Answered step by step

Verified Expert Solution

Question

1 Approved Answer

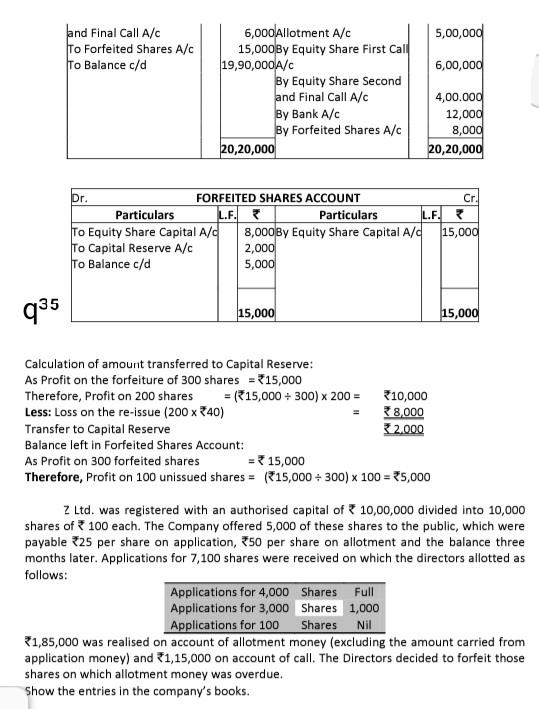

5,00,000 and Final Call A/C To Forfeited Shares A/c To Balance c/d 6,00,000 6,000 Allotment Alc 15,000 By Equity Share First Call 19,90,000 A/C By

5,00,000 and Final Call A/C To Forfeited Shares A/c To Balance c/d 6,00,000 6,000 Allotment Alc 15,000 By Equity Share First Call 19,90,000 A/C By Equity Share Second and Final Call A/C By Bank A/C By Forfeited Shares A/c 20,20,000 4,00.000 12,000 8,000 20,20,000 Dr. FORFEITED SHARES ACCOUNT Cr. Particulars L.F. Particulars L.F. To Equity Share Capital Ald 8,000 By Equity Share Capital A/ 15,000 To Capital Reserve A/C 2,000 To Balance c/d 5,000 935 15,000 15,000 Calculation of amount transferred to Capital Reserve: As Profit on the forfeiture of 300 shares = 315,000 Therefore, Profit on 200 shares = (15,000 + 300) x 200 = 10,000 Less: Loss on the re-issue (200 x 340) 8,000 Transfer to Capital Reserve 2.000 Balance left in Forfeited Shares Account: As Profit on 300 forfeited shares = 15,000 Therefore, Profit on 100 unissued shares = (15,000 + 300) x 100 = 25,000 z Ltd. was registered with an authorised capital of 10,00,000 divided into 10,000 shares of 100 each. The Company offered 5,000 of these shares to the public, which were payable 25 per share on application, 250 per share on allotment and the balance three months later. Applications for 7,100 shares were received on which the directors allotted as follows: Applications for 4,000 Shares Full Applications for 3,000 Shares 1,000 Applications for 100 Shares Nil 31,85,000 was realised on account of allotment money (excluding the amount carried from application money) and 1,15,000 on account of call. The Directors decided to forfeit those shares on which allotment money was overdue. Show the entries in the company's books

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started