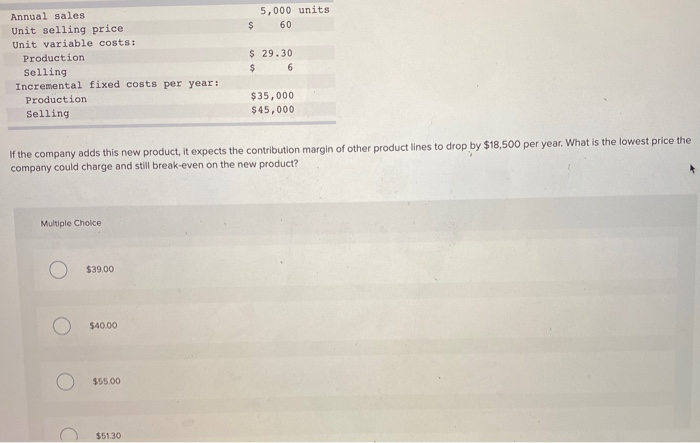

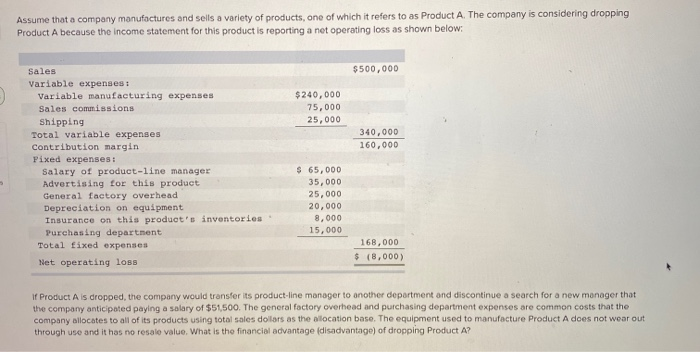

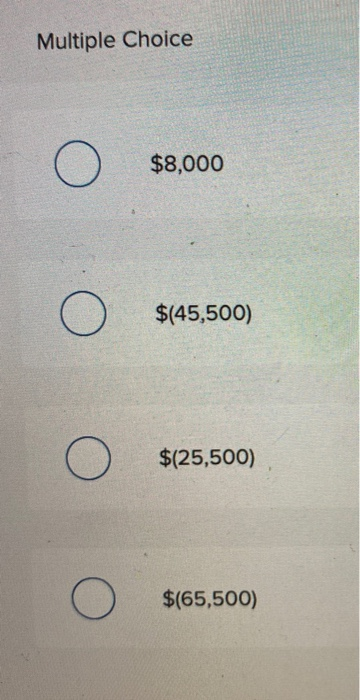

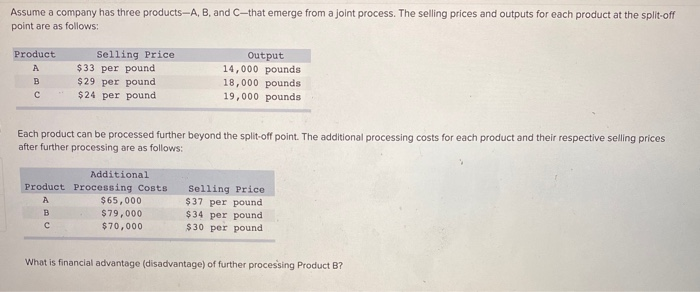

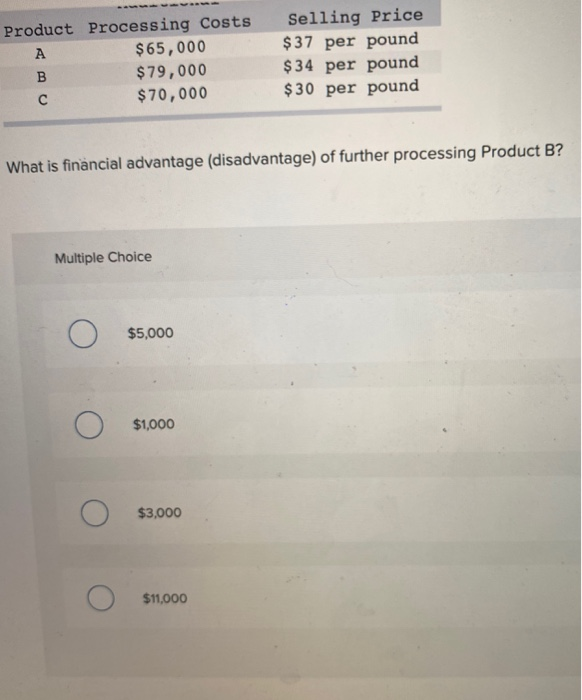

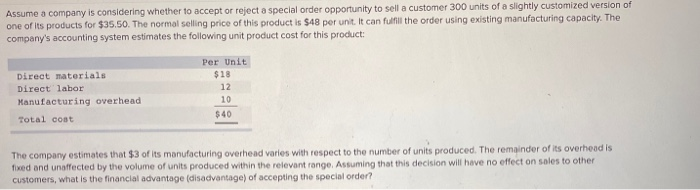

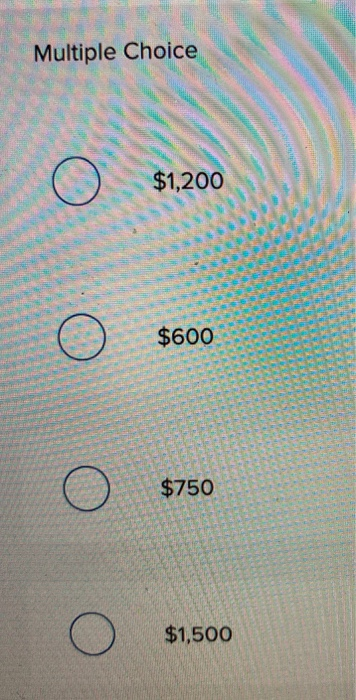

5,000 units 60 $ Annual sales Unit selling price Unit variable costs: Production Selling Incremental fixed costs per year: Production Selling $ 29.30 $ 6 $35,000 $ 45,000 If the company adds this new product, it expects the contribution margin of other product lines to drop by $18,500 per year. What is the lowest price the company could charge and still break-even on the new product? Multiple Choice $39.00 $40.00 o $55.00 $51.30 Assume that a company manufactures and sells a variety of products, one of which it refers to as Product A. The company is considering dropping Product A because the income statement for this product is reporting a net operating loss as shown below: $500,000 $240,000 75,000 25,000 340,000 160,000 Sales Variable expenses : Variable manufacturing expenses Sales commissions Shipping Total variable expenses Contribution margin Pixed expenses: Salary of product-line manager Advertising for this product General factory overhead Depreciation on equipment Insurance on this product's inventories Purchasing department Total fixed expenses Net operating loss $ 65,000 35,000 25,000 20,000 8,000 15,000 168,000 $ (8,000) If Product Als dropped, the company would transfer its product line manager to another department and discontinue a search for a new manager that the company anticipated paying a salary of $51,500. The general factory overhead and purchasing department expenses are common costs that the company allocates to all of its products using total sales dollars as the allocation base. The equipment used to manufacture Product A does not wear out through use and it has no resale value. What is the financial advantage disadvantage) of dropping Product A? Multiple Choice O $8,000 O $(45,500) O $(25,500) O $(65,500) Assume a company has three products-A, B, and C-that emerge from a joint process. The selling prices and outputs for each product at the split-off point are as follows: Product A Selling Price $33 per pound $ 29 per pound $24 per pound Output 14,000 pounds 18,000 pounds 19,000 pounds Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: Additional Product Processing Costs $65,000 B $ 79,000 $70,000 Selling Price $37 per pound $ 34 per pound $30 per pound What is financial advantage (disadvantage) of further processing Product B? Product Processing Costs $65,000 B $ 79,000 $70,000 Selling Price $ 37 per pound $ 34 per pound $30 per pound What is financial advantage (disadvantage) of further processing Product B? Multiple Choice $5,000 $1,000 $3,000 $11,000 Assume a company is considering whether to accept or reject a special order opportunity to sell a customer 300 units of a slightly customized version of one of its products for $35.50. The normal selling price of this product is $48 per unit. It can fulfill the order using existing manufacturing capacity. The company's accounting system estimates the following unit product cost for this product: Direct materials Direct labor Manufacturing overhead Total cost Per Unit $18 12 10 $40 The company estimates that $3 of its manufacturing overhead varies with respect to the number of units produced. The remainder of its overhead is fixed and unaffected by the volume of units produced within the relevant range. Assuming that this decision will have no effect on sales to other customers, what is the financial advantage (disadvantage of accepting the special order? Multiple Choice $1,200 $600 $750 O $1,500