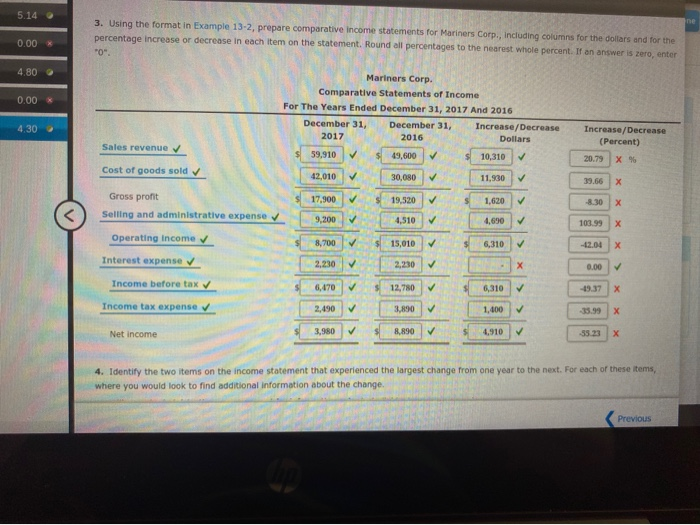

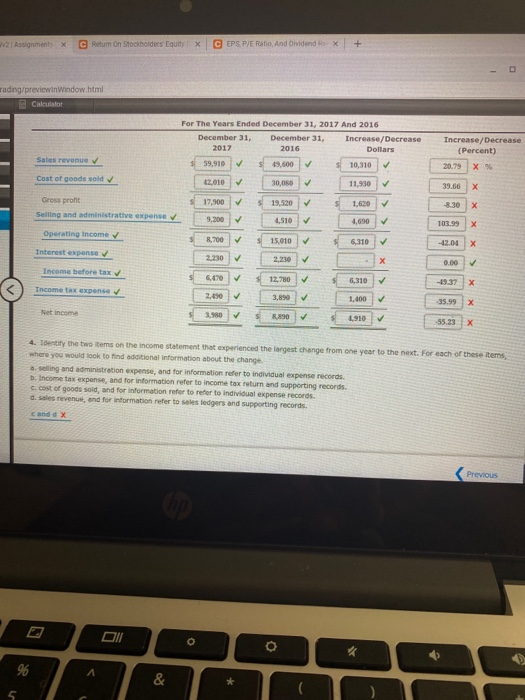

5.14 3. Using the format in Example 13-2, prepare comparative Income statements for Mariners Corp., including columns for the dollars and for the percentage increase or decrease in each item on the statement. Round all percentages to the nearest whole percent. If an answer is zero, enter "0". 0.00 4.80 0.00 Mariners Corp. Comparative Statements of Income For The Years Ended December 31, 2017 And 2016 December 31, December 31, Increase/Decrease 2017 2016 Dollars 59,910 49,600 $ 10,310 4.30 Increase/Decrease (Percent) Sales revenue 20.79 X % Cost of goods sold 42,010 30,080 11,930 39.66 17,900 Gross profit Selling and administrative expense 19,520 1,620 -8.30 9,200 4,510 4,690 103.99 Operating income 8,700 $ 15,010 6,310 -12.04 Interest expense 2.230 2,230 X 0.00 Income before tax 6,170 $ 12,780 6,310 X Income tax expense 2,490 3,890 1,400 3,980 Net income 8,890 4,910 4. Identify the two items on the income statement that experienced the largest change from one year to the next. For each of these items, where you would look to find additional information about the change. Previous 12 Assignments C Return on Stockholders Equity x CEPS. P/E Ratio And Olvidend X + rading/previewinwindow.html Calculator For The Years Ended December 31, 2017 And 2016 December 31, December 31, Increase/Decrease 2017 2016 Dollars 59,910 19,600 $10,310 Increase/Decrease (Percent) 20.79 X% Sales revenue Cost of goods sold 12.010 30,00 11,930 39.66 17,900 19,520 Gross pront Selling and administrative expense -8.30 9,200 4.510 4,690 103.99 Operating Income 8,700 > 15.010 6,310 -12.00 Interest expense 2.230 2,230 0.00 Income before tax >> 6,470 12.780 6,310 Income tax expense > > 2.150 3,890 1.400 35.99 X Net income 3.980 8,890 0.910 -55.23 X 4. Identify the two items on the income statement that experienced the largest change from one year to the next. For each of these items, where you would look to find additional information about the change selling and administration expense, and for information refer to individual expense records b. Income tax expense, and for information refer to income tax return and supporting records. C. cost of goods sold, and for information refer to refer to individual expense records. d. sales revenue and for information refer to sales ledgers and supporting records. Cand d X Previous O x 96 A & * 5 5.14 3. Using the format in Example 13-2, prepare comparative Income statements for Mariners Corp., including columns for the dollars and for the percentage increase or decrease in each item on the statement. Round all percentages to the nearest whole percent. If an answer is zero, enter "0". 0.00 4.80 0.00 Mariners Corp. Comparative Statements of Income For The Years Ended December 31, 2017 And 2016 December 31, December 31, Increase/Decrease 2017 2016 Dollars 59,910 49,600 $ 10,310 4.30 Increase/Decrease (Percent) Sales revenue 20.79 X % Cost of goods sold 42,010 30,080 11,930 39.66 17,900 Gross profit Selling and administrative expense 19,520 1,620 -8.30 9,200 4,510 4,690 103.99 Operating income 8,700 $ 15,010 6,310 -12.04 Interest expense 2.230 2,230 X 0.00 Income before tax 6,170 $ 12,780 6,310 X Income tax expense 2,490 3,890 1,400 3,980 Net income 8,890 4,910 4. Identify the two items on the income statement that experienced the largest change from one year to the next. For each of these items, where you would look to find additional information about the change. Previous 12 Assignments C Return on Stockholders Equity x CEPS. P/E Ratio And Olvidend X + rading/previewinwindow.html Calculator For The Years Ended December 31, 2017 And 2016 December 31, December 31, Increase/Decrease 2017 2016 Dollars 59,910 19,600 $10,310 Increase/Decrease (Percent) 20.79 X% Sales revenue Cost of goods sold 12.010 30,00 11,930 39.66 17,900 19,520 Gross pront Selling and administrative expense -8.30 9,200 4.510 4,690 103.99 Operating Income 8,700 > 15.010 6,310 -12.00 Interest expense 2.230 2,230 0.00 Income before tax >> 6,470 12.780 6,310 Income tax expense > > 2.150 3,890 1.400 35.99 X Net income 3.980 8,890 0.910 -55.23 X 4. Identify the two items on the income statement that experienced the largest change from one year to the next. For each of these items, where you would look to find additional information about the change selling and administration expense, and for information refer to individual expense records b. Income tax expense, and for information refer to income tax return and supporting records. C. cost of goods sold, and for information refer to refer to individual expense records. d. sales revenue and for information refer to sales ledgers and supporting records. Cand d X Previous O x 96 A & * 5