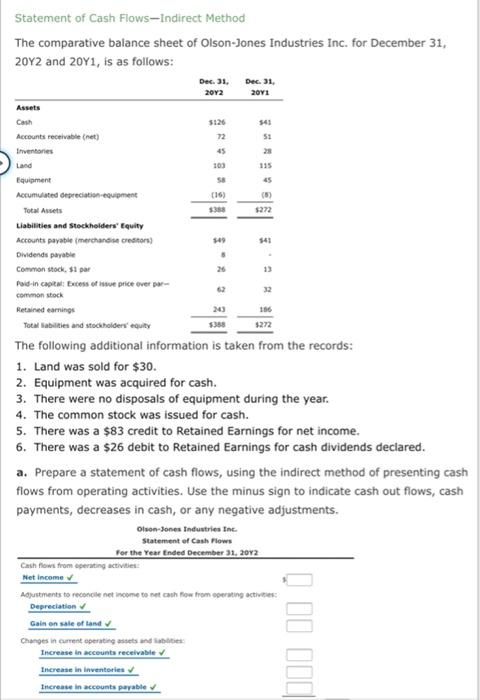

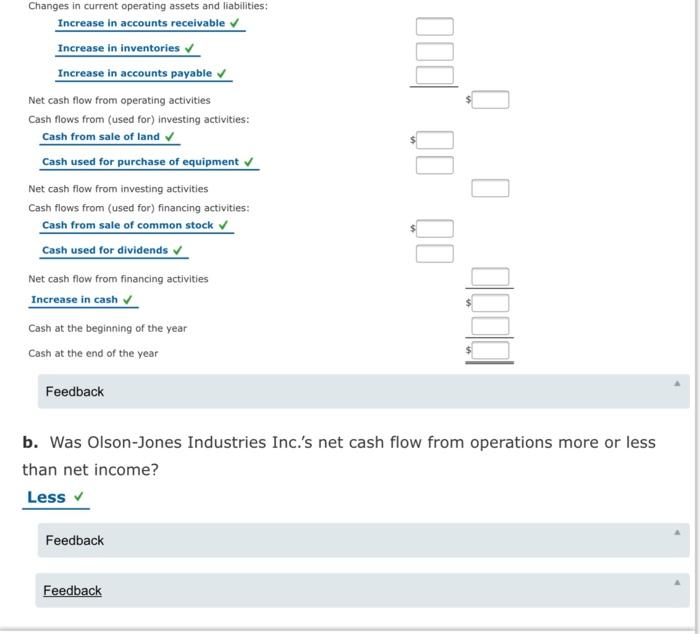

51 45 (16) 549 13 62 32 $358 Statement of Cash Flows-Indirect Method The comparative balance sheet of Olson-Jones Industries Inc. for December 31, 2012 and 2041, is as follows: Dec. 31. Dec. 31. 2012 2011 Assets Cash Accounts receivable (net) 72 Inventores Land Equipment Accumulated depreciation equipment Total Assets Liabilities and Stockholders' Equity Accounts payable (merchandise creditor) Dividends payable Common stock, 1 par Pald-in capita Excess of sue price over Common stock Retained earnings 186 Total abilities and stockholders' equity 5272 The following additional information is taken from the records: 1. Land was sold for $30. 2. Equipment was acquired for cash. 3. There were no disposals of equipment during the year. 4. The common stock was issued for cash. 5. There was a $83 credit to Retained Earnings for net income. 6. There was a $26 debit to Retained Earnings for cash dividends declared. a. Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Use the minus sign to indicate cash out flows, cash payments, decreases in cash, or any negative adjustments. Olson-Jones Industries Inc Statement of Cash Flows For the Year Ended December 31, 2012 Cash flows from operating activities Net Income Adjustments to reconcile net income to net cash flow from operating active Depreciation Gain on sale of land Changes in current operating assets and Increase in accounts receivable Increase in inventories Increase in accounts payable Changes in current operating assets and liabilities: Increase in accounts receivable Increase in inventories Increase in accounts payable Net cash flow from operating activities Cash flows from (used for) investing activities: Cash from sale of land Cash used for purchase of equipment Net cash flow from investing activities Cash flows from (used for) financing activities: Cash from sale of common stock Cash used for dividends Net cash flow from financing activities Increase in cash Cash at the beginning of the year Cash at the end of the year 0 10 00 . Feedback b. Was Olson-Jones Industries Inc.'s net cash flow from operations more or less than net income? Less Feedback Feedback