Answered step by step

Verified Expert Solution

Question

1 Approved Answer

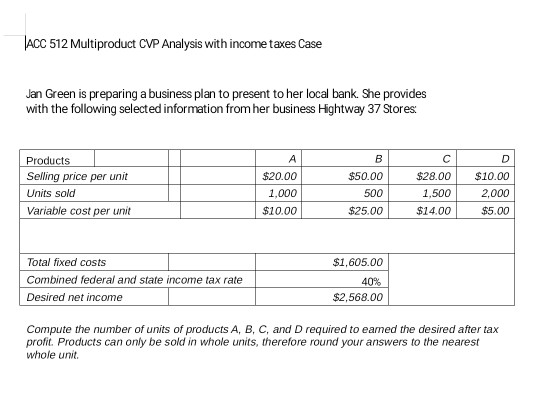

512 Multiproduct CVP Analysis with income taxes Case Jan Green is preparing a business plan to present to her local bank. She provides with the

512 Multiproduct CVP Analysis with income taxes Case Jan Green is preparing a business plan to present to her local bank. She provides with the following selected information from her business Hightway 37 Stores: Products Selling price per unit Units sold Variable cost per unit $20.00 1,000 $10.00 $50.00 500 $25.00 $28.00$10.00 2,000 $5.00 1,500 $14.00 Total fixed costs Combined federal and state income tax rate Desired net income $1,605.00 40% $2,568.00 Compute the number of units of products A, B, C, and D required to eamed the desired after tax profit. Products can only be sold in whole units, therefore round your answers to the nearest whole unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started