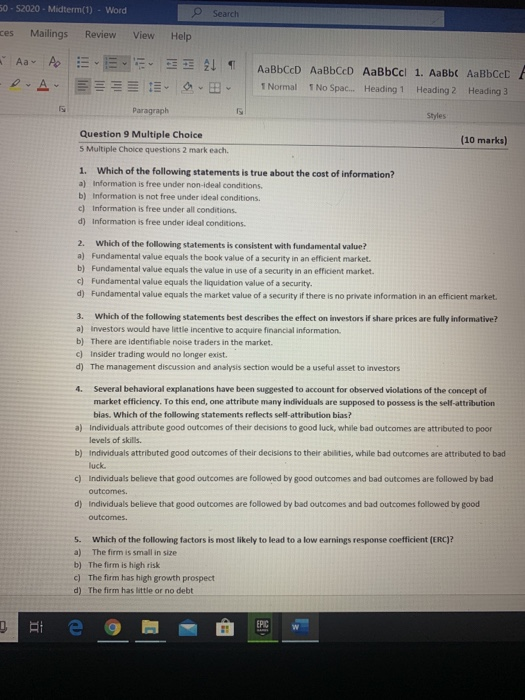

50-S2020 - Midterm(1) - Word Search ces Mailings Review View Help 21 Aa A A AaBbCD AaBbCD AaBbccl 1. AaBb AaBbCcDF 1 Normal T No Spac... Heading 1 Heading 2 Heading 3 Paragraph Styles Question 9 Multiple Choice 5 Multiple Choice questions 2 mark each (10 marks) 1. Which of the following statements is true about the cost of information? a) Information is free under non-ideal conditions. b) Information is not free under ideal conditions. c) Information is free under all conditions. d) Information is free under ideal conditions. 2. Which of the following statements is consistent with fundamental value? a) Fundamental value equals the book value of a security in an efficient market. b) Fundamental value equals the value in use of a security in an efficient market. c) Fundamental value equals the liquidation value of a security. d) Fundamental value equals the market value of a security if there is no private information in an efficient market 3. Which of the following statements best describes the effect on investors if share prices are fully informative? a) Investors would have little incentive to acquire financial information b) There are identifiable noise traders in the market. c) Insider trading would no longer exist. d) The management discussion and analysis section would be a useful asset to investors 4. Several behavioral explanations have been suggested to account for observed violations of the concept of market efficiency. To this end, one attribute many individuals are supposed to possess is the self-attribution bias. Which of the following statements reflects self-attribution bias? a) Individuals attribute good outcomes of their decisions to good luck, while bad outcomes are attributed to poor levels of skills. b) Individuals attributed good outcomes of their decisions to their abilities, while bad outcomes are attributed to bad luck. c) Individuals believe that good outcomes are followed by good outcomes and bad outcomes are followed by bad outcomes d) Individuals believe that good outcomes are followed by bad outcomes and bad outcomes followed by good outcomes. 5. Which of the following factors is most likely to lead to a low earnings response coefficient (ERC)? a) The firm is small in size b) The firm is high risk c) The firm has high growth prospect d) The firm has little or no debt RI e