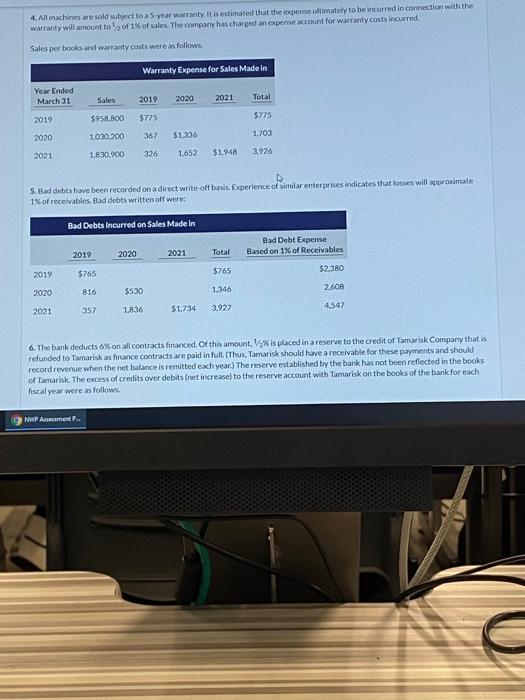

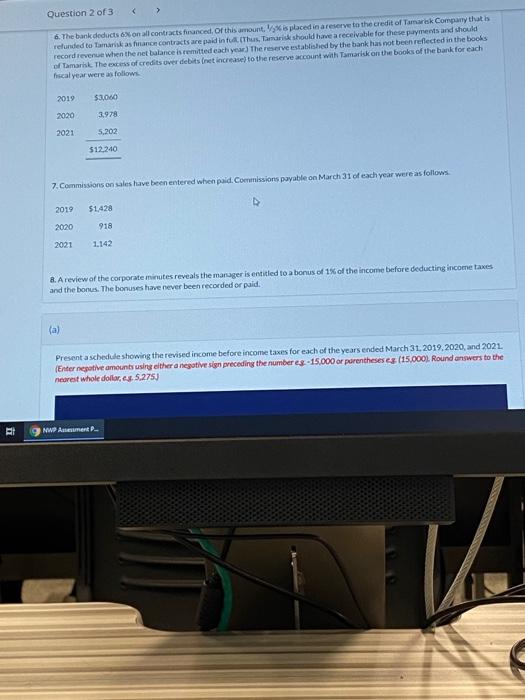

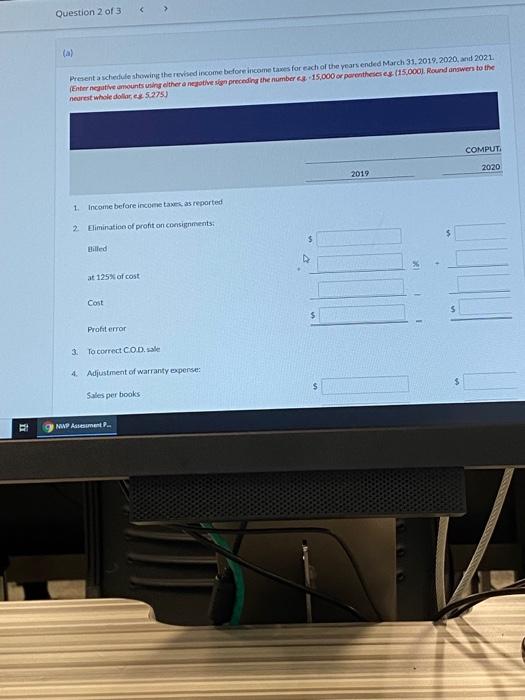

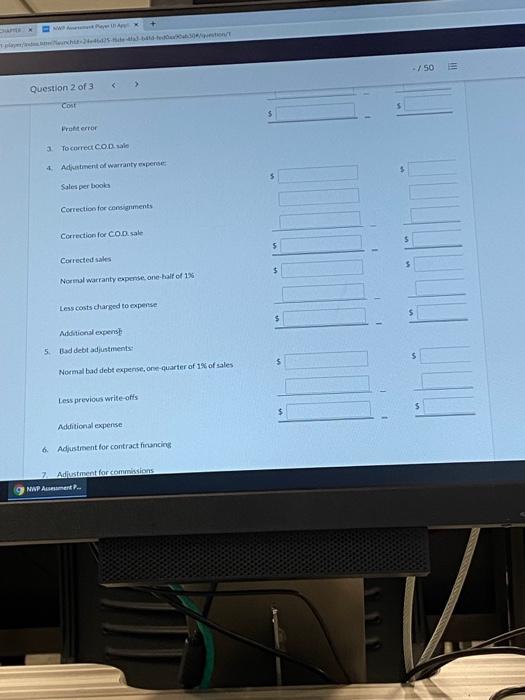

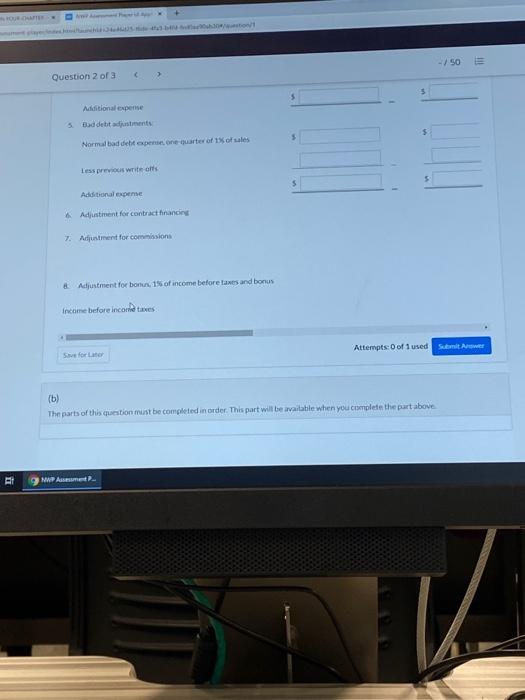

-/50 Question 2 of 3 View Policies Current Attempt in Progress You have been asked by a client to review the records of Tamaris Company, a small manufacturer of precision tools and machines Your dient is interested in buying the business, and arrangements have been made for you to review the accounting records. Your camination reveals the following information 1. Tamarisk Company commenced business on April 1. 2018, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes Year Ended March 31 Income Before Taxes 2019 $73032 113,628 2020 2021 105,652 2. Arelatively small number of machines have been shipped on consignment. These transactions have been recorded an ordinary sale and billed as such On March 31 of each year, machines billed and in the hands of consignees amounted to 2019 56.630 2020 none 2021 5,702 Salts price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year, 3. On March 30, 2020, two machines were shipped to a customer ona COD. basis. The sale was not entered until April, 2020, wh cash was received for $6.222. The machines were not included in the inventory at March 31.2020. (Title passed on March 30, 2020 4. All machines are sold subject to a 5 year warranty. It is estimated that the expense ultimately to be incurred in connection with g NWP Assessment 4. All machines are sold subject to a 5-year warranty. it is estimated that the expense ultimately to be incurred in connection with the warranty will amount to of 1% of sales. The company has charged an expense account for warranty costs incurred Sales per books and warranty costs were as follows Warranty Expense for Sales Made in Year Ended March 31 Sales 2019 2020 2021 Total 2019 5775 $275 $958.800 1,030,200 2020 367 1.703 $1,336 2021 1.830,000 326 1.652 $1.948 3.926 5. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate 1% of receivables. Bad debts written off were: Bad Debts incurred on Sales Made In Bad Debt Expense Based on 1% of Receivables 2019 2020 2021 Total $765 $2.380 2019 $765 816 2020 $530 1346 2,608 2021 357 1.836 $1,734 4.547 3.927 6. The bank deducts o% on all contracts financed. Of this amount.Vis placed in a reserve to the credit of Tamarisk Company that is refunded to Tamarisk as finance contracts are paid in full (Thus, Tamarisk should have a receivable for these payments and should record revenue when the net balance is remitted each year) The reserve established by the bank has not been reflected in the books of Tamarisk. The excess of credits over debits (net increase) to the reserve account with Tamarisk on the books of the bank for each fiscal year were cas follows 9NWP Anment- Question 2 of 3 6. The bank deducts on all contracts financed, of this amount.Vis placed in a reserve to the credit of Tamarak Company that is refunded to Tamariskas france contracts are paid in futhus, Tamaris should have a receivable for these payments and should record revenue when the net balance is remitted each year) The reserve established by the bank has not been reflected in the books of Tamarh. The excess of credits over debits (net increase) to the reserve account with Tamarisk on the books of the bank for each fiscal year were as follows 2019 $3060 2020 3.978 2021 5.202 $12.240 7. Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were as follows D 2019 $1428 2020 918 2021 1.142 8. A review of the corporate minutes reveals the manager is entitled to a bonus of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid. (a) Presentaschedule showing the revised income before income taxes for each of the years ended March 31,2019,2020 and 2021 (Enter negative amounts using either a negative sign preceding the number es -15,000 or parentheses (15.000). Round answers to the nearest whole dollars. 5.275J NWP Anment Question 2 of 3 (A) Present a schedule showing the revised income before income taxes for each of the years ended March 31,2019,2020 and 2021. Enternative amounts using either a notive sin preceding the number. 15.000 or parenthesesc. 115.000). Round answers to the nearest whole dollars 5.275) COMPUT 2020 2019 1 Income before income taxes as reported 2 Elimination of proht on consignments Billed at 125% of cost Cost $ Protiterror 3. To correct COD sale 4. Adjustment of warranty expense: Sales per books II NIP Assesment P- ww ./50 Question 2 of 3 Cost Prolterror 3 To correct COD sale Adestment of warranty perce Sales per books Correction for consignments Correction for COD sale 5 Corrected sales 5 $ Normal Warranty expense, one-half of 1% Less costs charged to expense 5 Additional expert 5 Bad debt adjustments: $ Normalbad debt expense one quarter of 1% of sales Less previous write-offs $ Additional expense 6. Adjustment for contract huncing Adjustment for commissions 9NWP Ansament - / 50 HIE Question 2 of 3 $ Additional expense Baddebitistments Normalbad debit expensione Guarter of 1% of sales Less previous write offs Additional experte Adjustment for contract hinancing 7. Adjustment for commissions & Adjustment for bonum. 1 of income before taxes and bonus Income before income taxes Attempts: 0 of 1 used Sunt Sve for (b) The parts of this question must be completed in order. This part will be available when you complete the part above WWPA -/50 Question 2 of 3 View Policies Current Attempt in Progress You have been asked by a client to review the records of Tamaris Company, a small manufacturer of precision tools and machines Your dient is interested in buying the business, and arrangements have been made for you to review the accounting records. Your camination reveals the following information 1. Tamarisk Company commenced business on April 1. 2018, and has been reporting on a fiscal year ending March 31. The company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes Year Ended March 31 Income Before Taxes 2019 $73032 113,628 2020 2021 105,652 2. Arelatively small number of machines have been shipped on consignment. These transactions have been recorded an ordinary sale and billed as such On March 31 of each year, machines billed and in the hands of consignees amounted to 2019 56.630 2020 none 2021 5,702 Salts price was determined by adding 25% to cost. Assume that the consigned machines are sold the following year, 3. On March 30, 2020, two machines were shipped to a customer ona COD. basis. The sale was not entered until April, 2020, wh cash was received for $6.222. The machines were not included in the inventory at March 31.2020. (Title passed on March 30, 2020 4. All machines are sold subject to a 5 year warranty. It is estimated that the expense ultimately to be incurred in connection with g NWP Assessment 4. All machines are sold subject to a 5-year warranty. it is estimated that the expense ultimately to be incurred in connection with the warranty will amount to of 1% of sales. The company has charged an expense account for warranty costs incurred Sales per books and warranty costs were as follows Warranty Expense for Sales Made in Year Ended March 31 Sales 2019 2020 2021 Total 2019 5775 $275 $958.800 1,030,200 2020 367 1.703 $1,336 2021 1.830,000 326 1.652 $1.948 3.926 5. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate 1% of receivables. Bad debts written off were: Bad Debts incurred on Sales Made In Bad Debt Expense Based on 1% of Receivables 2019 2020 2021 Total $765 $2.380 2019 $765 816 2020 $530 1346 2,608 2021 357 1.836 $1,734 4.547 3.927 6. The bank deducts o% on all contracts financed. Of this amount.Vis placed in a reserve to the credit of Tamarisk Company that is refunded to Tamarisk as finance contracts are paid in full (Thus, Tamarisk should have a receivable for these payments and should record revenue when the net balance is remitted each year) The reserve established by the bank has not been reflected in the books of Tamarisk. The excess of credits over debits (net increase) to the reserve account with Tamarisk on the books of the bank for each fiscal year were cas follows 9NWP Anment- Question 2 of 3 6. The bank deducts on all contracts financed, of this amount.Vis placed in a reserve to the credit of Tamarak Company that is refunded to Tamariskas france contracts are paid in futhus, Tamaris should have a receivable for these payments and should record revenue when the net balance is remitted each year) The reserve established by the bank has not been reflected in the books of Tamarh. The excess of credits over debits (net increase) to the reserve account with Tamarisk on the books of the bank for each fiscal year were as follows 2019 $3060 2020 3.978 2021 5.202 $12.240 7. Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were as follows D 2019 $1428 2020 918 2021 1.142 8. A review of the corporate minutes reveals the manager is entitled to a bonus of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid. (a) Presentaschedule showing the revised income before income taxes for each of the years ended March 31,2019,2020 and 2021 (Enter negative amounts using either a negative sign preceding the number es -15,000 or parentheses (15.000). Round answers to the nearest whole dollars. 5.275J NWP Anment Question 2 of 3 (A) Present a schedule showing the revised income before income taxes for each of the years ended March 31,2019,2020 and 2021. Enternative amounts using either a notive sin preceding the number. 15.000 or parenthesesc. 115.000). Round answers to the nearest whole dollars 5.275) COMPUT 2020 2019 1 Income before income taxes as reported 2 Elimination of proht on consignments Billed at 125% of cost Cost $ Protiterror 3. To correct COD sale 4. Adjustment of warranty expense: Sales per books II NIP Assesment P- ww ./50 Question 2 of 3 Cost Prolterror 3 To correct COD sale Adestment of warranty perce Sales per books Correction for consignments Correction for COD sale 5 Corrected sales 5 $ Normal Warranty expense, one-half of 1% Less costs charged to expense 5 Additional expert 5 Bad debt adjustments: $ Normalbad debt expense one quarter of 1% of sales Less previous write-offs $ Additional expense 6. Adjustment for contract huncing Adjustment for commissions 9NWP Ansament - / 50 HIE Question 2 of 3 $ Additional expense Baddebitistments Normalbad debit expensione Guarter of 1% of sales Less previous write offs Additional experte Adjustment for contract hinancing 7. Adjustment for commissions & Adjustment for bonum. 1 of income before taxes and bonus Income before income taxes Attempts: 0 of 1 used Sunt Sve for (b) The parts of this question must be completed in order. This part will be available when you complete the part above WWPA