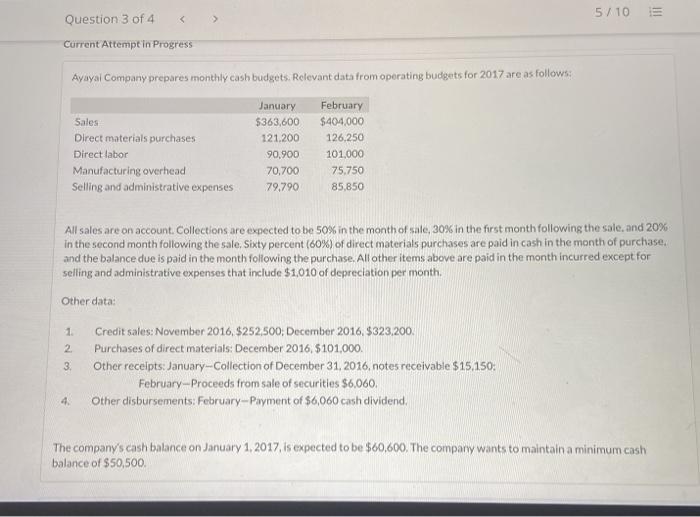

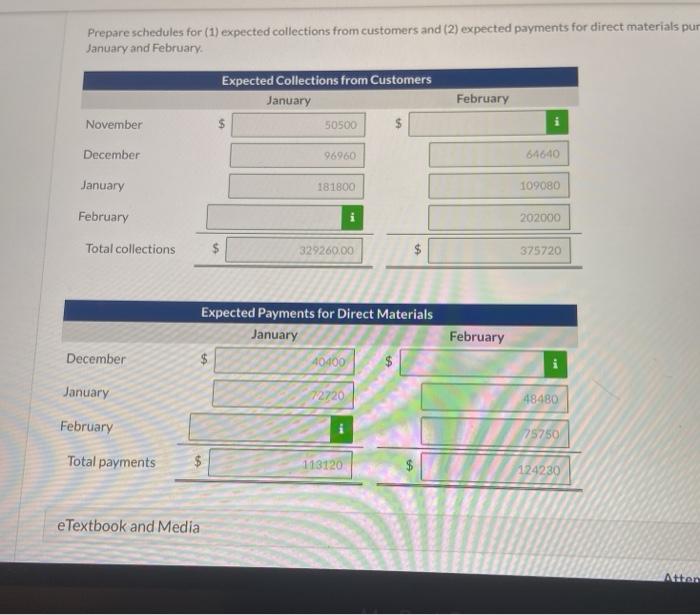

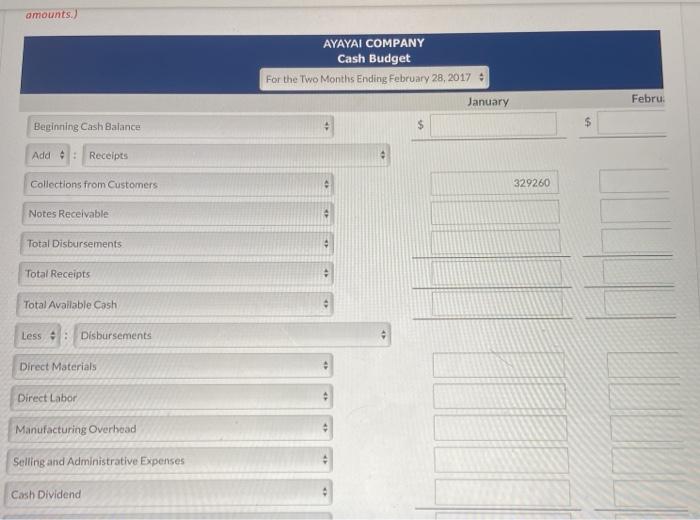

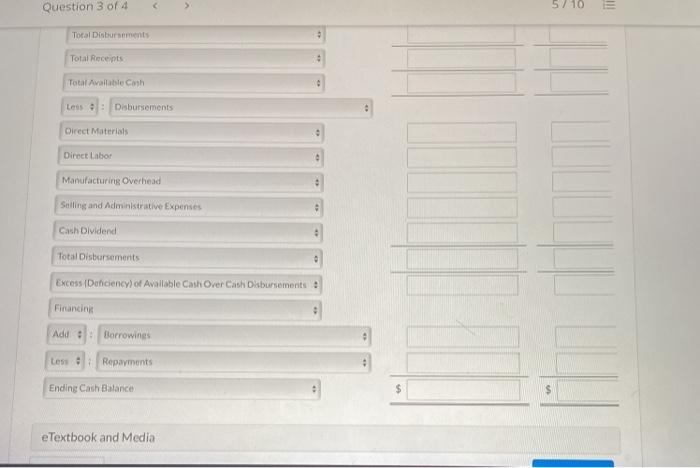

5/10 Question 3 of 4 Current Attempt in Progress Avayal Company prepares monthly cash budgets. Relevant data from operating budgets for 2017 are as follows: Sales Direct materials purchases Direct labor Manufacturing overhead Selling and administrative expenses January $363,600 121.200 90.900 70,700 79,790 February $404,000 126,250 101.000 75.750 85,850 All sales are on account. Collections are expected to be 50% in the month of sale, 30% in the first month following the sale, and 20% In the second month following the sale. Sixty percent (60%) of direct materials purchases are paid in cash in the month of purchase and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,010 of depreciation per month. Other data: 2 3 Credit sales: November 2016, $252,500: December 2016,$323.200. Purchases of direct materials: December 2016 $101.000. Other receipts: January-Collection of December 31, 2016, notes receivable $15.150: February - Proceeds from sale of securities $6,060, Other disbursements: February-Payment of $6,060 cash dividend, 4. The company's cash balance on January 1, 2017, is expected to be $60,600. The company wants to maintain a minimum cash balance of $50,500. Prepare schedules for (1) expected collections from customers and (2) expected payments for direct materials pur January and February Expected Collections from Customers January 50500 $ February November December 96960 64640 January 181800 109080 February 202000 Total collections 329260.00 375720 Expected Payments for Direct Materials January 40400 February December January 22720 48480 February 75750 Total payments 113120 124230 e Textbook and Media Atten amounts.) AYAYAI COMPANY Cash Budget For the Two Months Ending February 28, 2017 Febru January Beginning Cash Balance Add: Receipts Collections from Customers 329260 Notes Receivable Total Disbursements Total Receipts Total Available Cash Less : Disbursements Direct Materials Direct Labor Manufacturing Overhead Selling and Administrative Expenses Cash Dividend Question 3 of 4