Answered step by step

Verified Expert Solution

Question

1 Approved Answer

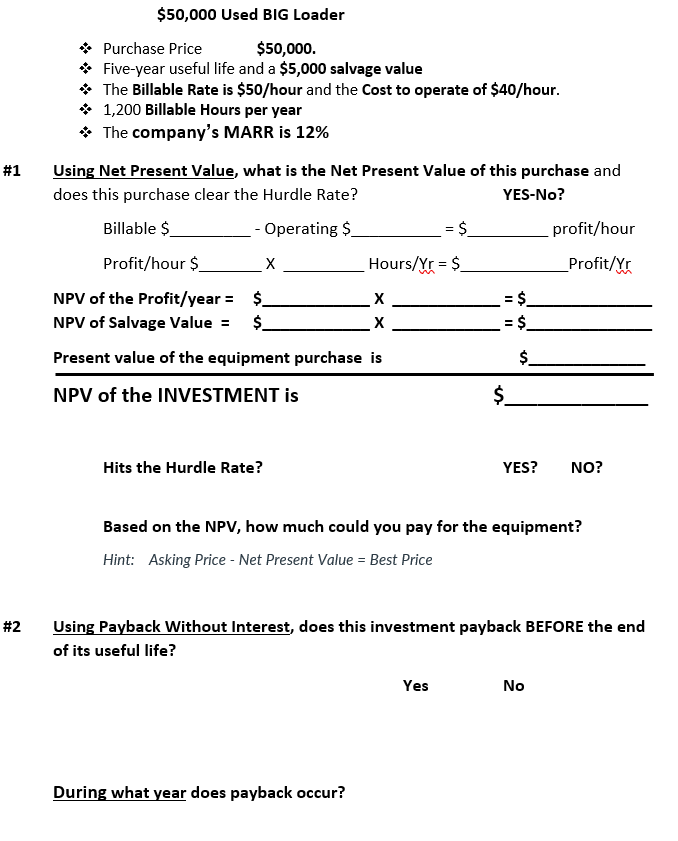

$50,000 Used BIG Loader * Purchase Price $$50,000. * Five-year useful life and a $5,000 salvage value * The Billable Rate is $50 /hour and

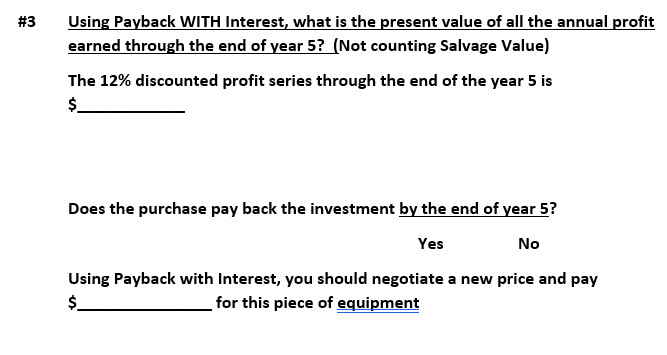

$50,000 Used BIG Loader * Purchase Price \$\$50,000. * Five-year useful life and a $5,000 salvage value * The Billable Rate is $50 /hour and the Cost to operate of $40 /hour. * 1,200 Billable Hours per year * The company's MARR is 12% Using Net Present Value, what is the Net Present Value of this purchase and does this purchase clear the Hurdle Rate? YES-No? Billable \$ - Operating \$ =$ profit/hour Profit/hour \$_ X Hours /Yr=$ Profit /Yr NPV of the Profit/year =$ x =$ NPV of Salvage Value =$ x =$ Present value of the equipment purchase is $ NPV of the INVESTMENT is $ Hits the Hurdle Rate? YES? NO? Based on the NPV, how much could you pay for the equipment? Hint: Asking Price - Net Present Value = Best Price Using Payback Without Interest, does this investment payback BEFORE the end of its useful life? Using Payback WITH Interest, what is the present value of all the annual profit earned through the end of year 5 ? (Not counting Salvage Value) The 12% discounted profit series through the end of the year 5 is \$ Does the purchase pay back the investment by the end of year 5 ? Yes No Using Payback with Interest, you should negotiate a new price and pay $ for this piece of equipment

$50,000 Used BIG Loader * Purchase Price \$\$50,000. * Five-year useful life and a $5,000 salvage value * The Billable Rate is $50 /hour and the Cost to operate of $40 /hour. * 1,200 Billable Hours per year * The company's MARR is 12% Using Net Present Value, what is the Net Present Value of this purchase and does this purchase clear the Hurdle Rate? YES-No? Billable \$ - Operating \$ =$ profit/hour Profit/hour \$_ X Hours /Yr=$ Profit /Yr NPV of the Profit/year =$ x =$ NPV of Salvage Value =$ x =$ Present value of the equipment purchase is $ NPV of the INVESTMENT is $ Hits the Hurdle Rate? YES? NO? Based on the NPV, how much could you pay for the equipment? Hint: Asking Price - Net Present Value = Best Price Using Payback Without Interest, does this investment payback BEFORE the end of its useful life? Using Payback WITH Interest, what is the present value of all the annual profit earned through the end of year 5 ? (Not counting Salvage Value) The 12% discounted profit series through the end of the year 5 is \$ Does the purchase pay back the investment by the end of year 5 ? Yes No Using Payback with Interest, you should negotiate a new price and pay $ for this piece of equipment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started