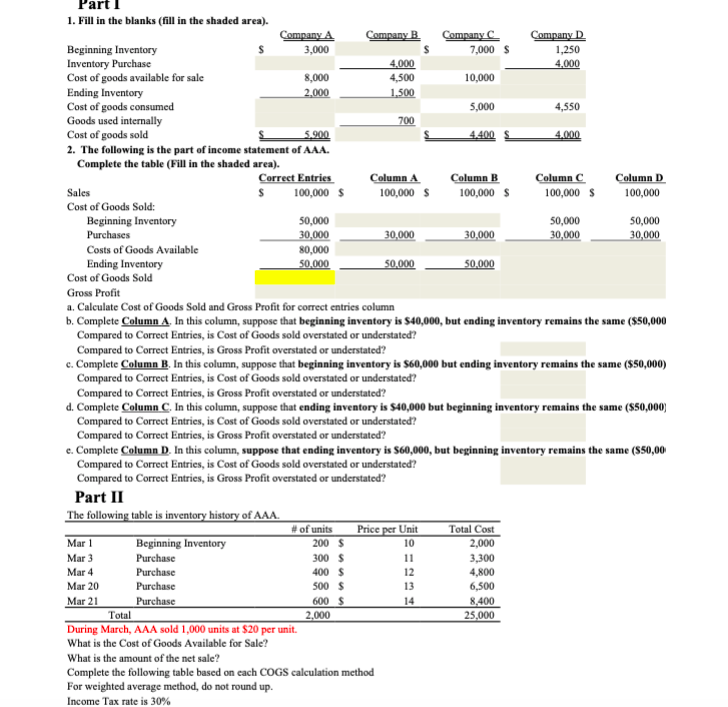

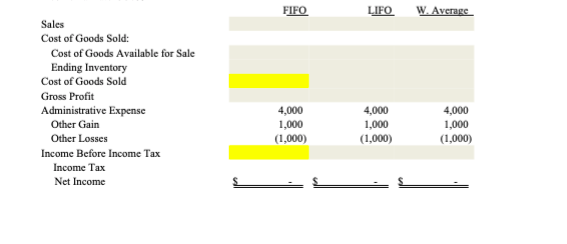

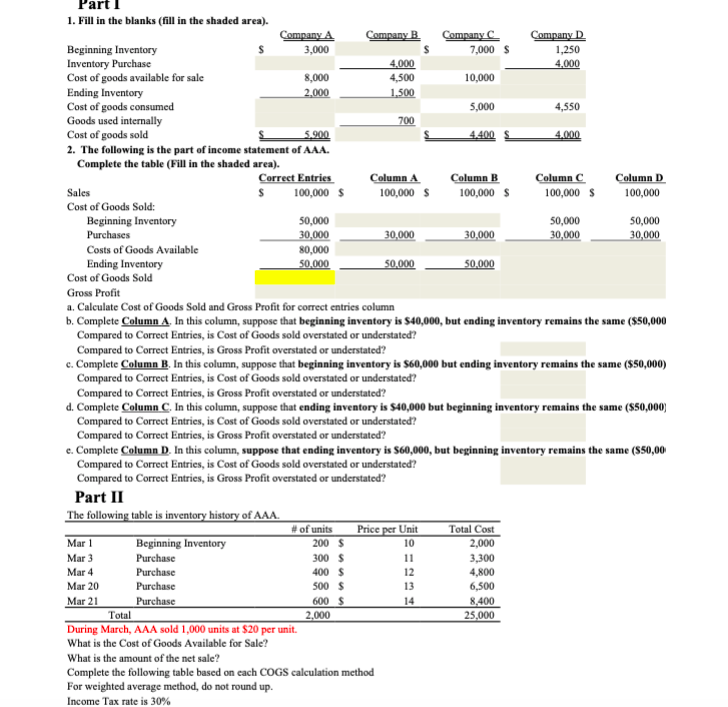

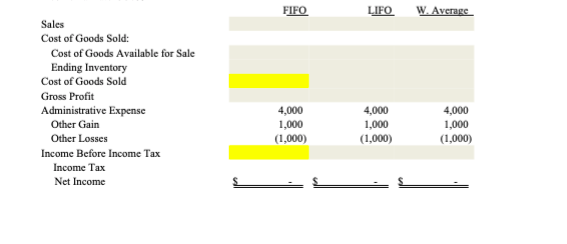

50,000 Part I 1. Fill in the blanks (fill in the shaded area). Company A Company B Company Company D Beginning Inventory 3,000 7,000 $ 1,250 Inventory Purchase 4,000 4.000 Cost of goods available for sale 8,000 4,500 10,000 Ending Inventory 2.000 1,500 Cost of goods consumed 5,000 4,550 Goods used internally 700 Cost of goods sold 5.900 4.400 4.000 2. The following is the part of income statement of AAA. Complete the table (Fill in the shaded area). Correct Entries Column A Column B Column C Column D Sales 100,000 $ 100,000 $ 100,000 $ 100,000 $ 100,000 Cost of Goods Sold: Beginning Inventory 50,000 50,000 Purchases 30,000 30,000 30,000 30,000 30,000 Costs of Goods Available 80,000 Ending Inventory 50.000 50,000 50,000 Cost of Goods Sold Gross Profit a. Calculate Cost of Goods Sold and Gross Profit for correct entries column b. Complete Column A. In this column, suppose that beginning inventory is $40,000, but ending inventory remains the same ($50,000 Compared to Correct Entries, is Cost of Goods sold overstated or understated? Compared to Correct Entries, is Gross Profit overstated or understated? c. Complete Column B. In this column, suppose that beginning inventory is $60,000 but ending inventory remains the same ($50,000) Compared to Correct Entries, is Cost of Goods sold overstated or understated? Compared to Correct Entries, is Gross Profit overstated or understated? d. Complete Column C. In this column, suppose that ending inventory is $40,000 but beginning inventory remains the same (50,000) Compared to Correct Entries, is Cost of Goods sold overstated or understated? Compared to Correct Entries, is Gross Profit overstated or understated? e. Complete Column D. In this column, suppose that ending inventory is $60,000, but beginning inventory remains the same (550,00 Compared to Correct Entries, is Cost of Goods sold overstated or understated? Compared to Correct Entries, is Gross Profit overstated or understated? Part II The following table is inventory history of AAA. # of units Price per Unit Total Cost Mar 1 Beginning Inventory 200 $ 10 2,000 Mar 3 Purchase 300 $ 11 3,300 Mar 4 Purchase 400 S 12 4,800 Mar 20 Purchase 500 $ 6,500 Mar 21 Purchase 600 $ 14 8,400 Total 2,000 25,000 During March, AAA sold 1,000 units at $20 per unit. What is the cost of Goods Available for Sale? What is the amount of the net sale? Complete the following table based on each COGS calculation method For weighted average method, do not round up. Income Tax rate is 30% 13 FIFO LIFO W. Average Sales Cost of Goods Sold: Cost of Goods Available for Sale Ending Inventory Cost of Goods Sold Gross Profit Administrative Expense Other Gain Other Losses Income Before Income Tax Income Tax Net Income 4,000 1,000 (1,000) 4,000 1,000 (1,000) 4,000 1,000 (1,000)