Answered step by step

Verified Expert Solution

Question

1 Approved Answer

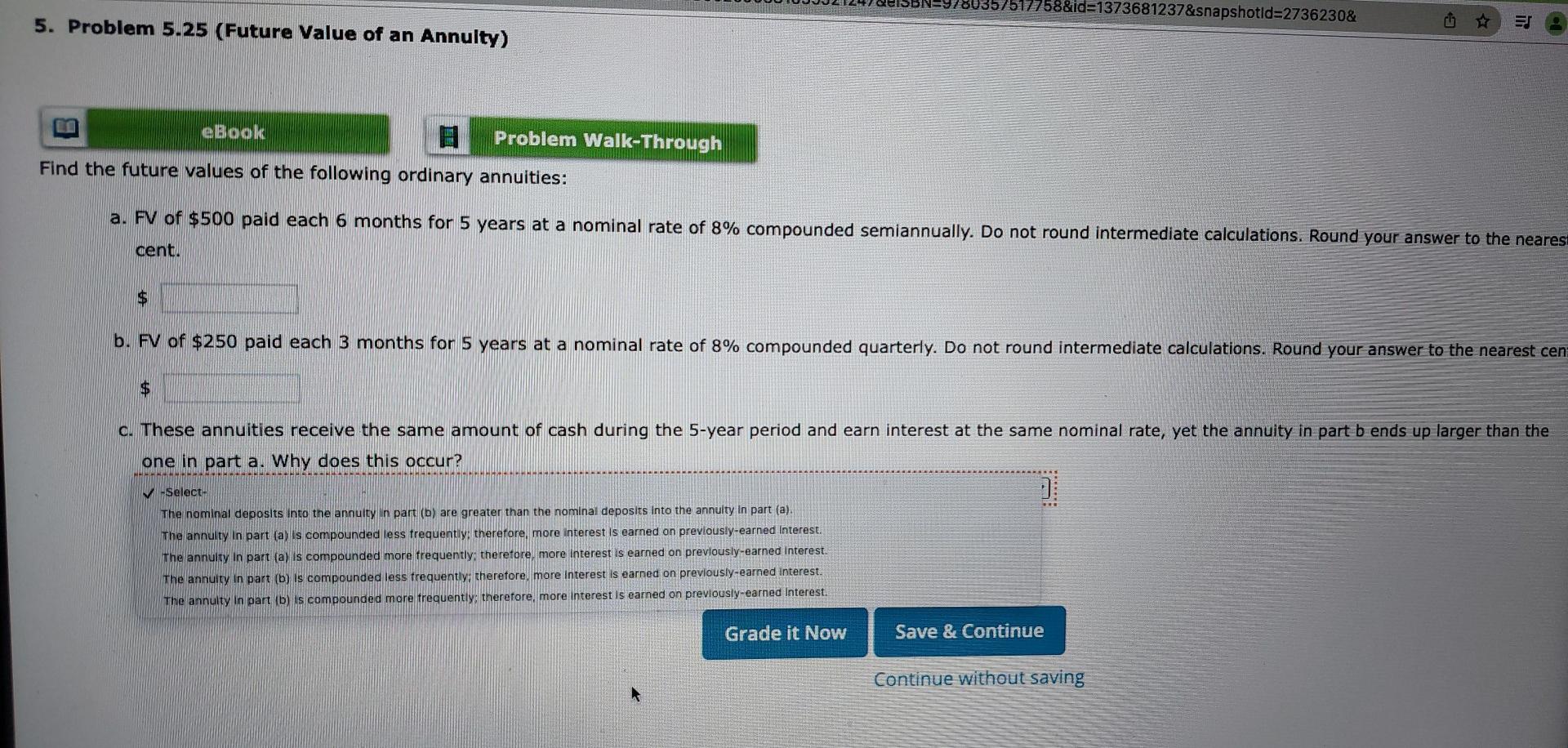

/517758&id=1373681237&snapshotid=2736230& 5. Problem 5.25 (Future Value of an Annulty) + TE eBook Problem Walk-Through Find the future values of the following ordinary annuities: a. FV

/517758&id=1373681237&snapshotid=2736230& 5. Problem 5.25 (Future Value of an Annulty) + TE eBook Problem Walk-Through Find the future values of the following ordinary annuities: a. FV of $500 paid each 6 months for 5 years at a nominal rate of 8% compounded semiannually. Do not round intermediate calculations. Round your answer to the nearest cent. $ b. FV of $250 paid each 3 months for 5 years at a nominal rate of 8% compounded quarterly. Do not round intermediate calculations. Round your answer to the nearest cen c. These annuities receive the same amount of cash during the 5-year period and earn interest at the same nominal rate, yet the annuity in part b ends up larger than the one in part a. Why does this occur? Select- :) The nominal deposits into the annuity in part (b) are greater than the nominal deposits into the annulty in part (a). The annuity in part (a) is compounded less frequently, therefore, more interest is earned on previously-earned Interest. The annuity in part (a) is compounded more frequently, therefore more interest is earned on previously-earned Interest. The annuity in part (b) is compounded less frequently, therefore, more interest is earned on previously-earned interest. The annulty in part (b) is compounded more trequently, therefore, more interest is earned on previously-earned Interest. Grade it Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started