Answered step by step

Verified Expert Solution

Question

1 Approved Answer

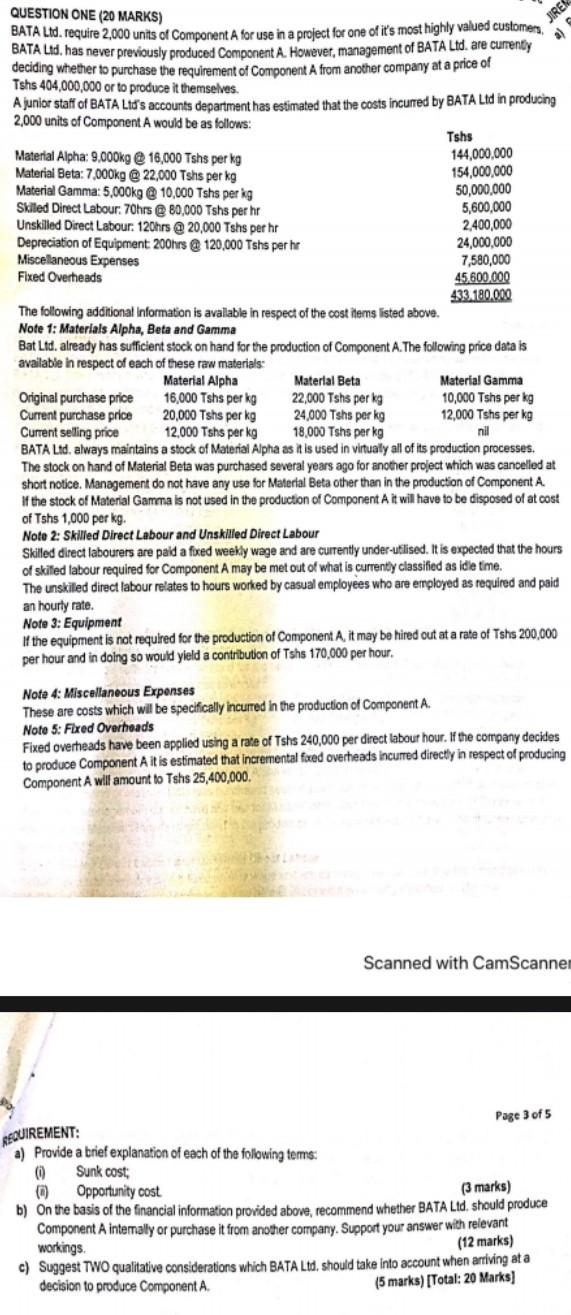

50,000,000 QUESTION ONE (20 MARKS) BATA Ltd. require 2,000 unts of Component A for use in a project for one of it's most highly valued

50,000,000 QUESTION ONE (20 MARKS) BATA Ltd. require 2,000 unts of Component A for use in a project for one of it's most highly valued customers, BATA Lid, has never previously produced Component A. However, management of BATA Ltd, are currently deciding whether to purchase the requirement of Component A from another company at a price of Tshs 404,000,000 or to produce it themselves. A junior staff of BATA Lid's accounts department has estimated that the costs incurred by BATA Ltd in producing 2,000 units of Component A would be as follows: Tshs Material Alpha: 9,000kg @ 16,000 Tshs per kg 144,000,000 Material Beta: 7,000kg @ 22,000 Tshs per kg 154,000,000 Material Gamma: 5,000kg @ 10,000 Tshs per kg Skilled Direct Labour 70hrs @ 80,000 Tshs per hr 5,600,000 Unskilled Direct Labour 120hrs @ 20,000 Tshs per hr 2,400,000 Depreciation of Equipment 200hrs @120,000 Tshs per hr 24,000,000 Miscellaneous Expenses 7,580,000 Fixed Overheads 45.600.000 433.180,000 The following additional Information is available in respect of the cost items listed above. Note 1: Materials Alpha, Beta and Gamma Bat Ltd. already has sufficient stock on hand for the production of Component A. The following price data is available in respect of each of these raw materials: Material Alpha Material Beta Material Gamma Original purchase price 16,000 Tshs per kg 22,000 Tshs per kg 10,000 Tshs per kg Current purchase price 20,000 Tshs per kg 24,000 Tshs per kg 12,000 Tshs per kg Current selling price 12,000 Tshs per kg 18,000 Tshs per kg nil BATA Ltd, always maintains a stock of Material Alpha as it is used in virtually all of its production processes. The stock on hand of Material Beta was purchased several years ago for another project which was cancelled at short notice, Management do not have any use for Material Beta other than in the production of Component A If the stock of Material Gamma is not used in the production of Component it will have to be disposed of at cost of Tshs 1,000 per kg. Note 2: Skilled Direct Labour and Unskilled Direct Labour Skilled direct labourers are paid a fixed weekly wage and are currently under-utilised. It is expected that the hours of skifed labour required for Component A may be met out of what is currently classified as idle time. The unskilled direct labour relates to hours worked by casual employees who are employed as required and paid an hourly rate. Note 3: Equipment If the equipment is not required for the production of Component A, it may be hired out at a rate of Tshs 200,000 per hour and in doing so would yield a contribution of Tshs 170,000 per hour. Note 4: Miscellaneous Expenses These are costs which will be specifically incurred in the production of Component A. Note 5: Fired Overheads Fixed overheads have been applied using a rate of Tshs 240,000 per direct labour hour. If the company decides to produce Component A it is estimated that incremental fixed overheads incurred directly in respect of producing Component A will amount to Tshs 25,400,000. Scanned with CamScanner Page 3 of 5 REQUIREMENT: Sunk cost: a) Provide a brief explanation of each of the following terms: 0 Opportunity cost (3 marks) b) On the basis of the financial information provided above, recommend whether BATA Lid should produce Component A intemally or purchase it from another company. Support your answer with relevant workings (12 marks) c) Suggest TWO qualitative considerations which BATA Ltd, should take into account when arriving at a decision to produce Component A (5 marks) [Total: 20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started